Just for appearance’s sake, you would have thought that one of the homeowners in Martha’s Vineyard would have offered to open his or her house to the migrants shanghaied to the island by Florida governor Rick DeSantis. Instead, the migrants were sent packing to a military base on the mainland.

President Barack Obama, for example, has plenty of room. In 2019, Obama purchased a seven-bedroom, nine-bath, nearly 7,000-square-foot house that sits on 29 bucolic acres alongside Edgartown Pond on the island’s southeastern shore. His two neighbors to his immediate north have eleven beds between them, according to real estate records. The two neighbors to his south have ten beds between them. So by our count, the neighborhood could have housed more than half of the newcomers.

Since this is the Breitbart Business Digest, we’ll point out that the former president’s investment in Martha’s Vineyard real estate has worked out extraordinarily well. The president reportedly paid $11.75 million for the place in 2019. Zillow estimates that it is now worth $18.4 million, nearly a 57 percent gain.

President Barack Obama plays golf at Farm Neck Golf Club in Oak Bluffs on Martha’s Vineyard on August 8, 2015. (SAUL LOEB/Getty Images)

Aerial view of Barack and Michelle Obama’s home on Martha’s Vineyard. (Photo: LandVest)

A handful of migrants from Venezuela wait outside of St. Andrews Episcopal Church on Martha’s Vineyard on September 15, 2022. (Jonathan Wiggs/The Boston Globe via Getty Images)

I’ve Seen Fire…

The labor market remains incredibly hot. The Labor Department reported Thursday that initial unemployment claims fell by 5,000 to 213,000 in the week ended September 10. This is the fifth consecutive week of falling claims. The four-week moving average, which smooths out volatility from week to week, declined to the lowest level since June.

This suggests that the Federal Reserve’s efforts to ease labor market tightness have not gained much traction. Employers are clearly holding on to workers despite softening in the retail sector and in manufacturing. These low levels of layoffs point toward another hot jobs number for September. The tightness of the labor market will give workers more leverage to push for higher wages. That will fuel inflationary pressures further.

By subscribing, you agree to our terms of use & privacy policy. You will receive email marketing messages from Breitbart News Network to the email you provide. You may unsubscribe at any time.

Shifting consumer spending toward services is likely creating additional demand for workers because so much of the services side of the economy is manpower intensive. Restaurant sales, for example, rose 1.1 percent in August, according to the Census Bureau.

…and I’ve Seen Rain…

FedEx delivered a pretty dire view of the global economy, sparking a broad selloff in stocks. The company warned that a macroeconomic slowdown was lowering the volume of goods being shipped around the world. In an appearance on CNBC Thursday, FedEx’s chief executive said he expects the global economy to enter a recession. The company warned that profits in the quarter that includes August would be roughly half of what Wall Street was expecting. Shares of FedEx fell 21 percent on Friday.

While FedEx’s size makes it a decent economic bellwether, it’s not safe to assume that the U.S. economy is in as dire shape as the decline in FedEx shares might seem to imply. In the first place, a lot of the softness FedEx expects is emerging from Asia and Europe, which have their own particular challenges. Second, FedEx was a huge benefiter of all the consumer spending on goods during the pandemic and post-pandemic recovery. Now that spending is rebalancing back toward services, this will hurt shipping volumes.

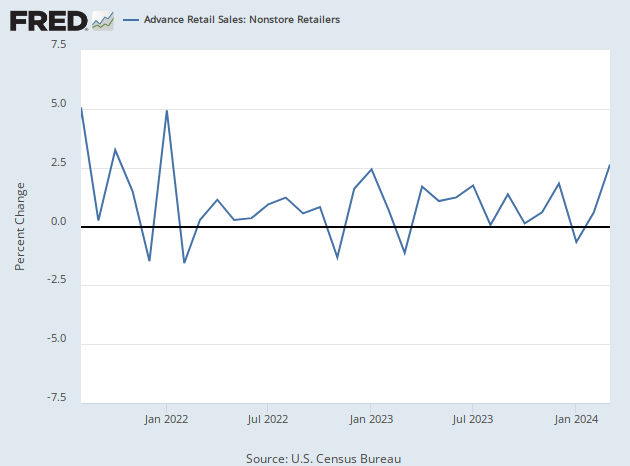

In the Census Bureau’s report on retail sales for August, online sales dropped by 0.7 percent. That is the first month-to-month decline since March and likely reflects a shift away from people ordering so much stuff. (Although some of the decline may be an artifact of the seasonal adjustment not properly accounting for Amazon’s Prime Day in mid-July.)

That said, the shift back to services is happening more slowly than expected. Remember that big jump in restaurant sales we mentioned? A good part of it was due to inflation rather than people eating out more frequently. The consumer price index of food away from home rose 0.9 percent. So the real increase was just 0.2 percent. On an annual basis, sales are up 10.9 percent, but the price index is up by eight percent, leaving real growth at just under three percent.

… I’ve Seen Rate Hike Cycles That Never Seemed to End

The Federal Reserve is almost certain to announce a 75 basis point rate hike next week, although there is a slim chance that they could announce a 100 basis point hike. If the Fed does act as expected, however, the focus of investors will be on the Summary of Economic Projections (SEP). We haven’t seen the dots since the June meeting, and it is very clear those are now badly out of date.

The last SEP had the Fed Funds rate rising to 3.4 percent by the end of this year and 3.8 percent by the end of next year. We’ve since heard from a number of Fed officials that they would like to see the target be around four percent early next year, which means the expected tightening has not just accelerated by 12 months but also pushed up the terminal rate. That report also had unemployment at 3.7 percent by the end of this year and 3.8 percent by the end of next year. Both are likely to be revised a good deal higher in the new estimates.

A big test will be not just how high the Fed Funds rate is expected to go but how long it will stay there. The June SEP had the rate falling back down to 3.4 in 2024. If the Fed wants to really convince the market that rates will stay higher for longer, officials may do away with the projected decline. The Fed still has work to do to convince markets that they will not soon see lower rates again.

COMMENTS

Please let us know if you're having issues with commenting.