New weekly jobless claims rose to 770,000 for the week that ended March 13, the Department of Labor said Thursday.

Economists surveyed by Econoday had forecast a decline to 700,000. The prior week was initially reported at 712,000 but was revised up to 725,000.

Jobless claims can be volatile week to week so economists like to look at the four-week average. This fell to 746,250, a decline from the upwardly revised average of 762,0000 for the prior week.

Jobless claims—which are a proxy for layoffs—remain at extremely high levels. Prior to the pandemic, the highest level of claims was 695,000 hit in October of 1982. In March of 2009, at the depths of the financial crisis recession, jobless claims peaked at 665,000.

Even when the economy is creating a lot of demand for workers, many businesses will shed employees as they adjust to market conditions. But in a high-pressure labor market, those employees quickly find jobs and many never show up on the employment rolls. What appears to be happening now is that many workers who lose their jobs cannot quickly find replacement work and are forced to apply for benefits.

Claims hit a record 6.87 million for the week of March 27, more than ten times the previous record. Through spring and early summer, each subsequent week had seen claims decline. But in late July, the labor market appeared to stall and claims hovered around one million throughout August, a level so high it was never recorded before the pandemic struck. Claims moved down again in September and had made slow, if steady, progress until the election and the resurgence of Covid-19 infections.

Continuing claims, which get reported with a week’s lag, were at 4.124 million, the lowest level since the pandemic struck.

The total number of continued weeks claimed for benefits in all programs—including new programs for gig workers and business owners—for the week ending February 27 was 18,216,463, a decrease of over 1.9 million from the previous week.

The highest insured unemployment rates in the week ending February 27 were in Pennsylvania (6.1), Alaska (5.6), Nevada (5.4), the Virgin Islands (5.1), Connecticut (5.0), New York (4.7), Rhode Island (4.5), Illinois (4.4), Massachusetts (4.4), and California (4.2).

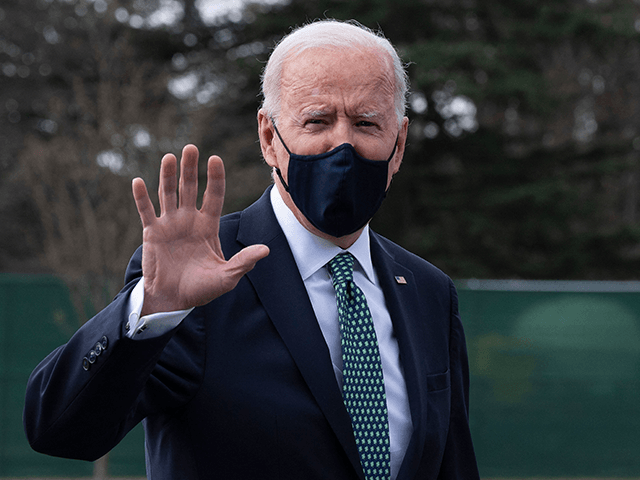

Critics of the $1.9 trillion stimulus bill have pointed out that the economy is doing much better than expected so the need for deficit spending is shrinking. Nonetheless, President Biden is expected to sign the bill into law on Friday.

COMMENTS

Please let us know if you're having issues with commenting.