Retail sales rose by much more than expected in September, calling into question the Federal Reserve’s decision last month to cut its benchmark interest rate by half a percentage point.

Sales at retail stores and online outlets rose by 0.4 percent for the month, despite a sharp decline in gas station sales and flat car sales. Excluding auto dealers and gas stations, retail sales jumped 0.7 percent for the month.

Economists had forecast a 0.3 percent increase both for the overall figure and the ex-gas and ex-autos measure.

Compared with a year ago, total retail sales are up 1.7 percent. But that obscures the strength in sales growth outside of gas stations, which are largely a function of gasoline prices, and autos. Excluding those, sales are up 3.7 percent from a year ago.

In the January through September period, sales are up 2.6 percent compared with the first nine months of last year. Excluding auto dealers and gas stations, sales are up an impressive 3.6 percent.

Two other categories—furniture stores and electronics and appliance stores—recorded monthly declines in spending. Every other category saw sales increase for the month.

By subscribing, you agree to our terms of use & privacy policy. You will receive email marketing messages from Breitbart News Network to the email you provide. You may unsubscribe at any time.

Grocery store sales rose one percent. General merchandise store sales rose 0.5 percent. Online sales rose 0.4 percent. Clothing stores rose by 1.5 percent. Health and beauty store sales rose 1.1 percent.

Bar and restaurant sales jumped one percent.

The figures are adjusted for seasonality but not for price changes.

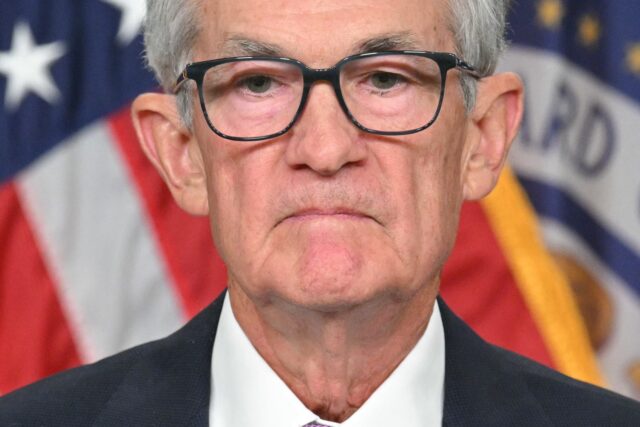

The bigger-than-expected increase in sales adds to the evidence that the Fed’s decision to enact a large rate cut last month was premature. The September jobs report was also much stronger than expected and inflation for the month came in hotter than expected.

Critics of the Fed’s aggressive cut have said that the decision to cut just a month-and-a-half before the presidential election—and to cut by twice as much as expected—creates the appearance that the central bank is playing politics with monetary policy.

COMMENTS

Please let us know if you're having issues with commenting.