Joe Biden has apparently decided to give Saudi Arabia’s leaders what they want. The question is whether he will get anything useful in return.

Saudi Arabia has been looking for better security assurances from the Biden administration and an official visit from President Biden, who promised during his campaign for the Democratic nomination to treat the Saudi leaders as “pariahs.” The U.S. has been demanding more petroleum production in hopes of stemming surging oil prices that have sent gasoline to record highs.

The Organization of the Petroleum Exporting Countries plus Russia and a few other oil producers, together now known as OPEC+, agreed to increase their collective cap on crude production by 648,000 barrels a day in July and August, up from the 432,000 barrels a day each month under their earlier agreement.

This is unlikely to bring down oil prices by very much, if at all. In the first place, the additional barrels are a fraction of the 950,000 barrels Russia has taken off the market already. Even more is likely to come off the market if Russia reacts to the European Union’s agreement to ban seaborne imports of oil and refined fuel from Russia by further reducing its production.

What’s more, a recent study of global oil markets by economists at the Federal Reserve Bank of Dallas found that the capacity constraints of OPEC+ members were already holding production under the existing quota.

“There are several reasons this supply gap has emerged. One important explanation—and one that continues to play a role in 2022—is the inability of some OPEC+ members to increase production to take advantage of their growing quotas. These countries are bumping into capacity constraints for several reasons, including infrastructure issues and the difficulty of attracting sufficient investment to offset production declines at existing wells,” economists Lutz Kilian, Michael D. Plante, and Kunal Patel wrote in a piece published on the Dallas Fed’s website in April.

