Biden Declares Mission Accomplished on the Economy

President Joe Biden once again put on his dancing shoes on Thursday to shuffle out a victory jig on the economy.

“I always say it is a mistake to bet against the American people, and just today we learned the economy grew 4.9 percent in the third quarter,” Biden said in an official statement from the White House. “I never believed we would need a recession to bring inflation down – and today we saw again that the American economy continues to grow even as inflation has come down.”

We also never believed that a recession would be required to bring inflation down, although that does not exactly put us in rare company with the president. To the best of our knowledge, there were roughly zero economic analysts who believed a recession would be required to reduce inflation from the four-decade highs that gripped the U.S. economy last year.

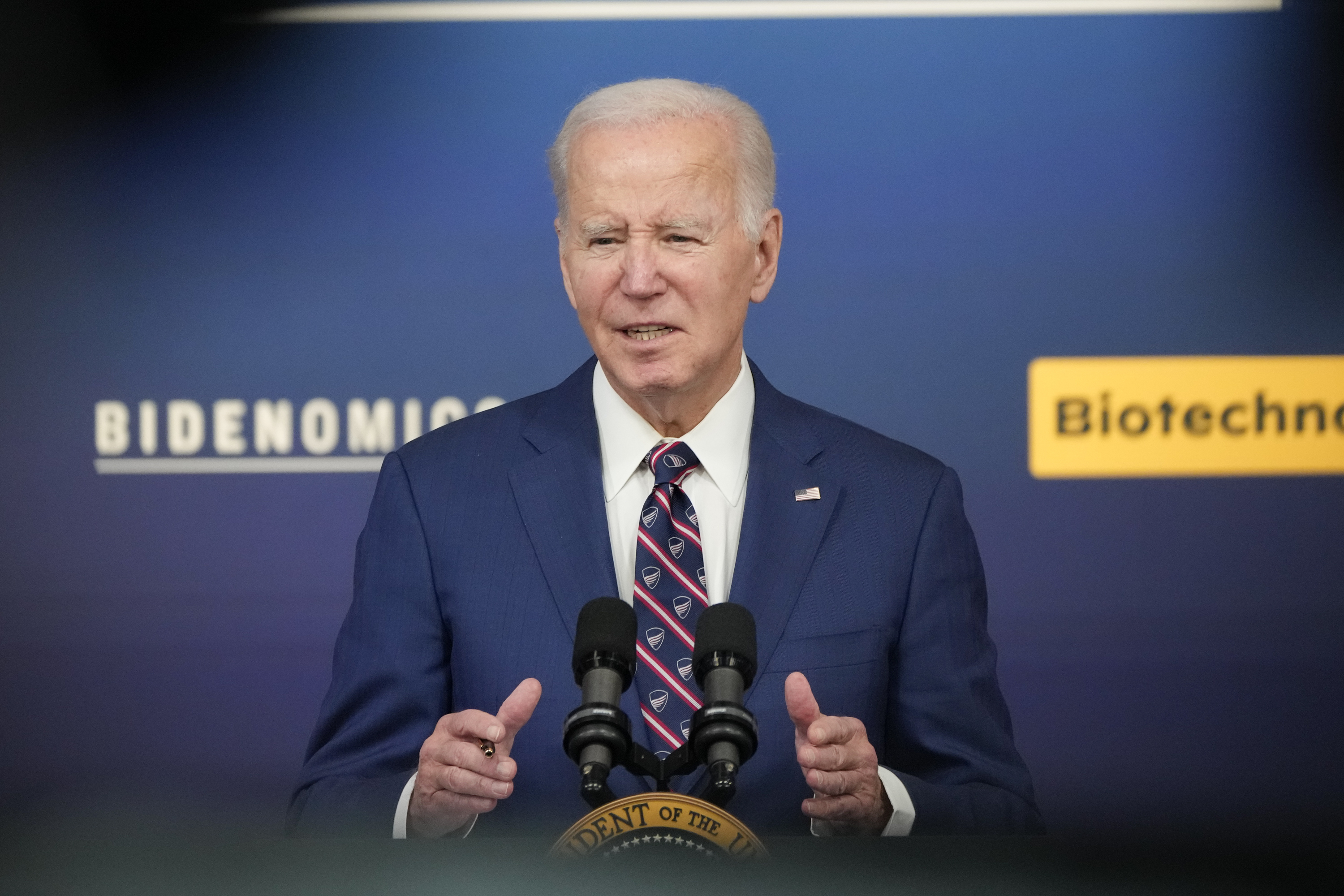

President Joe Biden speaks during an event on Bidenomics at the White House on Oct. 23, 2023. (AP Photo/Jacquelyn Martin)

