Claim: “A recent survey by the Federal Reserve found that more Americans feel financially comfortable than any time since the survey began in 2013,” President Biden said Friday.

Verdict: Misleading.

The survey is not recent, as the president claimed. It is based on responses from households last October and November, when inflation was much lower and had a lot less of an impact on household sentiment.

The most recent inflation data available to households showed prices were up 5.3 percent over the most recent 12-months in September and 6.2 percent in October. Core inflation, which excludes volatile food and energy prices, was at four percent in September and 4.6 percent in October. A survey from Gallup showed that only five percent of Americans named inflation as the nation’s top problem in October.

Since then inflation has skyrocketed. The Consumer Price Index was up 8.6 percent annually in March and 8.2 percent in April. Core inflation was 6.4 percent in March and 6.1 percent in April. The share of American households citing inflation as the top problem rose to 18 percent, the highest since 1983.

The Fed study cited by Biden is the 2021 Survey of Household Economics and Decisionmaking (SHED). It found that 78 percent of adults were doing at least okay financially, meaning they reported either “doing okay” financially (39 percent) or “living comfortably” (39 percent). Those numbers are not that much different from the 2018 and 2019 results, in which 75 percent indicated they were either “doing okay” financially (39 percent) or “living comfortably” (36 percent), matching the rate in 2018.

At the end of the Obama administration, when Biden was vice-president, only 70 percent said they were doing okay or living comfortably. The election of Donald Trump in 2016 led to a four point jump in the 2017 survey.

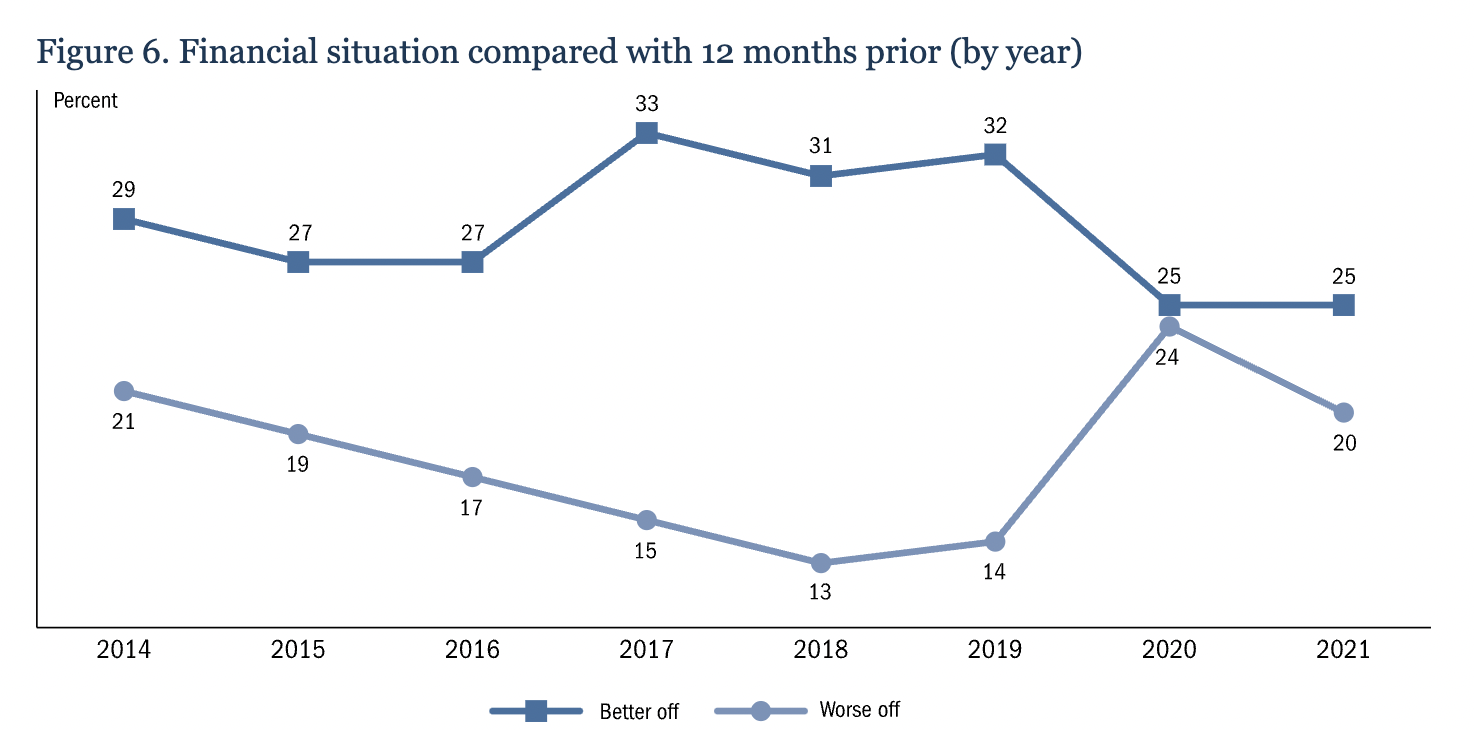

The share of adults saying they were doing better financially at the end of 2021 than they were a year ago was just 25 percent, unchanged from the 2020 result. That number had been significantly higher throughout the prepandemic Trump years. The share saying they are worse off declined to 20 percent from 24 percent but remains 10 points above the 2019 level.

To get a longer-term perspective, the Fed also asked people to compare their current financial circumstances to how they perceived their parents’ financial situation at the same age. A majority of adults (57 percent) thought they were better off financially than their parents were, up from 54 percent in 2020 but no different from the 2019 result. Twenty-one percent thought they were worse off than their parents were at the same age, one point higher than the 2019 level.

More recent surveys show a sharp decline in economic sentiment. The University of Michigan’s index of consumer sentiment has fallen by 26 percent over the past 12 months. Gallup’s consumer confidence index recent fell to minus 45, twenty points below where it stood last October and the worst rating since 2009.

Biden’s use of outdated survey data indicates that his White House has still not come to terms with the damage inflation is doing to the U.S. economy and the economic confidence of American households.

COMMENTS

Please let us know if you're having issues with commenting.