You can see why Joe Biden’s friends want to blame Russia for U.S. inflation.

The American public’s approval of Joe Biden’s handling of the economy slipped a notch lower in February, according to the latest Gallup poll. It’s like someone has put a neon sign flashing #BIDENFLATION on the White House lawn.

Now they’re scrambling everyone, trying to pull the plug. But this strategy of blaming Putin probably will not work for a simple reason: inflation was already soaring.

Just 37 percent of Americans said they approve of Biden’s handling of the economy, down from 38 percent in November, 46 percent in August, and 54 percent a year ago. Sixty-two percent say they disapprove of Biden’s handling of the economy.

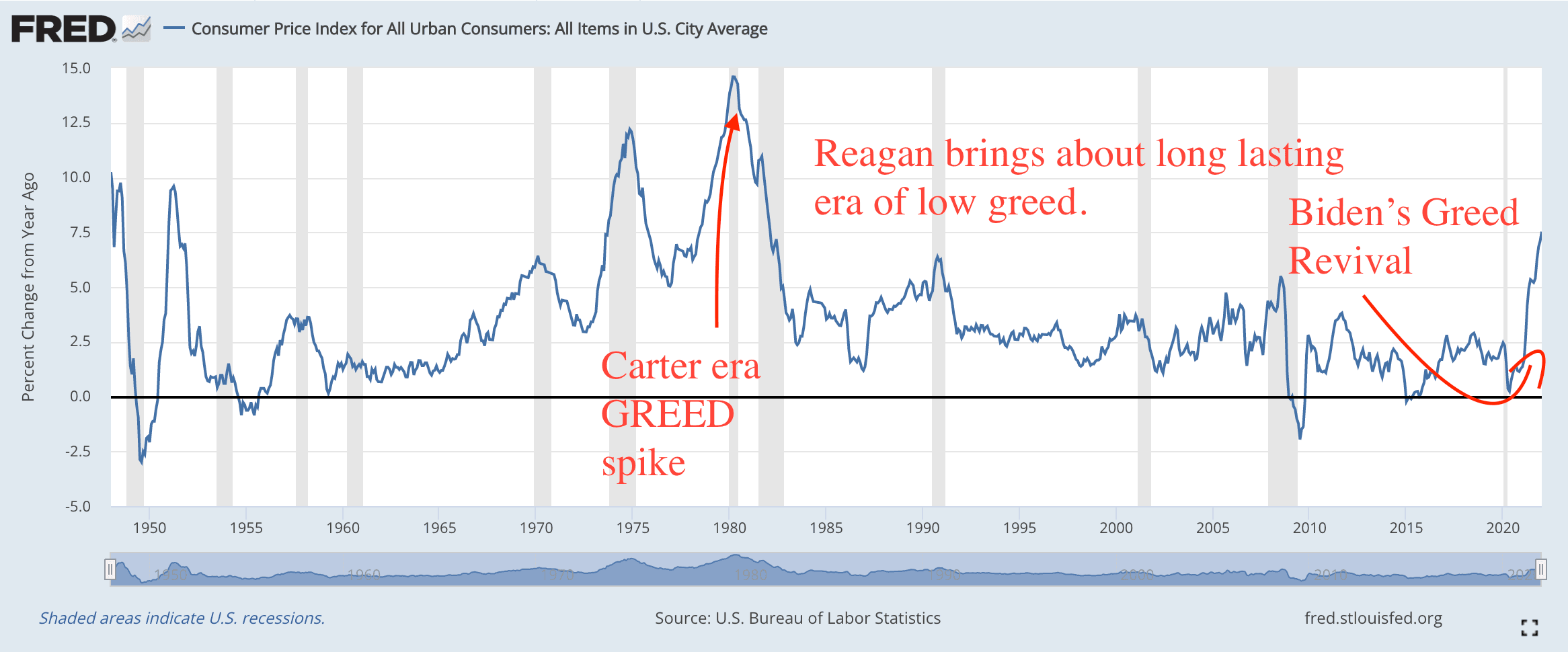

Inflation rose sharply last year and has continued to climb this year. In January, the Consumer Price Index hit its fastest pace of inflation in 40 years.

Biden and his White House lost the confidence of the public by downplaying inflation and claiming it was likely to fall back down to tolerable levels. The Biden administration also attempted to pin the blame on inflation on corporate greed, a scapegoating that attracted the mockery of economists and fell flat with the American public who doubted that corporations had suddenly experienced a surge in greed after Biden’s election.

Now the Biden administration and allies in the media are claiming, falsely, that prices are high because of the conflict over Ukraine.

The conflict could push up prices of oil and natural gas, as well as wheat and some agricultural products, but those prices were already rising long before Russia’s latest moves on Ukraine. The price of oil had climbed high enough last year, for example, that Biden ordered an unprecedented peace-time release from the Strategic Petroleum Reserves. The biggest jumps in inflation occurred last year, when the Consumer Price Index jumped sharply in the spring and again in the fall.

The conflict is likely to have only a short-lived effect on the price of gas here in the U.S., assuming it does not escalate into a full-scale war. If the U.S. imposes an embargo on Russian oil, for example, that oil will be sold elsewhere. The oil displaced by the influx of Russian oil will be sold into the U.S. Oil is not completely fungible but it is fungible enough to allow for substitution in the global market. For example, we used to buy lots of oil from Venezuela. When we stopped, we started importing more from…wait for it…Russia. The process will not be instantaneous and prices will likely jump at first but those disruptions really will be transitory.

The blame-shifting on inflation might backfire because the public already thinks Biden bungled relations with Russia. In August of 2021, the approval rating for Biden’s handling of Russia was at just 39 percent. But in February, it fell to 36 percent.

Inflation was caused by a permissive monetary policy supporting too much deficit spending as America emerged from the pandemic recession. It has continued, in part, because the Biden administration keeps attempting to spend even more money and insists on putting forward implausible plans to reduce their effects on the deficit with accounting gimmicks.

With any luck, inflation will retreat in the not-too-distant future thanks to the death of Build Back Better, a Fed willing the aggressively tighten, and a rebalancing of political power on Capitol Hill next year that will assure the public that Biden’s big spending days are dead.

COMMENTS

Please let us know if you're having issues with commenting.