January Was “Always Christmas But Never Winter”

In C.S. Lewis’s novel The Lion, The Witch and the Wardrobe, a faun informs a young English girl that in Narnia it is “always winter but never Christmas.” Something like the opposite happened in the U.S. economy in January: we got a kind of second Christmas with retail sales booming but nothing like the cooling of inflation that was widely expected.

The cover of C.S. Lewis’ classic children’s novel “The Lion, the Witch, and the Wardrobe.” (Wikimedia Commons)

The Producer Price Index, or PPI, came in much hotter than expected. The headline index rose 0.7 percent compared with a month earlier, and the December figure was revised up to a minus 0.2 percent decline instead a minus 0.5 percent. Economists had forecast a lift of just 0.4 percent. Over the past 12 months, the PPI is up six percent, much hotter than the 5.5 percent that was penciled in by forecasters.

Gasoline prices jumped 6.2 percent in the month. Diesel fuel prices rose 10.9 percent. Overall energy prices rose five percent. Prices were up sharply for residential natural gas, and home heating oil prices rose 1.9 percent.

Somewhat offsetting the gain in energy prices was a one percent decline in food prices, which brought the 12-month increase in food prices down to just 11.6 percent. Finished consumer foods fell one percent because of a steep 16.6 percent decline in “crude” consumer foods—basically fruits and vegetables that are consumed without further processing. (Don’t get too excited. Prices are up 44 percent compared with a year ago.) Processed consumer foods—which includes milk and bread—saw a 1.4 percent rise in prices in January and are up 8.9 percent from a year ago.

Core PPI Inflation Is Way Too Hot

Excluding food and energy prices, core producer prices were up by a solid 0.5 percent. That was far stronger than the 0.3 percent that was forecast. What’s more, the December core PPI figure was revised up from a 0.1 percent increase to 0.3 percent. Many analysts like to look at so-called “core-core” PPI inflation, which also excludes trade services, which measure changes in wholesale and retail margins rather than prices, when looking at producer prices. This rose 0.6 percent in January, up sharply from 0.2 percent in December, which was revised up from the preliminary estimate of 0.1 percent.

The PPI indexes include a gauge that closely tracks other measures of inflation faced by households—such as the Consumer Price Index and the Commerce Department’s Personal Consumption Expenditure price index—called “personal consumption less food, energy, and trade services.” Prices here were up 0.6 percent for the month, the highest gain since March of 2022’s 0.75 percent increase.

Contrary to widespread expectations that goods prices would be a disinflationary force, goods prices excluding food and energy rose 0.6 percent. The indexes for finished goods less food and energy, which includes purchases by the government and items not directly paid for by consumers, and finished consumer goods less food and energy were each up 0.7 percent. Household furniture prices were up 0.7 percent, home electronics prices rose 0.4 percent, and appliances climbed 0.1 percent. This is not what has been built into the models showing inflation cooling this year.

The PPI figures upend the idea that the Federal Reserve’s interest rate increases have put monetary policy into a restrictive enough stance that inflation can be expected to slowly decline. Many of the measures were much higher than in recent months, suggesting a re-acceleration of inflation. The headline figure of 0.7 percent was the highest since June. The core goods prices were up the most since May of 2022. The core-core PPI index saw the largest advance since moving up 0.9 percent in March 2022.

The Labor Market Is Still Sizzling

The Labor Department on Thursday also released the latest estimates for unemployment claims. With all the headlines about layoffs in both technology and entertainment, it’s easy to see why these might be expected to pick up. But they remain at incredibly low levels.

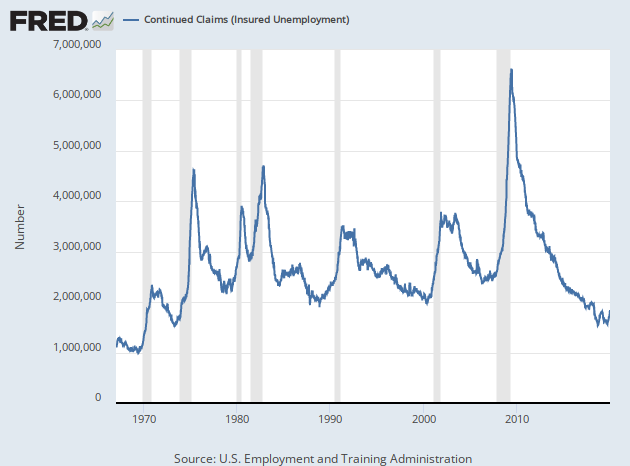

Initial claims for unemployment benefits dropped to 194,000, the fifth consecutive week in which claims have been below 200,000. To understand just how low this is, take a look at the chart below which shows claims prior to the pandemic. We’ve excluded the years after the pandemic struck because the huge spike in 2020, in which weekly claims jumped to 6.2 million in the week ended April 4, would make the chart unreadable. What you can see here is that except for a few brief months during the Trump presidency, initial claims have never been below 200,000 since 1969. They’ve only rarely been below 300,000.

This number is not adjusted for the size of the workforce eligible for unemployment benefits. Back in 1969, for example, the labor force was half of what it is today. So, the level of people seeking jobless benefits as a share of the labor force was much higher back then than it is today.

Similarly, continuing claims are extremely low. These rose by 16,000 to 1,696,000 in the latest report. As you can see in the chart below, which ends in December 2019, we’ve almost never seen claims this low. Apart from the Trump-era, you have to go back to 1973 to get claims in this neighborhood.

When the Labor Department said there were 11 million job vacancies at the end of December, an unexpected increase in openings, many thought maybe it was a fluke or seasonal distortion. Then we got the nonfarm payrolls report showing that employers added 517,000 workers to payrolls in January, and unemployment fell to 3.4 percent, the lowest since 1969. This brought the ratio of vacancies to unemployed people to 1.9 to one, near the record high hit last year. Now we’ve had five weeks of historically low unemployment claims. This is not a statistical illusion. The labor market is firing on all cylinders.

The U.S. economy experienced an inflationary boom in January—which means the Federal Reserve has a lot more work to do in its efforts to tame inflation. The chances that the Fed pauses after two more hikes are getting slimmer.

COMMENTS

Please let us know if you're having issues with commenting.