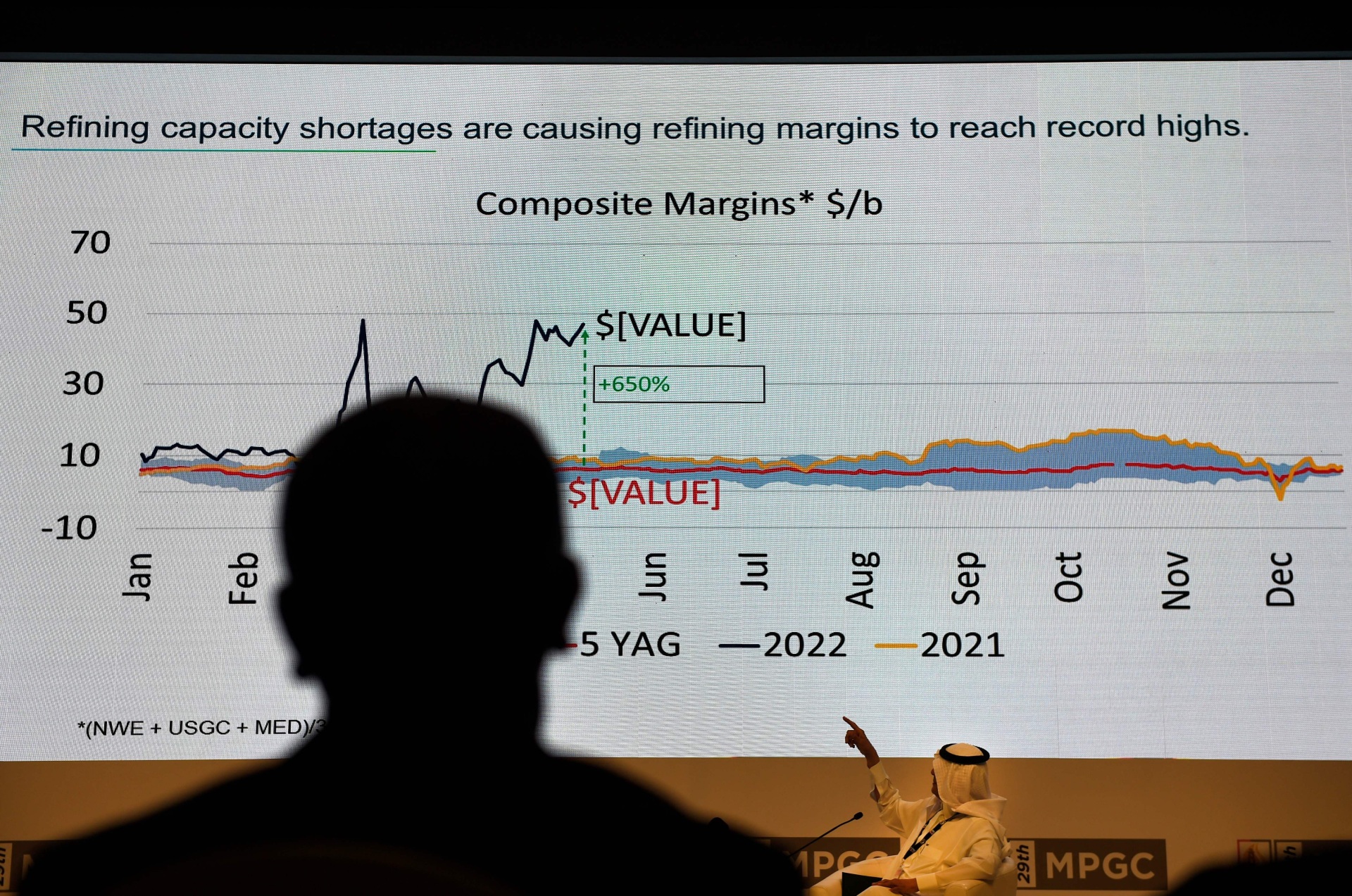

Saudi Energy Minister Abdulaziz bin Salman Al Saud addresses the 29th annual Middle East Petroleum and Gas conference in the Bahraini capital Manama, on May 16, 2022. (Mazen Mahdi/AFP via Getty Images)

Part of the problem is the way the OPEC+ quota works. All the members get a piece of the quota equal to the percentage they reduced production when prices crashed during the pandemic. There’s no mechanism for redistributing the production allowance when one or more countries fall short. So if Nigerian production declines or Russia shuts off its oil taps, the agreement does not allow the Saudis or the United Arab Emerites to step up and fill the supply gap.

Most likely, the only two countries that can quickly and sustainably ramp up production are Saudi Arabia and the UAE. As a result, any actual increase in production is likely to amount to half of the increase in the quota.

A glance at oil futures confirms that the market was unimpressed. Prior to the OPEC announcement, Brent Crude futures had fallen to $113 a barrel on the rumor that something was going to change. By the close of business on Thursday, Brent was above $118 a barrel. That is high enough to keep gasoline prices in the U.S. setting new records as summer driving increases demand and China reopens from its recent lockdowns.

Gasoline prices tend to be particularly salient in the realm of politics. They are frequently encountered by Americans driving to work, to school, or on vacation, so they have a bigger influence on economic psychology than things like used car prices. Perhaps only grocery prices have a bigger impact. And gas demand is pretty inelastic when compared to other categories of consumer goods. So when the price of gas goes up, households compensate by spending less on other goods and services.

The Saudis have scored a great diplomatic victory by winning a Biden visit and whatever other favors the administration has promised the kingdom in exchange for more oil. Unfortunately, none of this will help American motorists. Nor will it give Biden’s sagging favorability ratings a boost.

The May Jobs Report

Speaking of sagging, the May jobs figures will be released Friday. The consensus is for 325,000 additional jobs, down from April’s 428,000, and a one-tenth of a point decline in the unemployment rate to 3.5 percent.

Even with those job gains, the economy will still have around 900,000 fewer people employed than before the pandemic. There were 11.4 million job openings at the end of April, according to the most recent JOLTS report, highlighting the still incredibly strong demand for workers.

The ADP report pointed to much smaller job gains—and even a decline among small businesses. While the small business payroll decline could mean workers were poached by bigger businesses with thicker margins from which to raise wages, we would not make too much of the report. ADP’s numbers have been all over the place since the pandemic struck and are not a very useful guide to the official numbers.

One particular category to watch: employment in the oil and gas extraction sector. This rose by 5,100 in the April report from the Bureau of Labor Statistics, and ADP’s category of “natural resources & mining” is up by 5,000 for May. A slowdown in hiring here would mean more bad news for motorists hoping for improvement at the gas pump.

COMMENTS

Please let us know if you're having issues with commenting.