The actual ground for disagreement among economists, market participants, and professional scribblers has been how much of an economic downturn was likely to result from the fiscal or monetary policies that would need to be implemented to bring inflation down to the two percent rate targeted by the Federal Reserve. No one doubted that inflation could come down from the high levels of 2022 without a recession. The question was how far it could come down and what it would take to bring it down.

The Real Fight Over Inflation, Recession, and Rate Hikes

There have been many camps battling it out over the past two years. There is the group that New York Times columnist Paul Krugman has dubbed “team long transitory,” who saw inflation as almost entirely due to supply constraints (and maybe some Putin price hikes and corporate price gouging) and therefore likely to subside on its own as the economy re-acclimated to the post-pandemic era. Closely related were the immaculate disinflationists, who saw the economy largely able to bring down inflation without too much restriction from the Fed and therefore without any significant negative economic consequences.

There are also the the greedflationists, who believe in the improbable proposition that the election of Biden was accompanied by the greatest outbreak of corporate greed in forty years. Given that many of the greedflationists consider themselves allies or fellow travelers of the Biden administration, this has always been an odd stance.

The soft-landers argued that while some tightening by the Fed was required and some slowdown was likely, we would be able to bring down inflation to two percent without a significant downturn or a recession. The hard-landers were divided into two subgroups. One thought that the tightening already in place at the start of the year would be enough to trigger a recession and that this recession would bring down inflation. The other thought that further tightening would be needed and that tightening would bring on a recession.

The Flow Showers, so-called after the influential weekly note published by Bank of America investment strategist Michael Hartnett, have maintained that nothing but a recession or a “credit event” would end the era of high inflation. Closely aligned with Hartnett’s group is the no-landers who do not see inflation coming down to two percent in the foreseeable future, perhaps in part because they expect the Fed will lose its nerve due to the downturn that further tightening would likely trigger.

Fed Chairman Jerome Powell and several Fed officials, including Governor Chris Waller and Richmond Fed President Tom Barkin, have staked out a position that might be termed “something’s got to give.” They believe that the current cocktail of high growth and falling inflation is unsustainable. If inflation is going to continue to fall, growth will have to decline to somewhere below two percent. If growth stays high, inflation is likely to start to climb. If growth falls on its own, the Fed can hold rates steady next year. If it does not, the Fed will have to raise rates further.

A Coming Conflict Between Biden and Powell

So, what is Biden’s position? It appears to be the opposite of the one held by Powell. Instead of seeing a contradiction between high growth and falling inflation, Biden appears to believe these can go together. A corollary of this is that monetary policy need not become more restrictive and fiscal policy need not become less expansionary. To the contrary, further rate hikes or spending cuts would amount to needless cruelty. In his statement, Biden warned about Republicans “slashing programs that are essential for hard-working families and seniors.”

This could lead to a pretty fierce conflict next year if inflation persists at current levels or shows signs of a second wave of rising prices. The Fed would likely react to this by hiking rates—and the Biden administration could react to that by crying foul. Partisans of the Biden administration might even accuse the Fed of attempting to tank the economy in advance of the presidential election.

There are reasons to be concerned that the disinflation that brought rates down from last year’s epic highs has run out of steam. The personal consumption price index rose 0.4 percent for the second month in a row in September, according to data released by the Commerce Department on Friday, which annualizes to 4.4 percent, more than twice the Fed’s target. Core PCE inflation came in at 0.3 percent or 3.6 percent annualized, up from a mere 1.4 percent annualized in August and the highest since April.

The best leading indicators of inflation are median and trimmed mean measures. The one-month annualized trimmed mean calculated by the Dallas Fed rose to 4.0 percent from 2.8 percent in August, the highest since April. The Cleveland Fed said median PCE inflation came in at 0.3 percent month-over-month, the second straight reading at that pace. These point to stubborn and sticky inflation rather than an ongoing decline.

COMMENTS

Please let us know if you're having issues with commenting.