The Fed Is Planning on Staying “Patient” at This Week’s Meeting

It’s Federal Reserve week.

The Federal Open Market Committee will meet this week on Tuesday and Wednesday to discuss the economy, inflation, and monetary policy. Markets and analysts agree that the Fed will not change the policy rate, leaving it at the range of 5.25 to 5.50 percent set back in July.

This Fed does not like to surprise markets with rate hikes. If Fed officials thought market participants were wrong to anticipate the Fed holding its benchmark rate target steady, they had plenty of opportunity since the September 19-20 meeting to push a different view. Instead, Fed speakers across the board communicated the message that the Fed can afford to be “patient” at this meeting.

The most important message from Fed officials likely came from Chairman Jerome Powell and Governor Chris Waller. Both laid out what can be considered the Fed’s base case for the economy and inflation. They said that while there is still a lot of uncertainty, they expect the economy will slow from the breakneck pace of growth seen in the third quarter and that the slowdown will allow inflation to keep falling.

Both Waller and Powell, however, noted concerns about the possibility of demand staying too strong. A strong labor market could keep consumer spending high through the end of the year, which would raise the risk of a second wave of inflation hitting the economy.

Waller and Powell—along with Richmond Fed President Tom Barkin—have said that they do not think it likely that the economy will be able to continue to grow as fast as it has been while generating significant disinflationary pressures. Powell has said many times in the past that the economy will likely need to grow “below trend”—which means slower than a 1.8 percent annualized pace—for several quarters in a row for inflation to come down to the Fed’s two percent target.

How Much Will GDP Growth Fall in the Fourth Quarter?

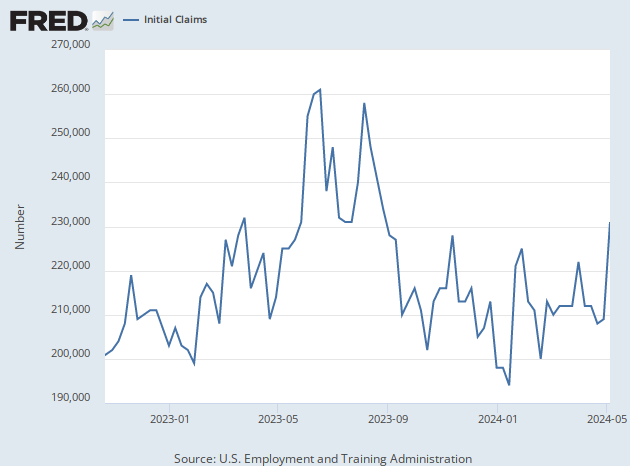

The current “blue chip consensus” is forecasting GDP to rise at less than a one percent pace in the fourth quarter. While we are only one-third of the way through the final quarter of the year, that seems overly pessimistic. The labor market is still very strong, with jobless claims coming in no higher than 211,000 in October.

We will get a clearer picture of the jobs market later this week when the Labor Department reports job openings on Wednesday and the employment situation report comes out on Friday. Given the low level of layoffs in October, the risk is heavily tilted toward upside surprises for these reports. Job openings are expected to come in at 9.35 million, down from 9.61 million at the end of August. Payrolls are expected to expand by 183,000, which would be a big number but far below the 336,000 we got for September. The unemployment rate is seen as holding steady at 3.8 percent.

The strong jobs market has been one of the key sources of fuel for the resilience of consumer spending this year. And consumer spending was largely behind the huge jump in growth in the third quarter. If the jobs market remains strong, it is hard to see growth falling to a less than one percent seasonally adjusted annual rate this year.

The Atlanta Fed’s GDPNow, which saw the third quarter surge earlier than most analysts, is currently clocking in at 2.3 percent growth for the fourth quarter. The New York Fed’s nowcast, which undershot the third quarter with a call for just 2.6 percent growth, has the fourth quarter at nearly 2.8 percent.

Will Early Shopping Flummox Analysts Again?

The past few years have seen analysts and markets get repeatedly bamboozled by the American consumer.

For the past two years, Americans have begun their holiday shopping early, leading to higher-than-expected sales in October. In 2021 and 2022, the big October sales numbers led retailers and analysts to expect the surge in spending to continue through the end of the year. What they missed was that the October shopping spree was not a sign that people were planning on buying a lot more but just that they were doing it earlier—and the early sales would wind up subtracting from sales during the traditional holiday shopping season.

What ended up happening last year and the year before was that November and December retail sales numbers were disappointing. Retailers found themselves with too much inventory at the end of the year. The unwinding of the inventory build-up became a major drag on GDP in the first quarter of the next year.

The final surprise was that January retail sales came in much stronger than expected because consumers were not as tapped out as they usually are following the big December spending spree.

We correctly predicted last year’s big January surge:

Yet there are several indications that the market may be underestimating household purchases for January. In the first place, forecasters have not quite come to terms with the shift in consumer behavior since the pandemic. Consumers are doing their holiday shopping earlier, which has led to a series of disappointing sales in November and December. The flip side of this is that the post-holiday consumer hangover decline in January is far milder than it used to be. This is one reason we saw upside surprises in retail sales in both January of 2022 and January of 2021.

Will history repeat itself this year? There certainly are signs of that holiday shopping is once again being pulled forward. Gallup reports that 28 percent of Americans said in a recent poll they would consider starting their shopping earlier than usual. That rises to 48 percent for adults under 30.

“Asked more generally when they planned to start shopping this year, 41 percent of U.S. holiday shoppers intend to start their shopping before November, while 59 percent will wait until November or December,” Gallup reported.

COMMENTS

Please let us know if you're having issues with commenting.