The September Rate Cut Is Now Locked In

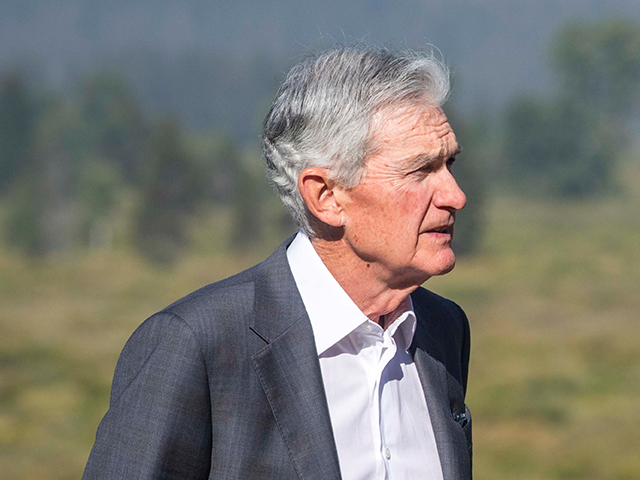

Jerome Powell’s Jackson Hole speech on Friday leaves little doubt that a rate cut is coming in September.

It’s very unusual for the Fed chairman to telegraph moves in monetary policy so clearly at Jackson Hole. Typically, the Fed chair prefers to preserve a bit of optionality by hinting about what it is to come rather than directly stating that a rate change will take place at the next Fed meeting.

Not this time. If Powell’s speech were put to music, it would sound a lot like the Chambers Brothers’ “The Time Has Come Today.”

Time has come today

Young hearts can go their way

Can’t put it off another day

I don’t care what others say

They say we don’t listen anyway

Time has come today…The rules have changed today

Powell did not sing it out, but he did say that “the time has come for policy to adjust.”

Since the minutes of the July meeting already showed that the majority of the Federal Reserve’s committee members were already leaning toward easing up on interest rates at the September meeting, Powell may have felt that there was no harm in being this direct. Yet, as the Fed shifts focus from battling inflation to supporting the labor market, the question arises: Are we about to witness another episode of policy overcorrection?

Powell’s comments were a clear indication that the Fed is changing gears. The Fed no longer views inflation as the primary threat. The labor market has moved to the forefront of the Fed’s concerns. His assertion that “the upside risks to inflation have diminished, and the downside risks to employment have increased” has been eagerly interpreted by markets as a cue for further rate cuts. The markets, always quick to anticipate the Fed’s moves, have already adjusted, with expectations of additional cuts stretching into 2024 and 2025.

Too Many Cuts Priced In

But the market may once again be getting ahead of itself. The futures market is now pricing in a cut at every meeting between now and the end of next year. That would be very aggressively dovish.

While Powell’s tone was certainly dovish, it wasn’t a carte blanche for the aggressive rate cuts that some have been hoping for. Instead, Powell seems to be advocating for a cautious, step-by-step approach—modest rate reductions rather than a wholesale easing. The door to a 50 basis point cut remains open, but only if the economic data deteriorates significantly. As it stands, the recent decline in jobless claims suggests that this more drastic action may not be necessary.

Powell’s focus on the labor market was unmistakable. He pointed out that the job market has “cooled significantly from its previously overheated state,” but he was careful to note that the rise in unemployment hasn’t been driven by the large-scale layoffs that typically herald a recession. In Powell’s view, the upcoming round of rate cuts is less about responding to a crisis and more about returning to a more normal monetary policy stance.

This raises a critical concern: Is the Fed, in its eagerness to prevent a slowdown, setting the stage for new problems down the road? The Fed’s history is replete with instances where rate cuts, once started, led to unintended consequences of asset bubbles and renewed inflation. If Powell and his colleagues aren’t careful, they could inadvertently reignite inflationary pressures, undoing much of the progress made in recent years.

There are signs that the economy may be stronger than the weak July jobs report and the 818,000 downward revision to jobs through March implied. S&P Global’s purchasing managers index this week showed that while manufacturing output is declining, growth in the services sector is accelerating and the economy continues to expand. The new home sales data released on Friday came in much hotter than expected, with sales rising to a 739,000 home rate from an upwardly revised 668,000 in the prior month. Economists had expected just 628,000 after the 617,000 initially reported in the prior month.

If the Fed begins with a 25 basis point cut in September, followed by further cuts at each subsequent meeting, it risks losing sight of the broader economic picture. While a softening labor market and inflation below three percent might justify a more lenient policy stance, the Fed must remain vigilant against moving too aggressively. Cutting rates too quickly could lead to a resurgence of inflation, forcing the Fed into a tighter monetary policy stance down the road.

Powell himself acknowledged the delicate balance the Fed must strike. The labor market has cooled, but it remains fundamentally strong, with unemployment rising only modestly and not as a result of mass layoffs. This isn’t the typical backdrop for drastic rate cuts. The Fed’s dual mandate—to foster maximum employment and stable prices—requires a balanced approach. Rushing into rate cuts could upset that balance.

The final leg of the journey in taming inflation is often the most treacherous, where the risk of policy missteps is greatest. The Fed must proceed with caution, fully aware that history has not been kind to those who cut rates too much, too soon. The potential for renewed economic volatility looms large if the Fed doesn’t get this right.

What’s more worrying, Powell’s remarks showed little cognizance of the idea that we may have entered a higher inflation era. Heightened geopolitical risks, regional wars, climate change policies, fiscal expansion in reaction to high prices of homes and necessities such as prescription drugs, AI-driven demand for energy, surging migration from the global south into the U.S., and an aging population with shrinking birthrates are all inflationary. The path to two percent may be much harder than the Fed anticipates.

Even in the short term there are risks. What happens if the August jobs numbers come in hotter than expected? The Fed has committed to cutting in September, but it would likely then have to send a strong signal that it intends to take a far more measured pace of cuts than the market is expecting.

COMMENTS

Please let us know if you're having issues with commenting.