G.K. Chesterton once said that he owed his success to having listened respectfully to the very best advice, and then doing the exact opposite.

This is how we have felt over the past year and half while the vast majority of establishment economists consistently were wrong about inflation. They forecast that inflation would stay mild, that it would stay confined to a few things related to passing shortages and the reopening, that it would prove transitory, and that it had peaked. We consistently argued that this was nonsense and predicted inflation would keep rising.

There were, of course, some establishment types who got things right (and plenty of heterodox economists, especially on the left, who were as wrong as the establishment types). Larry Summers, Oliver Blanchard, Jason Furman—all thoroughly establishment and left-of-center—predicted higher inflation or warned that it might prove more persistent than the rest of the establishment—including Federal Reserve and Biden administration officials—were forecasting.

How exactly did we get it right? The answer is not as complicated as many of those who are now re-assessing their errors suspect.

The economic recovery was well under way in 2021 when the Biden administration took office. The unemployment rate, for example, had been plunging from its height of 14.7 percent in April 2020 to 6.4 percent in January of 2021, perhaps the most rapid labor market rebound in U.S. history. Maybe in the history of the world. There were 7.9 million job vacancies in March of 2021, exceeding the pre-pandemic level. Gross Domestic Product had soared at an annual rate of 6.9 percent in the fourth quarter of 2020. American households had piled up a $2.7 trillion nest egg of excess savings. The economy, in short, was booming.

