When asked why he robbed banks, Willie Sutton is said to have replied, “Because that’s where the money is.”

That’s usually the answer when it comes to proposals to increase taxes or impose a new tax. If you look beyond the rhetoric and political posturing, very often the real rationale is simply that politicians have spotted some money that they think would be better utilized in their hands than in the hands of those who earned it. The phrase “robbing Peter to pay Paul” is often used to describe redistributive tax schemes, but we have to think it would be more fitting if it was Saul getting paid, since St. Paul gave up his tax collecting after conversion.

President Joe Biden is no exception. His latest budget proposal includes a new minimum 20 percent tax rate on households with a $100 million net worth. The tax rate applies to total income, which includes unrealized capital gains.

Democrats have long looked at accumulated unrealized capital gains as a body of wealth that has unjustly escaped taxation. In truth, however, the capital gains this proposal aims for do not escape taxation. They are taxed at the steep estate tax rate of 40 percent when they are passed on following the death of the person who built the fortune. In other words, taxes on unrealized capital gains are deferred rather than avoided.

What Biden’s proposal would do is tax the gains now, leaving fewer gains to be taxed in the future. Today’s government revenue would subtract from tomorrow’s. Our children and our grandchildren would collect less estate tax revenue because Biden’s generation wants to put their hands on the gains now. It is really an intergenerational swindle, a tax on future generations disguised as a tax on the wealthy.

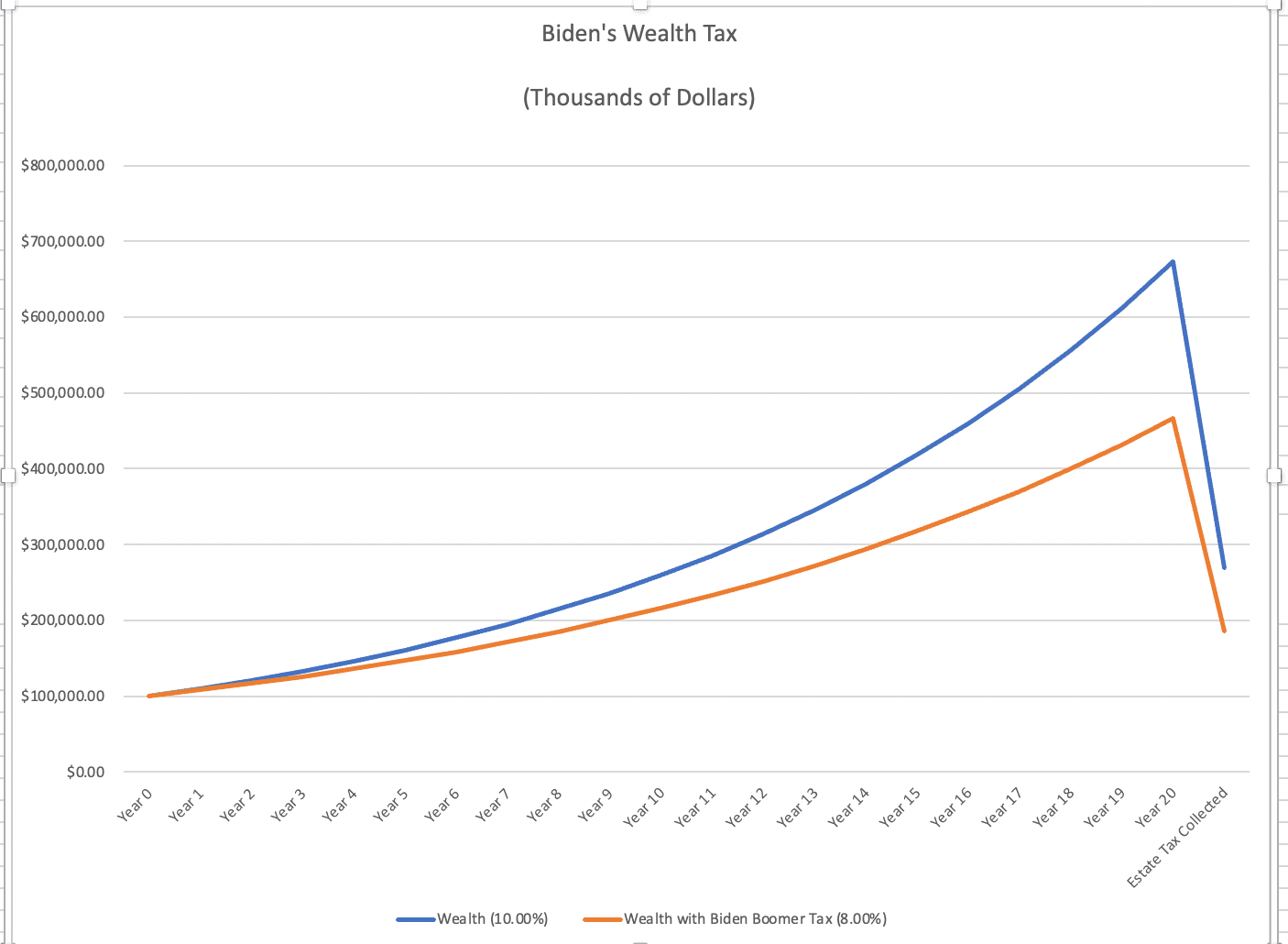

Imagine for a moment a household with $100 million in assets that appreciate on average 10 percent a year. She is a frugal widow and lives off a small income that we can ignore for these purposes. Under the current system, her gains compound and do not face taxation until she shuffles off this mortal coil. At the end of 20 years, her fortune will be worth $673 million, and her estate tax will add up to around $269 million.

The 20 percent minimum tax rate effectively reduces the gain to 8 percent a year. So with the new minimum tax, the widow’s fortune grows to $466 million over the 20 years. Her estate pays the tax of $186 million when it comes time to pass it on to her heirs. The minimum tax would have produced a shortfall for the generation that collects the estate tax of $83 million. That by the way is around $10 million more than the government collected in the tax on unrealized gains along the way. The government did not just destroy the widow’s wealth, it destroyed its own.

Under Biden’s new tax, her estate would be worth $466 million at her death, instead of $673 million. The estate tax paid by her heirs would be $186 million, instead of $269 million – a difference of $83 million. But the tax collected in her lifetime would be $73 million. So the net result is a loss of income to the government. Class warfare is expensive.

The irony is that one of the supposed goals of imposing the tax is to reduce the burden on future generations by reducing the need for government borrowing. But the reason today’s borrowing is thought to burden future generations is because some of the revenue they collect will have to go to pay debt, reducing the amount of discretionary spending for any given level of revenue. This tax on unrealized gains just skips that step by reducing the amount of revenue collected directly.

Biden is going after the wealth, including tax revenues, of future generations because that is where the money is.

COMMENTS

Please let us know if you're having issues with commenting.