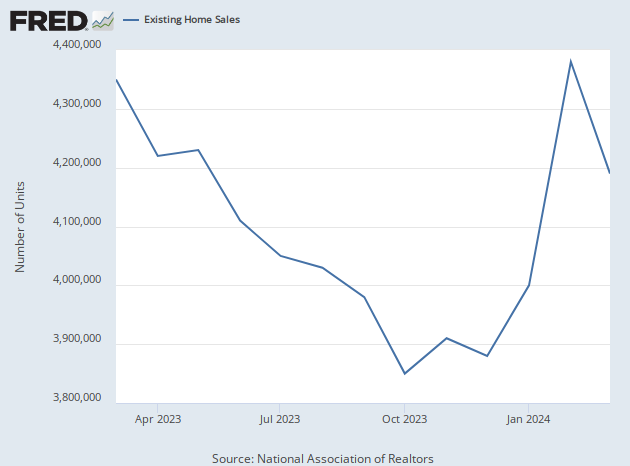

Sales of previously owned homes in the U.S. fell in August 0.7 percent from a month earlier to an annual pace of 4.04 million, the National Association of Realtors said Thursday. That’s the slowest since January of this year.

Economists had forecast an increase in the volume of sales from July’s 4.07 million to 4.10 million.

Home sales have dropped significantly as mortgage rates have climbed. Last week, the average interest rate on a 30-year fixed-rate mortgage climbed to 7.18 percent, according to Freddie Mac. That’s the highest rate since December of 2020.

The rapid rise of rates following a prolonged period of ultralow rates during the pandemic has meant that a lot of homeowners feeling “locked in” to homes in low interest rates. In this environment, many people would have to accept a much higher rate on their next home than they pay on their current home. As a result, many owners are keeping homes off the market.

The low level of supply has pushed up prices for homes and spurred building of new homes. As well, it is likely keeping rents elevated as landlords see the market reflecting higher values for residential real estate.

The combination of high prices and high-interest rates has created one of the least affordable housing markets on record.

The median selling price rose in August was 3.9 percent higher than a year earlier, at $407,100. That is one of the highest median prices on record. The median price is up 12.7 percent since the start of the year. Bloomberg News reported that an economist for the National Association of Realtors said prices are up 46 percent since August of 2019.

“Home prices continue to march higher despite lower home sales,” Lawrence Yun, the chief economist of the National Association of Realtors, said in a statement. “Supply needs to essentially double to moderate home price gains.”

COMMENTS

Please let us know if you're having issues with commenting.