The economy has a sense of humor.

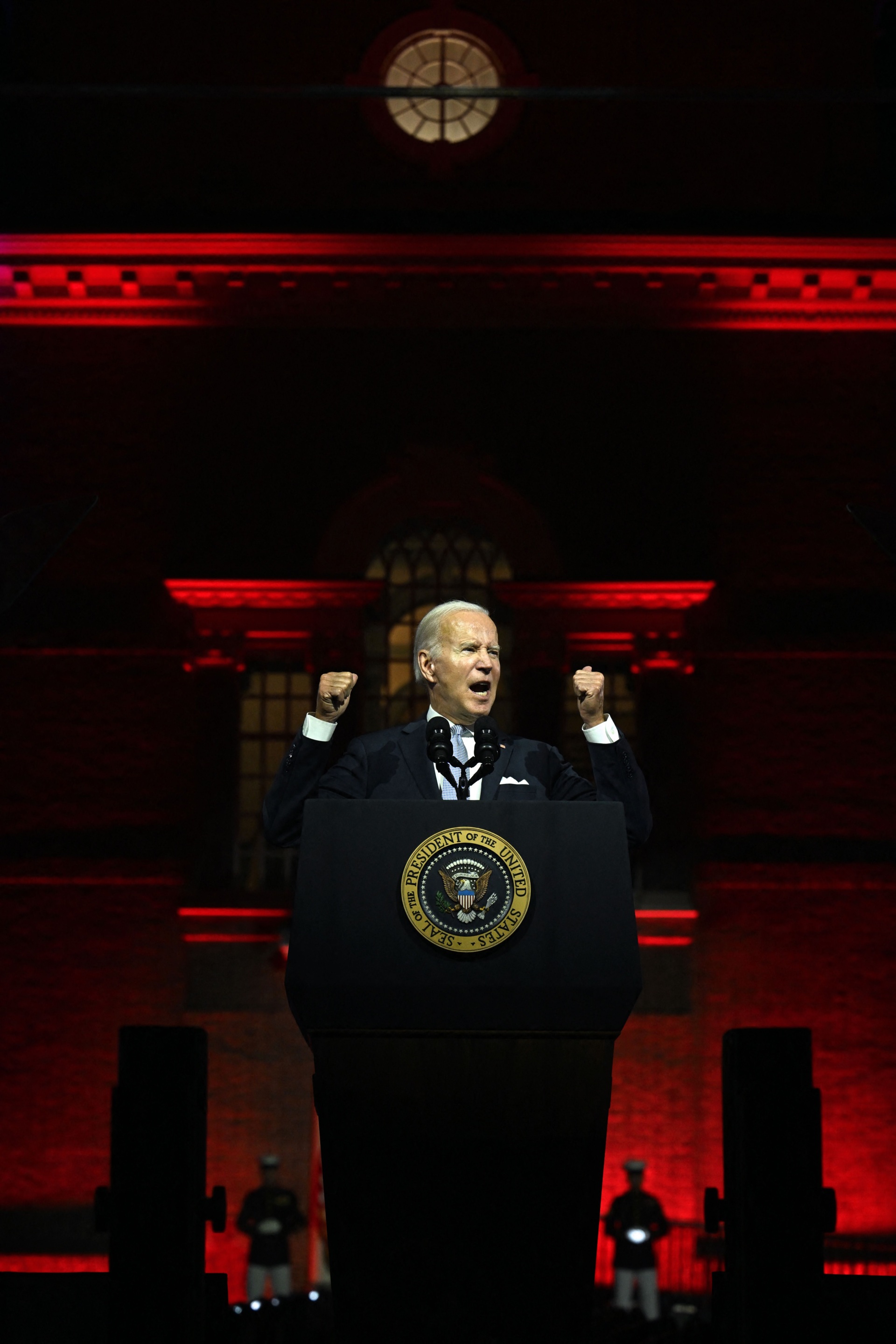

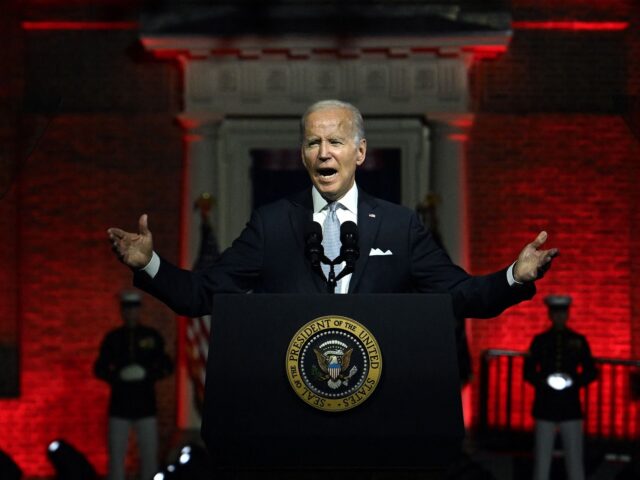

The morning after President Joe Biden delivered his Dark Brandon at the Gates of Hell speech, the Labor Department delivered a jobs report that was pretty close to perfect.

