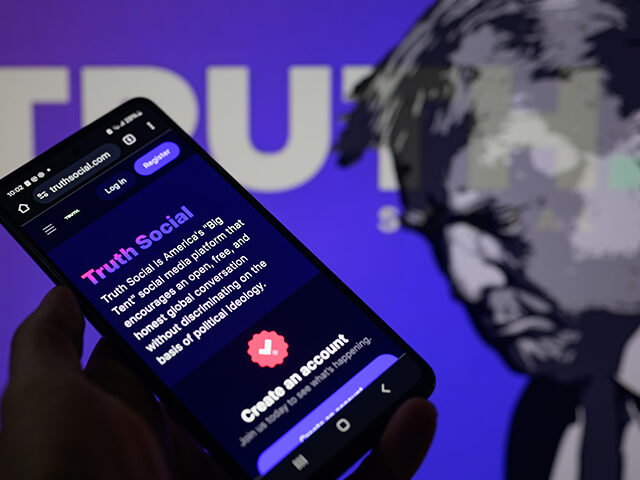

Trump Media Needs to Lose More Money Faster

Donald Trump’s digital media company is not losing money fast enough.

The parent company of the Truth Social social media app, Trump Media & Technology Company, said in a regulatory filing that it lost $58.2 million last year. It took in a total of $4.1 million in revenue, mostly from advertising sales.

Shares sold off sharply after the losses were disclosed. By midday on Monday, the company’s shares were off by about 23 percent. At 1:30 p.m., shares were trading around $47 to $48 per share, which seems like some sort of ironic joke by the gods of financial markets seeing as Trump is seeking to become the 47th president of the United States.

As we predicted when shares soared last week, the decline has been met with gleeful exuberance by Trump’s critics and the financial press. Dan Primack, a well-informed and usually reliable guide to financial markets, found himself saying that “it’s no longer possible to even pretend that the share price has any relation to the actual business.”

“At this point, owning TMTG is basically an in-kind donation to Donald Trump. Both financially and reputationally,” Primack wrote in a recent piece for Axios.

If that were true, however, you wouldn’t expect the shares to decline following the disclosure of financial information. It’s not as if Trump’s political prospects worsened perceptibly on Monday compared to last week. Nothing over the weekend would appear to have convinced investors to reduce their alleged “in kind donations” to Trump’s cause.

You’ve Got to Lose Money to Win Users

So what did spook investors? Investors may be disappointed that Trump Media was not losing more money last year.

In order to justify its lofty valuation, Trump Media will have to grow its user base and boost sales by taking market share of advertising away from other platforms, especially in the mobile advertising market. That is likely to require the company to spend a lot of money to promote itself and improve its product.

Last year, the biggest expense for the company was interest on its debt. Operating expenses amounted to just $16 million last year. That suggests a lack of focus on growth or a lack of ambition, neither of which seems fitting for a company named for the forty-sixth president of the United States.

No one is buying shares of Trump Media because they expect the company to be moderate when it comes to its sense of purpose. Investors very likely want the management of Trump Media to build it into a “big beautiful” company.

On that score, the company went in the wrong direction last year. In the first nine months of the year, it reportedly lost $49 million. That’s around a $5.4 million loss per month. In the final quarter, losses accumulated at a rate of just around $3 million per month. That suggests an unwelcome timidity on the part of management.

A pedestrian takes a photo of a screen displaying Truth Social stock information outside the Nasdaq MarketSite in New York City, on March 26, 2024. (Yuki Iwamura/Bloomberg via Getty Images)

Sales appear to have suffered. The company generated sales of $751,000 in the final three months of last year, down from $1 million in the second quarter. While some of this decline is likely due to the hesitancy of advertisers to hawk their products on a platform named for someone actively campaigning for president, it raises the prospect that the company could also be seeing a decline in users or engagement.

Many skeptics of Trump Media’s valuation have said that the level of revenue generated by the company is insufficient to justify the $8 billion or so market value of the company. History suggests otherwise. Instagram had no revenue at all when Facebook bought it for $1 billion—$300 million in cash and $700 million in Facebook shares—in 2012, around two years after the picture-sharing app was launched. Analysts think it probably generated more than $60 billion in revenue last year, around 44 percent of Facebook’s total.

The proceeds from the merger with the Digital World PAC will give Trump Media a big source of liquidity to invest in the company. To live up to the hopes of its investors, it will need to deploy that money as hastily as financial prudence permits.

The value of a social media platform is a function of two variables: the expected number of users and the expected revenue per user. There’s not much the company can do right now to change the expected revenue per user, so it should focus on impressing investors with the potential to grow users.

COMMENTS

Please let us know if you're having issues with commenting.