How badly did omicron hit the U.S. economy? A new study suggests the wounds were deep and some could last for months.

Each new wave of coronavirus infections appears to have a diminishing drag on the economy, in part because so many employees and businesses have adjusted their workflow to allow working from home. The omicron wave that sent new cases spiking in January still managed to side-lined millions of workers and had far-reaching effects by further snarling supply chains, a report from the Federal Reserve Bank of New York showed Wednesday.

Business growth in the New York region had been going strong in the final months of 2021. But the sudden rise of infections hit pause on growth, the New York Fed’s surveys in January and February indicated.

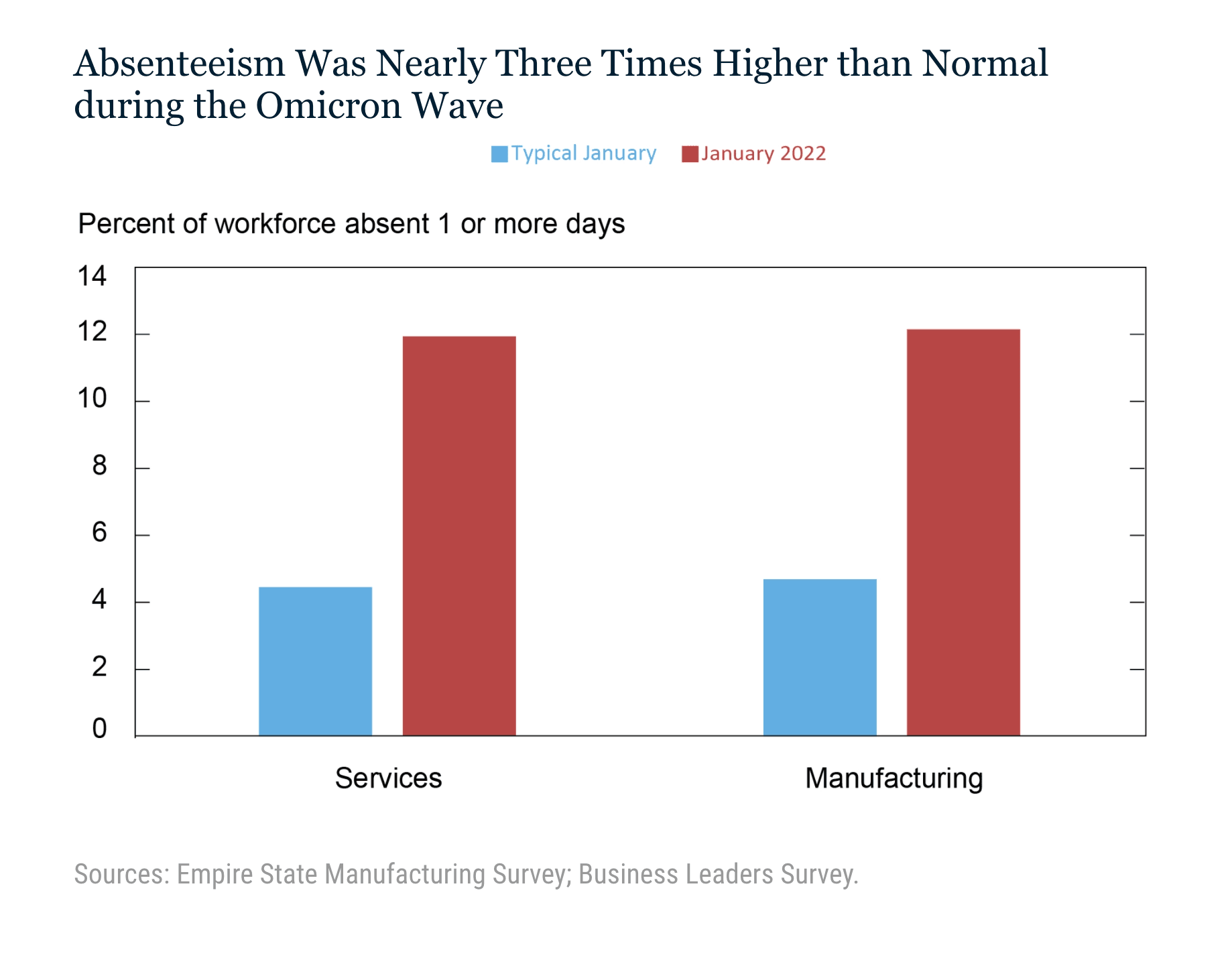

Staffing became a major problem. More than half of service companies and almost two-thirds of manufacturers reported experiencing high absenteeism with the Omicron wave. Absenteeism among existing staff in January was around 12 percent on average, for both manufacturers and service firms, nearly three times its normal level.

Different kinds of businesses dealt with the labor shortage differently.

“A sizable number of businesses in the education & health and leisure & hospitality sectors cut back on the volume of service they provide. Businesses in manufacturing and distribution, on the other hand, were more inclined to increase the hours of those who were present at work, as well as make more use of outside contractors or temporary workers,” the New York Fed said.

The Fed describes more differences between how services and manufacturers experienced the Omicron wave.

Hampered by the Omicron wave, much of the weakness in the service sector emanated from businesses relying heavily on face-to-face contact in the leisure & hospitality and retail sectors. In the manufacturing sector, however, the weakness appears to be more related to supply disruptions, as many firms were not able to procure the supplies they needed to increase output to desired levels. In fact, far more manufacturers continue to indicate that supply disruptions are worsening than improving, and roughly 85 percent note that such disruptions are impeding their business.

The good news is that infections have dropped sharply in the region. A majority of companies in the region expect economic activity to increase over the next six months, with service sector firms more optimistic than manufacturers. Those businesses hampered by supply disruptions, however, expect these to last another seven to nine months, on average.

COMMENTS

Please let us know if you're having issues with commenting.