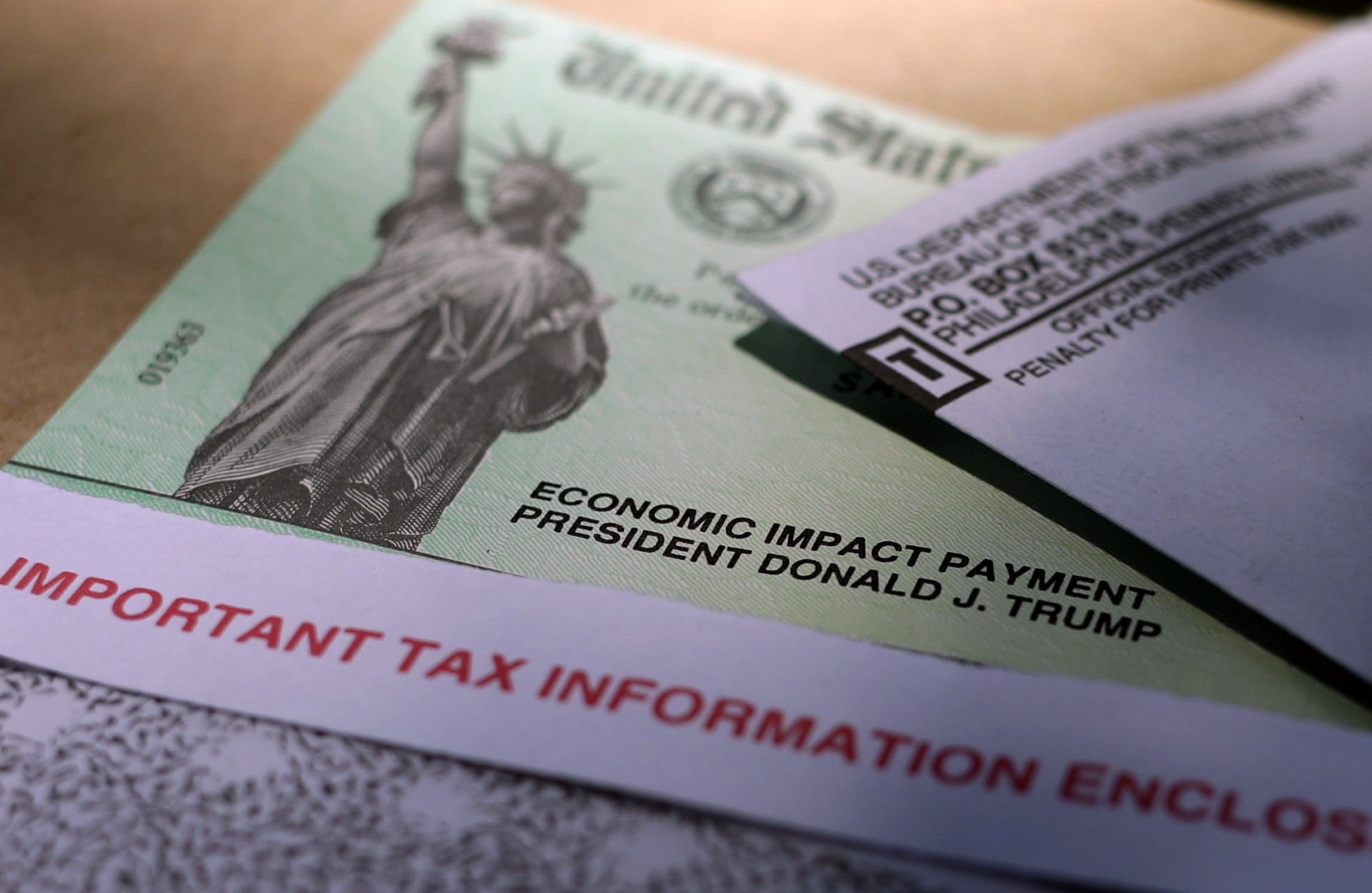

President Donald J. Trump’s name is printed on a stimulus check issued by the IRS to combat the adverse economic effects of the COVID-19 pandemic on April 23, 2020. (AP Photo/Eric Gay)

One of the reasons for this boom was the extraordinary efforts of the U.S. government to rescue the American economy from a deep and lasting recession that would likely have otherwise gripped the nation on the coattails of the pandemic. The Trump administration, together with allies on Capitol Hill, crafted a plan that was heavily criticized before and during its deployment but was also highly effective. The U.S. economy fared better than peer economies around the world, with fewer business failures, better economic growth, less unemployment, and less hardship for households. The Federal Reserve did its part by keeping interest rates low and providing an immense amount of liquidity to credit markets—which filtered through to broader financial markets and the real economy.

We supported the rescue efforts of 2020. Indeed, we were advocates for something like the plan that was adopted early in 2020 even before it was announced. We argued that only the government had the means to prevent an economic disaster—and that the government had the duty to prevent it because so much of the economic pain was the result of measures undertaken to protect public health. When you ask people to stay home, to close their businesses, to school their children at home for the sake of the public good, it is imperative that you compensate them for their sacrifices. That is what the U.S. did so effectively in 2020.

The trouble set in when the Biden administration decided that it needed to make its mark on the pandemic response by pushing the $1.9 trillion American Rescue Plan. The economy very simply did not need the additional deficit spending. The time for stimulus had passed. What was needed was steady-handed growth in which supply chains could be unsnarled, consumer spending could peaceably migrate back toward a more typical balance of goods and services, and production allowed to catch up with demand.

President Joe Biden speaks alongside Vice President Kamala Harris about their American Rescue Plan in Washington, DC, on July 15, 2021. (SAUL LOEB/Getty Images)

The impetus was purely political. If the Biden administration did not enact a rescue plan, history would show that it was the Trump administration that had rescued the American economy. This was not an acceptable outcome for a political party and its establishment media arm that had insisted that Trump had badly damaged the economy with his allegedly bungled response to the pandemic. The American Rescue Plan was not an economic necessity, but it was a political necessity for the left and the anti-Trumpers.

The argument from Summers and Blanchard against the rescue plan was mainstream Keynesian. They argued that the additional spending was too large and that if it had a normal-sized “fiscal multiplier,” it would overheat the economy. Demand for labor and goods would rise faster than supply, triggering inflation. This was right, as far as it went; but our analysis went further.

Container ships anchor near the congested ports of Long Beach and Los Angeles as they wait to offload their cargo on September 20, 2021. (Mario Tama/Getty Images)

From our point of view, the economy was likely to remain supply constrained because of the climate change agenda that had declared war on fossil fuels. This would cause fuel shortages and drive up energy prices, hurting production. The threat of higher taxes on corporations, wealth taxes, and windfall profits taxes would diminish investment. Stimulus payments, extended and super-sized unemployment benefits, student loan payment suspensions, and eviction moratoriums not only increased consumer spending but bit into the incentive to work, diminishing the labor supply by decreasing the opportunity cost of choosing leisure or activism over a paying occupation. The possibility of lifting tariffs would discourage the reshoring of manufacturing, leaving the U.S. economy vulnerable to supply constraints from abroad.

