Construction spending in the U.S. rose four-tenths of a percentage point in November, producing a gain of 9.3 percent over the last twelve months, data from the Commerce Department said Monday.

But what looks like a boom in spending may actually be an illusion created by inflation and shortages of building materials.

In November, the Producer Price Index for construction materials was up 34.7 percent. This is a Department of Labor measure of inflation that gauges what sellers of materials used for construction projects get paid for their products. November’s figure was the highest ever recorded in recorded going back to 1948, surpassing the previous high from June 2021.

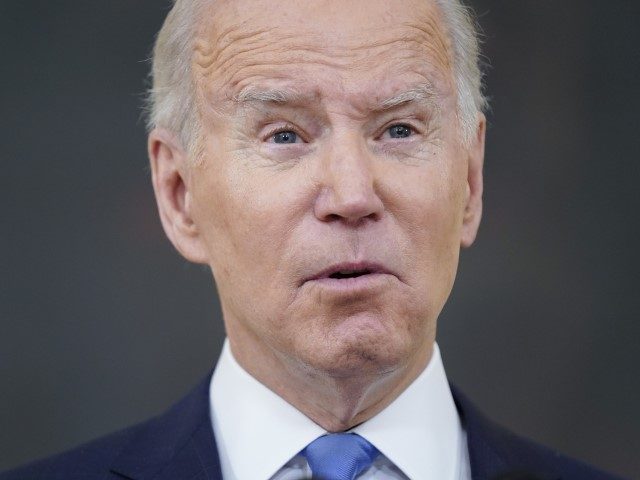

We haven’t just broken the records when it comes to inflation in construction prices. Our era of Bidenflation has smashed them to smithereens. The housing bubble era peaks saw prices rising between 10 percent and 12 percent. The high hit back in 1974 was 21 percent. The long-term average is 3.6 percent.

If we look at construction spending in light of the rise of prices of materials, it appears that construction spending is actually falling. In materials-inflation adjusted terms, November actually saw the biggest annual crash of spending in data going back to 1994. The previous record decline came in the crash following the early 2000s housing bubble.

This suggests that despite what looks on the surface like strong annual gains in spending, we’re actually likely doing less construction than we have in the past.

Residential construction, which has obviously been much stronger over the past year, rose 0.9 percent in November and is up 16 percent over the past year. But when we offset that against materials costs, real construction activity appears to be down by around 16 percent.

Spending on public construction projects fell 0.2 percent in November and is down 0.9 percent over the past 12 months, perhaps somewhat surprising given the huge amount of deficit spending we saw last year. The infrastructure bill passed last year might turn this around in 2022.

The pandemic is still weighing on non-residential construction, which was flat last month and is up just 3.4 percent in non-inflation adjusted terms over the past year. Office construction is down 32.1 percent over the past 12 months. Hotel and motel construction is down 30.7 percent. If you adjust these for the change in construction materials cost, you get eye-popping declines of over 60 percent.

One hopeful economic sign is the construction projects for the commercial sector, one of the largest categories of nonresidential building, is up by 15.1 percent after dropping sharply last year. This category tends to lag downturns in the economy, likely because commercial construction contracts compel spending even after the economy makes a turn for the worse.

The delta variant, however, appears to have stalled the recovery in commercial construction. Starting in September, the growth line goes flat. November saw a 0.1 percent decline compared with October.

The overall gain of 0.4 percent was below economist expectations but the sting of that is largely erased because October’s monthly gain was revised up to 0.4 from 0.2 and September’s figure was also upwardly revised. So what appears to have happened is that some of the gains expected in November had already occurred.

Many analysts, however, appear to be making the mistake of not looking through the nominal spending numbers to the cost-inflation-adjusted figures. Rather than booming, construction in the U.S. appears to be sluggish.

COMMENTS

Please let us know if you're having issues with commenting.