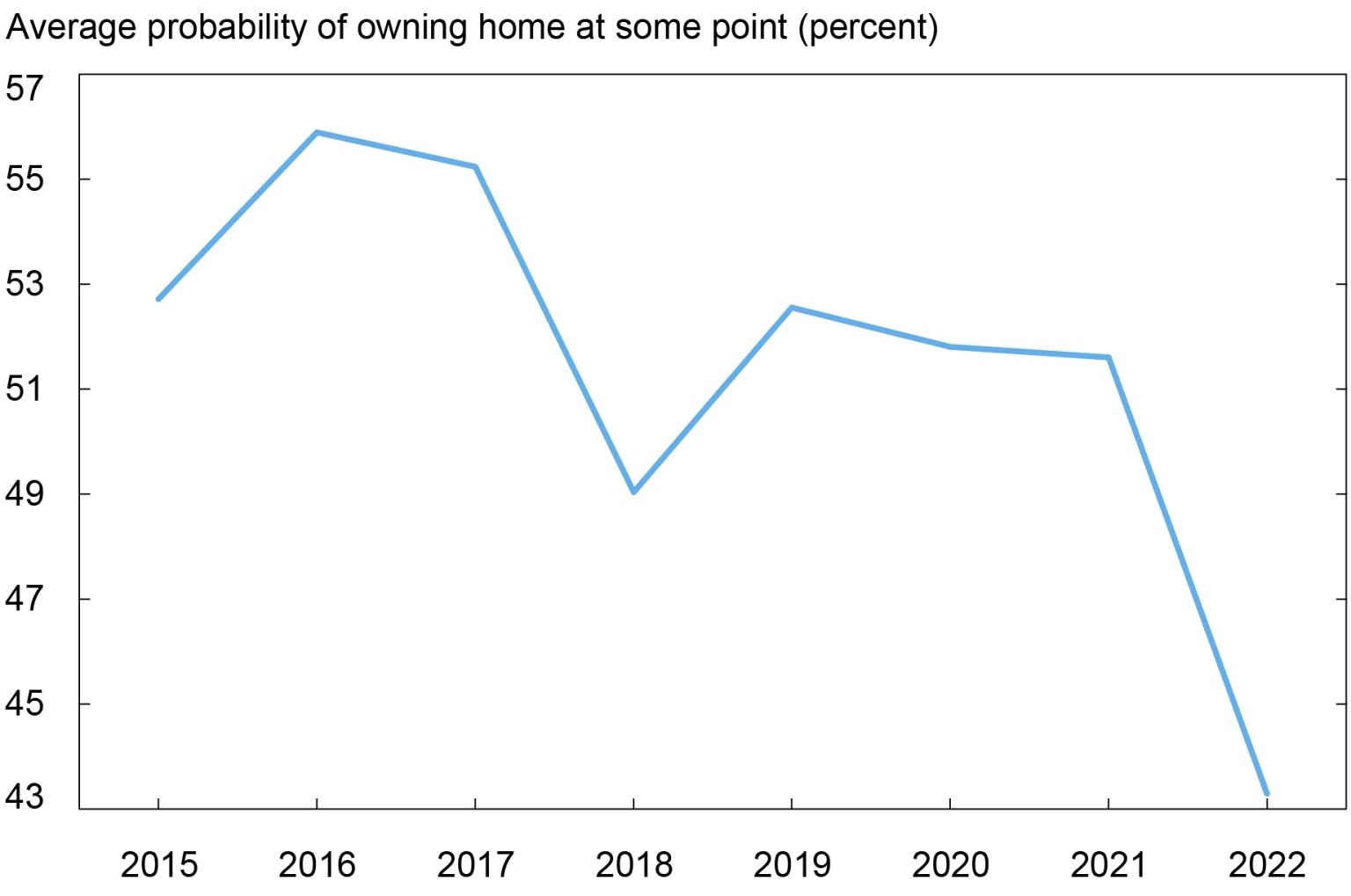

Less than half of Americans currently renting their home expect to ever become homeowners, a survey conducted by the Federal Reserve Bank of New York shows.

The N.Y. Fed’s 2022 Housing Survey shows that just the average likelihood of a renter expecting to own a home in the future has fallen to 43 percent, the first time that number has dropped well below 50 percent in the history of the surveys, according to economists at the New York Fed.

(Note: the Fed’s chart seems to show it once hit 49 percent in 2018 but that may be within the survey’s margin of error and not considered by Fed officials to be significantly below 50 percent.)

Twenty-two percent of households reported that they had planned to purchase a home but now view renting as a better financial decision. The majority of respondents either preferred to rent (36 percent) or said they were waiting for prices to come down before buying (42 percent).

Renters also expect sharp increases in their rents in the year ahead. People who rent their home expect rents to rise by 12.8 percent one year from now compared to 5.9 percent one year ago. That’s above the 11.5 percent increase expected by the broader range of households that includes homeowners. A year ago the all-inclusive expectation was for rent increases of 6.6 percent, an indication that homeowners actually expected bigger rent increases than renters.

“This is consistent with the idea that short-term rent expectations are being shaped by the sharp increases in rent that have occurred in recent months. The expected price of rent five years from now rose to an annualized increase of 5.2 percent, compared to 4.4 percent a year ago,” N.Y. Fed economists Fatima-Ezzahra Boumahdi, Leo Goldman, Andrew Haughwout, Ben Hyman, Haoyang Liu, and Jason Somerville wrote in a blogpost at Liberty Street Economics.

Home prices have been driven sharply higher in the last two years. The Federal Housing Finance Agency’s home price index is up 23.7 percent compared with the start of 2022. The S&P/Case-Shiller home price index is up 19.2 percent compared with a year ago.

Households are expecting home prices in their zip code to rise by 7.0 percent on average, compared to 5.7 percent in February 2021. Longer-term expectations remain more settled, with households expecting 2.2 percent annualized growth over the next five years.

COMMENTS

Please let us know if you're having issues with commenting.