We’re No Longer Headed Toward the ‘Last Mile’ on Inflation

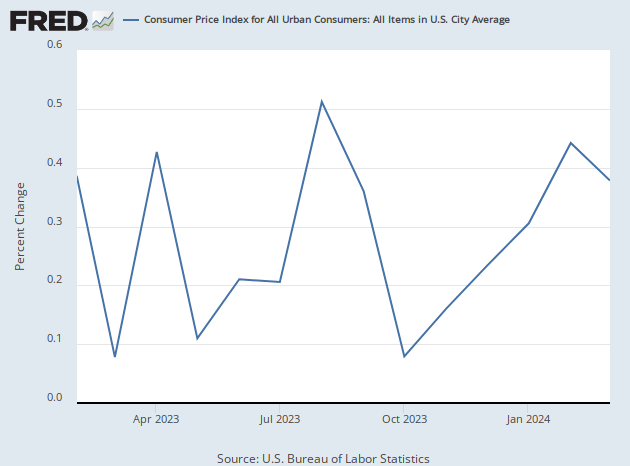

Inflation accelerated for the fourth straight month in February, confirming the upward momentum in prices and further undermining the case for rates cuts from the Federal Reserve this year.

The consumer price index (CPI) rose 0.4 percent from January, a tick above the 0.3 percent in the prior month. It has now risen in each month starting with November and is running four times as fast as it was in October.

Compared with 12 months ago, headline CPI is up 3.2 percent, which is faster than the prior month’s year-over-year gain of 3.1 percent. Wall Street had been expecting the 12-month figure to hold at 3.1 percent.

When discussing inflation, it is often helpful to annualize the most recent numbers. The 12-month figure is what gets reported in headlines and is probably psychologically and politically important. But it is backward looking, telling us how hot inflation has run more than how hot it is running.

Annualizing the more recent numbers also helps put them into perspective. The February increase annualizes to 5.4 percent, which is extremely high and the highest annualized rate since last August. If we annualize the past three months of inflation, we get a four percent rise. Six months annualized gives us 3.2 percent.

That progression is important. One month annualized is higher than three months, three months is higher than six months, and six months is equal to 12 months. Which is to say that that the trend of inflation is not only on the rise, it is rising faster. The story of disinflation ended around eight months ago, and now we appear to be in a new wave of inflation.

As Jim Bianco of Bianco Research and Ben Hunt of Epsilon Theory have pointed out, disinflation is over.

“Inflation’s downtrend ended eight months ago (red bar, top panel), right as Wall Street invented a term for inflation’s decline, the ‘last mile’ (black line, bottom panel),” Bianco tweeted Tuesday. “There has been no ‘last mile’ since Wall Street started using this term last summer. We now enter month nine of Wall Street not even realizing this narrative is not working.”

Core Inflation Is Heating Up, Goods Inflation Is Back

Core inflation surprised on the upside. It was up 0.4 percent compared for the month, compared with the expectation of 0.3 percent. That matched the January figure. Before rounding, inflation was up 0.358 percent for the month, which is slightly lower than the January figure and annualized to 4.4 percent.

The progression of the annualized figures tell the same story of a rising and accelerating trend. Three-month core annualized is 4.2 percent and six-month core annualized is 3.9 percent. Both are higher than the 12-month core figure of 3.8 percent.

There’s little comfort in the core services excluding housing figure—the so-called “super core”—that Fed officials have said they are watching closely. This rose 0.5 percent in February (0.47 percent before rounding) and is up 4.5 percent over the past 12 months. That’s lower than the red hot January figure of 0.9 percent (0.85 percent unrounded), but the progression of annualized figures tells a similar story: 6.4 percent for three months is above the 5.8 percent six-month annualized figure, and both are above the 12-month number.

In last night’s Breitbart Business Digest, we pointed out that the January producer price index (PPI) showed rising inflationary pressure in the goods sector and that this would likely mean the goods side of CPI would show an increase. This was an out-of-consensus call because Wall Street analysts were predicting a further decline in goods prices in January.

We were right. The February CPI report shows that core goods prices rose 0.1 percent, the first rise since May of last year. While core goods prices are still down year over year, the return of rising prices means that goods can no longer be counted on to put downward pressure on the overall price level.

Wall Street analysts are still insisting that the disinflation narrative is “intact.” It is not. The economy is growing at a solid pace, and the labor market is strong enough to provide inflationary pressures. The Biden administration’s budget deficits continue to fuel excess demand without doing much to boost supply. Inflation is re-igniting, and there is a danger of significant overheating. This should keep the Fed from cutting interest rates in June or July—and very likely for the rest of the year.

COMMENTS

Please let us know if you're having issues with commenting.