Powell’s Still for Pausing

Federal Reserve Chairman Jerome Powell still appears to support a pause at the next meeting—and expects the Fed will hold rates near current levels rather than cut later this year.

Speaking to a conference in Washington on Friday morning, Powell sent a clear signal that he thinks the Fed can afford to hold off on further rate hikes at the Federal Open Market Committee (FOMC) meeting in mid-June. Going a bit further than he has in the past, he said that the current stance of policy is “restrictive,” meaning that rates are high enough that they are holding back the economy.

“We’ve come a long way in policy tightening and the stance of policy is restrictive, and we face uncertainty about the lagged effects of our tightening so far and about the extent of credit tightening from recent banking stresses,” Powell said, reading from prepared notes. “Having come this far, we can afford to look at the data and the evolving outlook to make careful assessments.”

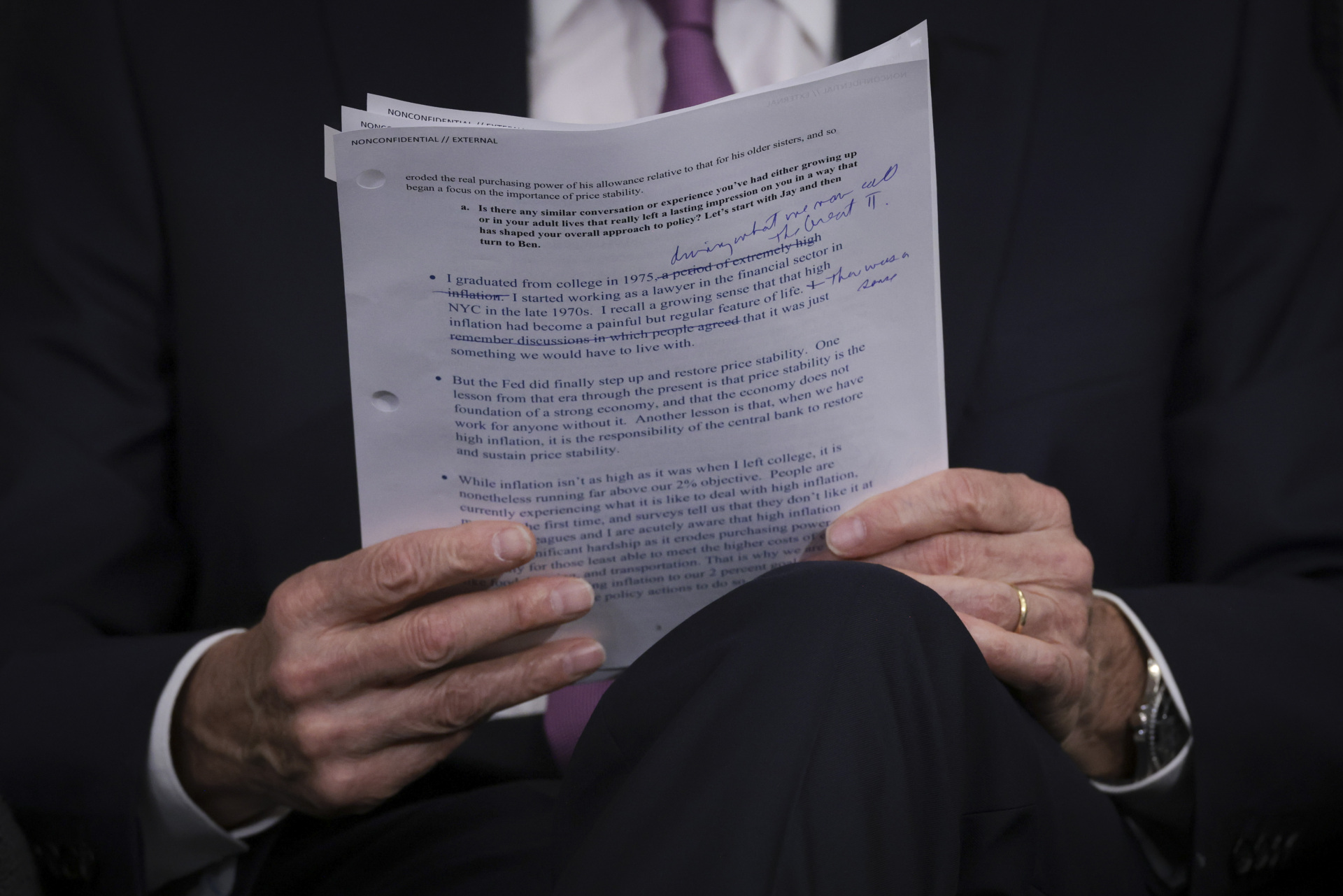

The notes themselves appeared to be part of the signal. Powell was making clear to markets that what he said was not an off-the-cuff remark but something prepared in advance. This was made even more obvious by the contrast with former Fed Chairman Ben Bernanke, who spoke without notes. The message of the notes—and the appearance that the questions also appeared to have been agreed upon in advance—was that we should be taking Powell’s words very seriously.

You can even see Powell’s last-minute, handwritten changes to his typewritten notes and the pre-cleared questions in the photos from Friday’s event.

Federal Reserve Board Chairman Jerome Powell (left) and former Federal Reserve Board Chairman Ben Bernanke (right) participate in a discussion on “Perspectives on Monetary Policy” at the Federal Reserve Board building in Washington, DC, on May 19, 2023. (Saul Loeb/AFP via Getty Images)

Federal Reserve Chairman Jerome Powell holds his prepared notes while speaking on May 19, 2023 in Washington, DC. (Win McNamee/Getty Images)

A Contrast with Other Fed Officials

The persistence of Powell’s support for a pause was also striking because we’ve heard from a number of Fed officials this week who appear to believe that perhaps the Fed should keep raising rates because the data does not yet provide evidence that prices are cooling off fast enough.

As recently as yesterday, Dallas Fed President Lorie Logan said the evidence did not yet support a pause. “The data in coming weeks could yet show that it is appropriate to skip a meeting. As of today, though, we aren’t there yet,” she said.

