President Joe Biden keeps trying to talk America out of worrying about inflation, but it is not working.

One of the reasons Biden has been so ineffective is that he has repeatedly made statement that conflict with the reality Americans encounter in their daily lives. For example, in an interview with 60 Minutes that ran this weekend, the president claimed that inflation in August was up “just an inch, hardly at all.”

Presumably, he had in mind the fact that the consumer price index rose just one-tenth of a percentage point from July to August. Unfortunately, once you strip out gasoline, inflation was up by a lot more than that. Core inflation, which excludes food and fuel, rose 0.6 percent. Food prices rose 0.7 percent. Median inflation, which many economists think is a good gauge of underlying inflationary pressures, rose 0.7 percent. That annualizes to more than nine percent inflation, the highest we’ve ever seen in records that go back to 1983.

In other words, prices were up by a lot in August. When Biden tells America that prices rising at an annualized rate of 9.2 percent is “just an inch, hardly at all,” he might as well be telling people not to believe their lying eyes.

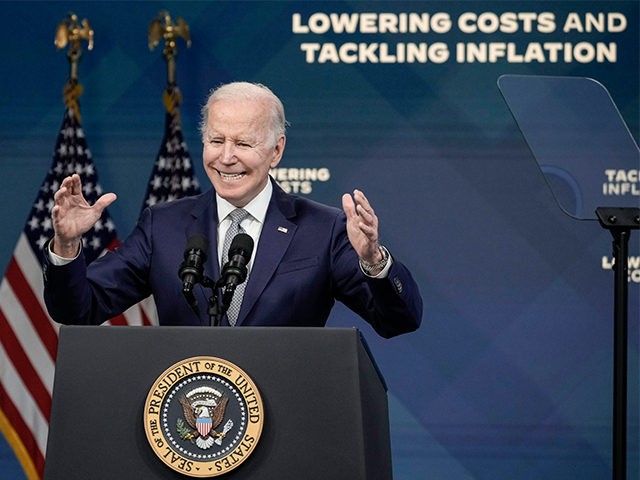

U.S. President Joe Biden speaking in the Roosevelt Room of the White House on April 28, 2022. (Anna Moneymaker/Getty Images)

The latest polling from the Economist and YouGov indicates that people prefer the evidence of the eyes to the president’s words. Seventy-five percent of people say inflation is a “very important” issue. Forty-three percent say they expect inflation will be higher six months from now than it is today. Another 26 percent say they expect inflation will be unchanged in six months. Only 18 percent say they expect it to be lower.

The partisan breakdown is even more remarkable. Sixty-three percent of Republicans expect higher inflation and 22 percent expect inflation to remain at the current levels. Just 7 percent of Republicans expect lower inflation. Forty-seven percent of independents expect higher inflation and 23 percent it to stay where it is. Only 13 percent expect inflation to fall. Even among Democrats, a majority expect inflation to rise or stay high, with 21 percent forecasting higher inflation and 33 percent forecasting inflation to stick. Just 32 percent of Democrats expect inflation to decline.

Biden is telling people that we’re going to get control of inflation, but even his own party is skeptical.

This is also bad news for the Federal Reserve. The poll numbers indicate that nearly three-quarters of Americans do not believe that the central bank’s tightening campaign will bring inflation down over the next six months. This raises the danger of an inflationary mindset taking hold. When consumers expect rising prices, they pull forward purchases to avoid higher prices in the future. The surge in demand can push prices up even faster. Similarly, workers expecting inflation will demand more in compensation, and that extra income adds to demand and therefore inflation.

Federal Reserve Board Chairman Jerome Powell speaks during a news conference in Washington, DC, on July 27, 2022. (MANDEL NGAN/AFP via Getty Images)

When Jerome Powell says that the “clock is ticking” on getting inflation under control, it is this shift toward inflationary psychology and behavior he is worried about. He would be wise to use his time in the public spotlight this week at the press conference after at the Federal Open Market Committee to once again try to persuade the public that he really will stop at nothing to bring down the rate of inflation. An extremely hawkish press conference, however, will likely tank the stock market. Powell knows this all too well, and that may lead to him pulling his punches a bit.

The market foresees a 75 basis point hike at the next meeting. Fed funds futures imply a slightly less than one-in-five chance of a 100 basis point hike. The real focus of investors, however, is likely to be what the Fed says or doesn’t say about the pace of hikes going forward. Larry Kudlow last week called for at least three 100 basis point hikes this year, which would put the fed funds rate at 5.25 percent. That’s unlikely to happen, but it would probably get the public to start paying attention and believing Powell when he says he will bring down inflation.

COMMENTS

Please let us know if you're having issues with commenting.