The U.S. economy might be heading into choppy waters.

The Conference Board’s Leading Economic Index (LEI) dropped by 0.6 percent in April, hitting 101.8. This follows a 0.3 percent dip in March. Over the past six months, the LEI has fallen by 1.9 percent, hinting at a slowdown on the horizon.

The latest numbers suggest “serious headwinds to growth,” according to the Conference Board. This drop was steeper than the 0.3 percent decline economists had predicted.

What’s Behind the Decline?

The LEI fell due to several factors: weaker business orders, fewer housing permits, and a dip in stock prices last month. While stocks have since rebounded to record highs, the second consecutive monthly drop in the LEI raises eyebrows. Historically, deep, broad, and lasting declines in the LEI often precede recessions, though the pandemic has muddied these patterns.

“The U.S. LEI declined again in April, marking its thirteenth consecutive month of contraction,” said Justyna Zabinska-La Monica, Senior Manager of Business Cycle Indicators at The Conference Board.

Is the LEI Broken?

Some analysts have grown skeptical about the predictive capacity of the LEI in the post-pandemic period. Starting in the summer of 2022, the index indicated a recession was nearing and it continued to indicate a looming economic contraction through January of this year.

That recession, which was also predicted by several other economic indicators, never arrived. In February, the index rose for the first time in two years and the Conference Board said the LEI was no longer predicting a recession.

“While the LEI’s six-month and annual growth rates no longer signal a forthcoming recession, they still point to serious headwinds to growth ahead. Indeed, elevated inflation, high interest rates, rising household debt, and depleted pandemic savings are all expected to continue weighing on the US economy in 2024. As a result, we project that real GDP growth will slow to under 1 percent over the Q2 to Q3 2024 period,” said Zabinska-La Monica.

Jim Bianco of Bianco Research has said that it is still useful to look at the LEI, arguing that the false recession signal is itself an indicator that the post-pandemic economy is behaving very differently than the pre-pandemic economy. As a result, expectations that interest rates, employment, and growth will “return to normal” are likely to be disappointed.

The stock market took the news in stride, with the Dow Jones and S&P 500 posting slight gains on Friday. Investors are cautiously weighing the implications of persistent inflation and potential Fed policy moves.

Inflation and Fed Moves

Inflation remains a thorny issue. The Consumer Price Index for All Urban Consumers (CPI-U) increased by 0.3 percent in April on a seasonally adjusted basis, following a 0.4 percent rise in March. Over the last 12 months, the all items index increased by 3.4 percent before seasonal adjustment. The index for all items less food and energy rose by 3.6 percent over the same period.

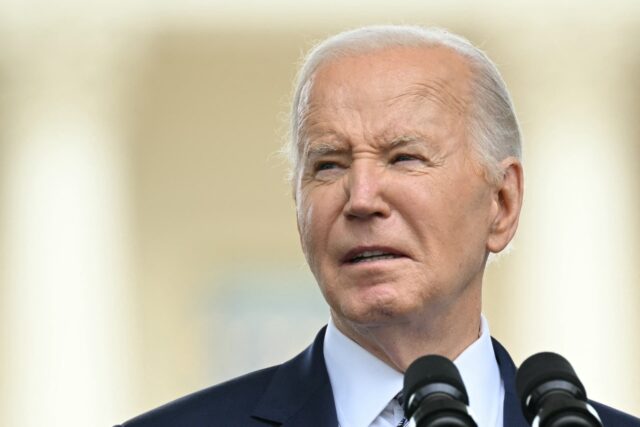

Much of the current inflation stems from President Biden’s early spending policies. The economy was already recovering when he took office, but he pushed through the $1.9 trillion American Rescue Plan despite warnings from economists that it would be inflationary. Biden’s portrayal of an economy in distress was used to justify this spending spree, aimed more at claiming credit for the recovery and satisfying demands from his leftwing supporters for expanded government. This excessive spending led to higher prices, forcing the Federal Reserve to raise and maintain high interest rates to combat inflation.

While the Federal Reserve still anticipates cutting rates in the future, it is currently taking a patient stance. The Fed is closely monitoring data to gain more confidence that inflation is coming down to its two percent target, adding to the uncertainty.

COMMENTS

Please let us know if you're having issues with commenting.