President Joe Biden speaks during the UN Climate Change Conference COP26 in Glasgow, Scotland, on November 2, 2021. (Erin Schaff/AP)

President Joe Biden speaks about rising gas prices at the White House on June 22, 2022. (Drew Angerer/Getty Images)

What’s more, it was not just the spending in the American Rescue Plan that the Biden administration was pushing. There was the infrastructure plan and the Build Back Better Plan. More spending was looming as far as the eye could see. Prospective spending contributes to inflation by shifting expectations about the availability and pricing of resources, labor, and goods.

The Fed was not blameless. Fed officials insisted that inflation was transitory and would likely remain confined to a relatively narrow part of the economy—positions that were adopted by the Biden administration whole cloth. Making matters worse, the Fed began to announce that it was now applying a sort of racial quota system to its maximum employment goal. It was not enough for unemployment to fall—the Fed said it now would work to reduce racial gaps in unemployment. This was an incredible undertaking because that gap was one of the most persistent facts about the economy ever recorded (although it did narrow dramatically during the pre-pandemic Trump era). In effect, the Fed was saying it would let inflation run hot until it had squeezed “systemic racism” out of the unemployment rate.

One of the most frustrating things about the insistence that narrow inflation meant inflation would be transitory is that there was good economic research—from the Federal Reserve Bank of Dallas, no less—suggesting exactly the opposite. In an article we published in August of 2021, we pointed to a recently published piece by a team of economists at the Dallas Fed that explained, “[N]arrowly based, extreme price surges often reflect supply/demand imbalances that can potentially affect prices for a broader range of goods and services. While these imbalances initially show up in PCE components with more flexible, faster-moving prices, they eventually bleed into more-moderate increases in a broader range of slower-moving prices.” In other words, narrow inflation was likely to lead to broad inflation—which is exactly what happened.

Federal Reserve Chairman Jerome Powell testifies before the Senate Banking Committee on June 22, 2022. (Tom Williams/Getty Images)

We were encouraged in our confidence that inflation would not fade by the insistence of the Biden administration and Fed officials that it would. This was undermining public confidence that the political, fiscal, and monetary authorities would act to tame inflation. And a public that loses confidence that inflation will be kept under control is one whose expectations for inflation become unmoored, contributing to even more inflation.

“Stability breeds instability,” Hyman Minsky taught us long ago. He pointed out that when people are optimistic about the present economic outlook, they tend to increase spending, borrowing, and investment to such an extent that the economy becomes fragile, risk-laden, and eventually panic ensues. For fiscal and monetary authorities, a similar rule applies. Stable prices breed inflation. This is because the stability encourages policymakers to ignore the risks, form narratives explaining away signs of inflation, and refuse to recognize disastrous price instability until it’s too late.

Traders work on the floor of the New York Stock Exchange on June 15, 2022, as Federal Reserve Chairman Jerome Powell announces an interest rate hike to combat inflation. (TIMOTHY A. CLARY/Getty Images)

We do not mean to claim too much credit. The point, after all, is not to bruise our own backs with self-congratulatory pats, but to explain to our readers why we were right where so many others were wrong. As we noted, there were others who saw inflation coming. In addition, Richard Curtin, the long-running (and recently retired) guru of the University of Michigan survey of consumers, warned month after month that consumer sentiment risked tipping into an inflationary beast mode, where consumers would accelerate inflation by purchasing goods in advance of expected price hikes and shortages. That behavior, of course, contributes to inflation, becoming a self-fulfilling prophecy.

Now it looks as if the economy is heading toward a recession, as consumers pull back on discretionary spending due to the high cost of living. This too was something we saw coming early, when we noticed that many apparent indicators of expansion were nothing of the sort. Nominal figures showed rising spending; but when adjusted for inflation, they suggested contraction. This was, at first, confined to a narrow group of products—especially household goods and discretionary or even luxury items—that had been the focus of intense spending throughout the pandemic. Like inflation, it has spread from narrow to broad; and now we’re seeing the services sector contract. This too we had been warned about by Professor Curtin, who repeatedly forecast that eventually consumers would balk at high prices and pull back from spending, initiating a contraction.

The whole experience has been a lesson in the wisdom of resistance to the advice of the experts. Chesterton got it right; and by following his example, so did we.

COMMENTS

Please let us know if you're having issues with commenting.