Biden described an America locked in a “battle for the soul of the nation” and said that conservatives had embraced “an extremism that threatens the very foundations of our Republic.” The labor market, on the other hand, provided some solace that perhaps we can escape the clutches of the inflation brought on by Biden’s profligacy with less deprivation than feared.

President Joe Biden delivers a primetime address denouncing “MAGA” Republicans outside of Independence National Historical Park in Philadelphia, Pennsylvania, on September 1, 2022. (Jim WATSON/AFP via Getty Images)

U.S. employers added 315,000 workers to their payrolls in August, the Labor Department said. For the first time in quite a while, this was actually in line with the forecasts of economists. Perhaps the guys with spreadsheets just got lucky, but we prefer the more optimistic interpretation that the economy is becoming a little less unpredictable.

More importantly, this represents a significant pullback in hiring from the 526,000 in July. The rise in job vacancies in July had created the potential for another mammoth month of job growth, which would have certainly added to inflation. Now July looks more like an outlier in a relatively stable, if not yet downwardly trending, jobs market.

The June payroll figure was revised down by 105,000, making the three-month average 378,000. That’s a very solid number, and perhaps a bit inflationary, but less so than the 413,000 we would have been looking at without that revision. This is also a reminder that these estimates can be volatile and subject to large revisions. We may learn that the torrid July figure was a significant overstatement.

Average hourly earnings are still rising, but the pace has slowed. In August, average hourly earnings rose 0.3 percent, down from 0.5 percent in July. This was slightly below the estimate for a 0.4 percent rise. The average hourly earnings for production and nonsupervisory workers rose 0.4 percent. The average workweek for employees fell a bit, as well, which brought the weekly earnings gain to nearly zero.

The unemployment rate climbed from 3.5 percent in July to 3.7 percent. This indicates a bit of a loosening in the labor market. You can think of the unemployment rate kind of like cars on a used car lot. If there are few cars on the lot, the salesman will be less inclined to negotiate a lower price. Raising the unemployment rate adds cars to the lot, giving the buyer more bargaining power.

Of course, the fact that there were 11.2 million job vacancies at the end of July pushes in the opposite direction. To extend the metaphor a bit, job vacancies are like customers coming into the lot. When the salesman sees the lot swarming with potential buyers, he’s likely to push harder to keep his prices up. Hiring on to payrolls may have slowed, but the appetite for labor among employers remains voracious.

Pedestrians walk past a “Now Hiring” sign in Arlington, Virginia, on March 16, 2022. (STEFANI REYNOLDS/AFP via Getty Images)

Perhaps more importantly, the unemployment rate rose for a very helpful reason: there were more people looking for work who previously were not in the labor force. The labor force grew by 766,000 in August, far above the 172,000 added to the population. The labor force participation rate rose from 62.1 to 62.3 percent. This is still below prepandemic levels, but at least it is moving in the right direction.

The expansion of the labor force is a helpful reminder that we have not necessarily locked ourselves into a permanently lower level of participation in the economy. There are 5.5 million people who are not counted in the labor force because they have not looked for a job lately but say they want to work. That’s around a half-million more workers who likely can be drawn back into the labor force. There are around 1.4 million workers who have looked for a job in the last 12-months but not in the last four weeks. They get counted as “discouraged workers” not in the labor force and could be a potent source of workers. Putting more of these people into jobs would provide some cushion from wage-driven inflation.

This jobs data could support a decision by Fed officials to raise rates by 50 basis points instead of 75 at their meeting this month. It also demonstrates that there is a path toward a bigger labor force that could lower inflationary pressures with less tightening of financial conditions by the Fed. While we would still be very skeptical about the idea of ‘immaculate disinflation’—inflation that comes down without a significantly higher rate of unemployment—it’s possible that we may get by with less of the pain that Fed chairman Jerome Powell has been warning us about.

One month does not make a trend. We still have the August consumer price and producer inflation reports ahead of us—and higher-than-expected prints could snuff out the hope for a softer landing. Dark Brandon’s rampages could still send the economy into a tailspin. But as the summer’s heat gives way to the cooler breezes of autumn, we are ready to accept with a smile and a laugh the optimistic signals when they come.

COMMENTS

Please let us know if you're having issues with commenting.