The Labor Market Is Still Very Strong

While the notion that the labor market has been softening underneath the strong headline figures is increasingly popular, the evidence marshaled to support it is not very strong.

The headline labor market figures have been extremely strong. The economy added 239,000 jobs in May, according to the Labor Department. The upward revisions to March and April tacked on another 93,000 jobs. The three-month average is now 283,000, a number that would be impressive in any economy and one that is absolutely shocking in an economy already at full employment and grappling with one of the most rapid rate hike cycles in history.

To put that number in context, it would only take around 75,000 to 100,000 new jobs each month to keep up with demographic trends. So, we’re running at or close to double “trend-like” payroll growth.

Meanwhile, employers were trying to fill more than 10 million job vacancies at the end of April. There were 1.8 openings for every unemployed person, a figure that was unprecedented prior to the post-pandemic labor crunch. In other words, the labor market is extraordinarily tight.

The payrolls data has been so strong that economists have not been able to keep up. Since the start of last year, payrolls have come in above the consensus estimate in 15 out of 17 months. This adds up to 1.75 million more jobs than forecast, according to Bank of America’s Ethan Harris, or about 100,000 jobs a month.

The Case for Weakness Is…Weak

So, where is the weakness? The unemployment rate moved up from 3.4 percent to 3.7 percent in May. This data, however, comes from the much more volatile and smaller household survey. This showed employment dropping 310,000 in May. While this survey is long-running and has a good track record over the long term, when it conflicts with the larger establishment survey in a given month, it is probably best to look to the establishment survey for guidance.

We do think the household survey could be picking up on an important economic trend. There appears to be a slowdown in the self-employment and very small business sector in the United States. Some of this may be due to tightening financial conditions and inflation pushing up costs. Some of the self-employed are likely moving onto payrolls, which would explain where all the workers fueling payroll growth are coming from. (That was a bit of a mystery given the fact that labor force participation has not been rising.) Some may simply be declaring themselves unemployed. The good news is that with 10.1 million vacant jobs, it is unlikely that they will stay that way for long.

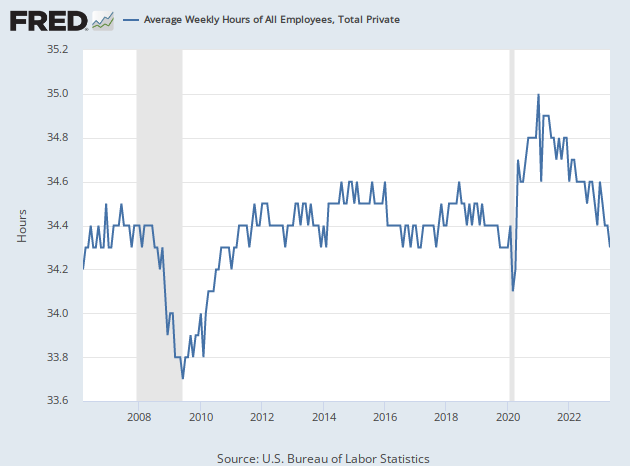

The dip in the average workweek is another widely cited data point supporting the softening labor market thesis.

This is overstated. The average workweek has declined from 34.6 hours in January to 34.3 hours in May. A big part of this appears to be a return to a normal amount of hours worked. In October 2019, for example, the average was also 34.3. The May number was not especially low by historical standards.

We suspect that part of what is driving down the workweek is the increasing demand that employees return to the office. Anecdotal evidence suggests that many workers are willing to work longer if they can do so from the comfort of their homes. What’s more, the absence of a commute allows for more time spent on the job.

Harris at Bank of America points to a shift in the composition of the workforce. We’re employing more workers in jobs in which people work fewer hours.

“This drop is mainly due to rapid hiring in industries with low average hours. For example, in the past two years 26% of job growth has been in leisure and hospitality where the average work week is only 25.4 hours compared to 34.3 hours for the private sector as a whole,” Harris wrote in a recent client note.

It’s also true that while average hours may be declining, total hours worked are rising because there are more people working.

The final component of the softer labor market thesis is wages. Average hourly wage growth has slowed down in the past few months to a four percent annual pace. But this, too, is largely reflecting the work force composition.

“A significant chunk of the weakness is due to high growth in low-wage jobs. Again focusing on the red-hot leisure and hospitality sector, even with some increase in pay in the last couple years these workers earn an average of $21 per hour compared to $33 for the private sector as a whole,” Harris wrote.

Eventually, the labor market is likely to crack under the pressure of rising rates. There just is not much evidence that it has started to crack yet.

COMMENTS

Please let us know if you're having issues with commenting.