The pace of inventory accumulation by U.S. businesses slowed in July but the extent of the slump was partially hidden by high inflation.

Business inventories rose 0.5 percent following a 0.9 percent increase in June, the Commerce Department said on Thursday.

Inventories are a key part of the calculation of gross domestic product. And inventory growth is often a signal of rising business confidence and a growing economy.

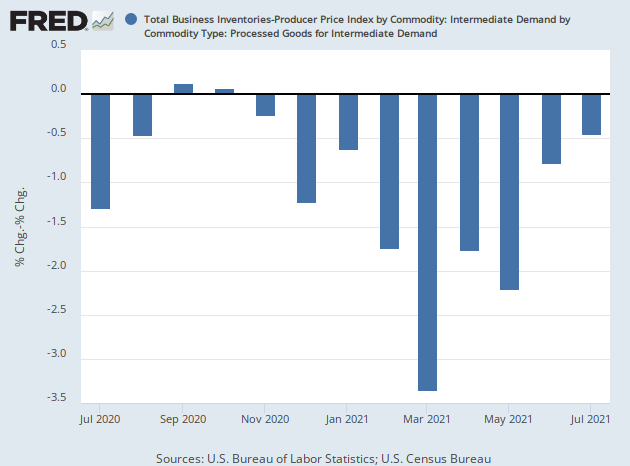

But the message of the June and July inventory accumulation is less clear because of inflation. The inventory numbers are reported in nominal figures, not adjusted for inflation. That’s not a problem when inflation is mild. But when inflation picks up, as it has this year, growth in nominal numbers can actually signal contractions in output.

The Producer Price Index for processed goods for intermediate demand, a rough proxy for inventory spending, rose 1.9 percent in June and 1.7 percent in July. In other words, when adjusted for rising prices, inventories actually contracted in those months.

By subscribing, you agree to our terms of use & privacy policy. You will receive email marketing messages from Breitbart News Network to the email you provide. You may unsubscribe at any time.

Inventories rose 7.2 percent on a nominal year-on-year basis in July. But the PPI for intermediate demand was up 23 percent.

What this indicates is that although businesses were spending more for inventories, they were accumulating less of the products for their inventories. That makes sense as June’s factory orders declined when adjusted for inflation.

Retail inventories gained 0.4 percent in July, a tick below June’s 0.5 percent rise.

Auto inventories rose 0.2 percent, held back by the persistent shortage of semiconductors that has forced automakers to cut back on production.

Retail inventories excluding autos, a category used for the calculation of GDP, rose 0.5 percent..

Shortages, supply chain issues, and congested ports have been hampering efforts of businesses to replenish inventories. As well, some businesses may be worried that high prices could drive off customers.

Wholesale inventories increased 0.6 percent. Manufacturing inventories rose 0.5 percent.

Business sales rose 0.5 percent in July after rising 1.6 percent in June. When measured against the Producer Price Index for final demand, which rose around one percent in both months, July signaled a real contraction after June’s real growth.

At July’s sales pace, businesses have around 1.25 months worth of inventory.

COMMENTS

Please let us know if you're having issues with commenting.