Mortgage rates are soaring once again, putting pressure on a housing market that builders and realtors say has already fallen into a recession.

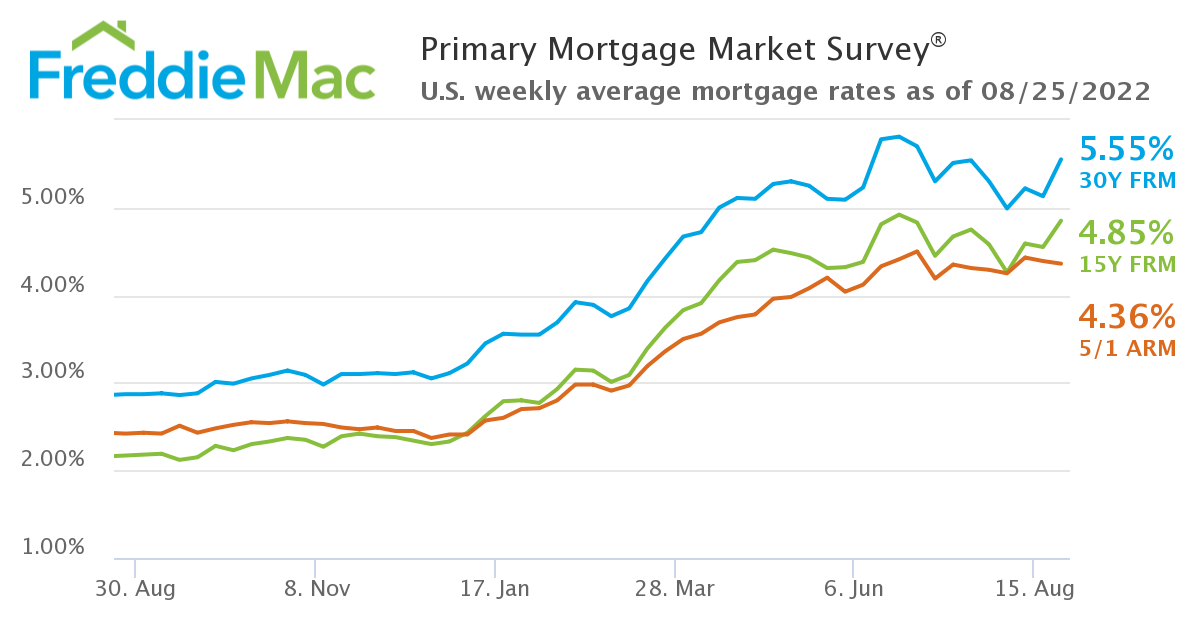

The average interest rate on a 30-year fixed mortgage climbed to 5.55 percent this week, according to data released by Freddie Mac Thursday.

The 30-Year Fixed Rate Conforming Mortgage Index, calculated from actual locked rates with consumers across 35 percent of all mortgage transactions nationwide, has risen to 5.741 percent, according to data from Black Knight also released Thursday. The rate on jumbo mortgages—those exceeding around $647,200 in most U.S. counties—rose to 5.529 percent. The rate on FHA loans, which are backed by the government and available to borrowers with worse credit profiles, rose to 5.571 percent.

The rates are the highest since June and around twice the rates borrowers saw last year.

Higher interest rates have cooled the market by making homes less affordable. Sales of existing homes fell 5.9 percent in July, the sixth straight month of falling sales. Sales of new homes fell by 12.7 percent in July and are down by 29.6 percent from a year ago. Sales of new homes fell every month this year except for a brief 1.77 percent uptick in May.

Home builder confidence has fallen for eight months. In July, the NAHB/Wells Fargo housing market index unexpectedly dropped six points to a reading of 49, below the breakeven point indicating a deteriorating market. Housing starts have fallen to their lowest level since the initial lockdown months of the pandemic.

The Federal Reserve has been hiking interest rates in an effort to tame inflation. The mortgage market is one of the most responsive to the stance of Fed policy.

COMMENTS

Please let us know if you're having issues with commenting.