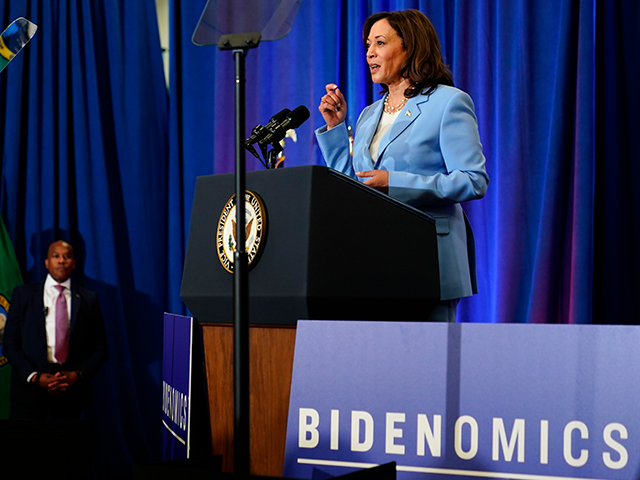

Harris Is ‘a Person of Interest’ in Monday’s Sell-Off

While we cannot say for sure that the death of the soft-landing and the market sell-off was caused by Kamala Harris, surely anyone investigating the matter should consider the vice president a person of interest.

Former President Donald Trump’s polling lead over President Joe Biden began to seriously widen in mid-June, around two weeks before the historic debate between the candidates. At the end of the first week in June, Trump’s Real Clear Politics polling average of 45.1 percent was just a hair above Biden’s 44.8 percent. Two weeks later, Trump was ahead 46.5 percent to Biden’s 45.2 percent.

The debate saw Trump’s lead expand rapidly. By the third day of July, Trump was three points ahead of Biden in the polling average. And the former president maintained that three-point lead over the next three weeks—until Biden finally dropped out of the race altogether. Prediction markets and election forecast models such as Nate Silver’s were giving Trump around a 70 percent chance of winning the election.

Trump’s Lead Was Very Good for Stocks

This was a glorious time for investors in stocks. The S&P 500 rose by 7.3 percent between the start of June and mid-July. That’s a very good return for a full year that was crammed into six or so weeks. While a big part of this surge was the growing conviction that the Fed would cut interest rates at the end of this summer, the growing probability that Trump would win back control of the White House and that Republicans would possibly sweep the election, gaining control of the Senate and keeping control of the House, at the very least gave the market an assist.

It’s hardly a mystery why Trump’s ascendancy in the polls would boost the stock market. Public opinions polls showed that Americans believe that Trump would be better for the economy than his Democrat rival. The University of Michigan’s consumer sentiment survey showed that 40 percent of the public thought Trump would be better for the economy and 35 percent thought Biden would be.

Similarly, Trump comes out way ahead in polls that ask voters how they expect their personal financial situation would fare based on the election. The University of Michigan survey found that 39 percent said Trump was the best candidate for their personal finances, with just 32 percent saying Biden was.

The University of Michigan’s consumer sentiment index declined sharply in July. But this was entirely due to a growing discontent with the present economic situation. The reading of sentiment about current conditions fell for Democrats, independents, and Republicans. The expectations index, however, rose in July, boosted by a big increase in the optimism among Republicans.

While all explanations of broad movements in financial markets require some speculation, this amounts to strong circumstantial evidence that the stock market’s rise was tied to the rise of Trump’s chances of winning. At the very least, it appears that the market liked the decrease in political uncertainty that Trump’s rise indicated.

The Harris Rise and Stock Market Fall

All that was overturned as Biden stepped down from the race for the White House and endorsed Harris. She has come out ahead in a few recent polls. Silver’s model now gives her slightly better than even odds of winning in November and much better chances than that of winning the popular vote.

Harris is regarded by very few people as good for the economy or their personal finances. A recent poll by YouGov for CBS News found that just 25 percent of the public say they expect Harris’s policies would make them financially better off. Forty-four percent say her policies would make them worse off. For Trump, 45 percent expect his policies would make them better off and 38 percent say they expect to be worse off.

If we break that down by partisan affiliation, the results are striking. Among Democrats, just 53 percent say they expect to be better off under Harris’s policies, with 43 percent saying her policies will not make a difference. Among Republicans, 87 percent say Trump’s policies will make them better off, with just ten percent saying the policies will not make a difference. (Oddly enough, three percent of Democrats say Harris’s policies will make them worse off financially—and the same percent of Republicans say that about Trump’s policies.)

Given these expectations, it would be surprising if investors did not regard Harris’s rising popularity with concern. Many seem to have concluded that a Harris victory would make a so-called soft-landing for the economy—an escape from inflation without a recession—much less likely. Since Biden stepped down and tapped Harris as his successor, the S&P 500 is down by six percent—almost entirely erasing the earlier Trump-rising rally.

Is it only Harris that drove Monday’s sell-off? Of course not. The economic fragility revealed by last week’s job report and the manufacturing sector PMIs played a big role in encouraging a more pessimistic attitude about the economy. The unwinding of the Japanese carry-trade no doubt forced some selling. Iran’s preparations to attack Israel should not be overlooked.

But it is safe to conclude from the evidence that the rising prospects of a Harris presidency were a contributing factor to the plunge on Monday. Anyone dusting the scene for evidence would find her prints all over the place.

COMMENTS

Please let us know if you're having issues with commenting.