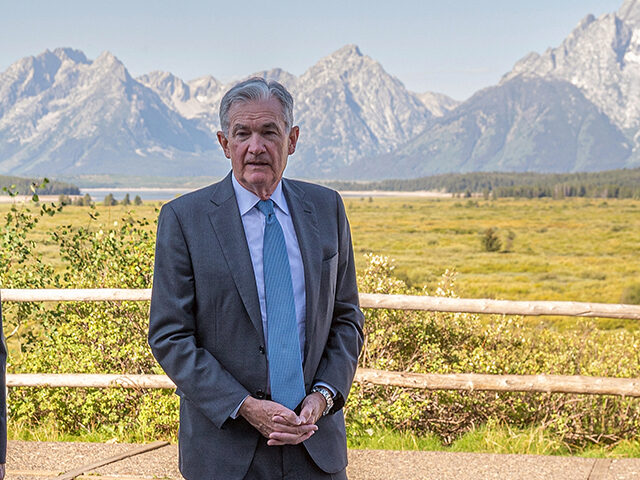

Federal Reserve Chairman Jerome Powell warned on Friday that additional rate increases might be required to put inflation on a convincing path to the central bank’s two percent target.

“Although inflation has moved down from its peak — a welcome development — it remains too high,” Powell said in his keynote address at the Kansas City Fed’s annual conference in Jackson Hole, Wyoming. “We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

Powell acknowledged that economic conditions had improved from a year ago, when the Fed chief used the Jackson Hole conference to warn that taming inflation would likely inflict pain on households and businesses. A year ago, the personal consumption expenditure price index the Fed favors to measure inflation was rising nearly 7 percent year-over-year and the economy had contracted in the first two quarters.

In June, the PCE price index was up slightly less than three percent. The economy grew at an annual rate of two percent in the first quarter of the year and 2.4 percent in the second quarter.

The consumer price index—the best-known measure of inflation—was up 3.2 percent in July compared with a year ago, down substantially from last year’s rate of 8.5 percent. On a monthly basis, the index rose just 0.2 percent in both June and July.

“The lower monthly readings for core inflation in June and July were welcome, but two months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” Powell said. “There is substantial further ground to cover.”

By subscribing, you agree to our terms of use & privacy policy. You will receive email marketing messages from Breitbart News Network to the email you provide. You may unsubscribe at any time.

The worry among some Fed officials is that the acceleration of growth could portend more inflation ahead, especially if the labor market remains extremely robust. In July, the unemployment rate was 3.5 percent and employers were looking to fill 9.6 million positions at the end of June. Both unemployment and openings were little changed from the prior month, defying predictions that the Fed’s interest rate hikes would cool off demand for labor.

Some Fed officials believe that further increases in interest rates or even a sustained period of rates as high as they are could slow the economy more than required to bring down inflation, perhaps triggering a recession. Others think that if the economy continues to accelerate and the Fed holds off on interest rate increases, inflation will stay high for longer than anticipated.

Powell’s remarks acknowledged both points of view.

“Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment,” he said. “Doing too much could also do unnecessary harm to the economy.”

Powell’s remarks were consistent with the idea that the Fed will not hike in September but may hike at its November meeting. Prior to the speech, Fed funds futures implied around an 80 percent chance of a pause in September. Those odds were largely unchanged immediately after the speech. Similarly, the market yesterday was pricing in around a 56 percent chance of an increase in November. After the speech, the odds were basically unchanged.

Powell said that financial conditions have broadly tightened in a way that is historically is consistent with bringing down inflation. But he noted that officials “are attentive to signs that the economy may not be cooling as expected.”

The Fed chair soundly rejected the idea that the Fed could relax its goal of two percent inflation and adopt a higher target.

“Two percent is and will remain our inflation target,” he said.

Markets were volatile following the speech as investors attempted to discern what it means for the economy, inflation, and rates. The broad impression is that the speech was somewhat hawkish but not more hawkish than markets were already anticipating.

COMMENTS

Please let us know if you're having issues with commenting.