There was also a contrasting use of the phrase “a long way.” Powell used it to signal how far rates have moved up. Logan, echoing other Fed officials, emphasized how far above the Fed’s target of two percent inflation the economy is. “We haven’t yet made the progress we need to make. And it’s a long way from here to two percent inflation,” Logan said.

One way of interpreting this is that by having the regional Fed presidents and Fed governors publicly take more hawkish views than the chair, the Fed is preserving its optionality. If the data between now and the June meeting show still strong job growth and a stubborn consumer price index, the Fed will be able to hike without too much of a shock to the market. If the data show the labor market loosening and inflation moderating, the Fed can adopt the expected pause.

Futures Markets Still See Cuts Ahead

The fed funds futures market has been all over the place when it comes to the possibility of a June hike. A week ago, it was pricing in just a 15 percent chance of another increase in June. Yesterday, after a series of hawkish statements from Fed officials, the implied odds had jumped to 35 percent. On Friday, the odds were back down to around 20 percent.

Powell also offered a subtle observation about the difference between the expectations of Fed officials when it comes to rates and the expectations implied by the prices of bonds and derivatives. As we have mentioned a few times around here, the financial markets are implying a series of rate cuts, while the Fed’s projections show that officials expect the fed funds rate to remain about where it is through the end of this year.

In Powell’s view, this is not an instance of the market doubting the Fed’s credibility on the path of rates but a difference in expectations for the economy. The Fed foresees a mild downturn that would not require rate cuts and would only put moderate downward pressure on inflation. Powell said that he thinks the expectation for cuts implies a much grimmer view of where the economy is heading.

Powell also pointed out that surveys of fund managers are much more consistent with the Fed’s expectation than what prices in financial markets seem to indicate. So, perhaps the prices are not reflecting expectations but an unusually high cost to insure against premature Fed cuts. That, however, merely raises the question of why the cost to insure against the cuts would be unusually high right now.

One important thing Powell said on the gap between the market-implied expectations and those of Fed officials is that so far the data supports the Fed’s view.

COMMENTS

Please let us know if you're having issues with commenting.