The chaotic plunge in oil prices spread on Tuesday beyond the May futures contract set to expire at the close of trading.

The May futures contract for West Texas Intermediate, the U.S. benchmark, went sharply negative on Monday but bounced into positive territory on Tuesday. The June WTI contract, however, crashed more than 41 percent to just below $12 a barrel.

Brent crude prices also fell steeply. The June contract plunged around 25 percent to less than $20 a barrel.

Traders say the month-out contract is more indicative of underlying supply and demand than futures contracts due to expire in a few days.

The United States Oil Fund, an exchange-traded fund with the ticker symbo USO, was briefly halted before the opening bell Tuesday. It plunged when it began trading, falling 25 percent by midday. Year to date, the fund is down 78 percent.

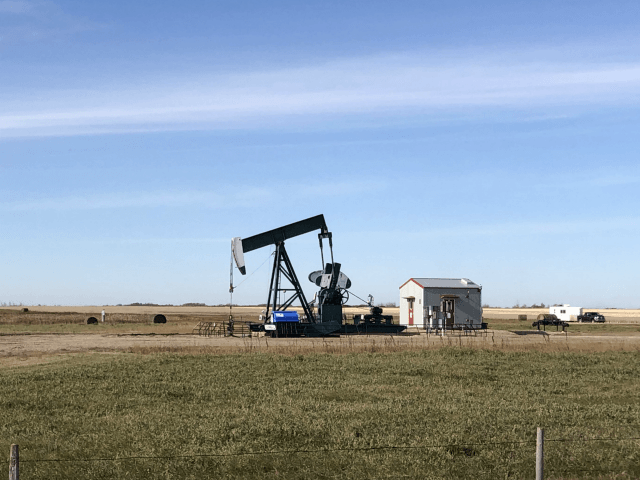

Oil prices have been hammered this year by a flood of supply and a crash in demand due to the coronavirus shutdowns. In recent weeks, oil inventories have built up so high that many storage facilities are running out of room.

The glut of gasoline has been partly fueled by a price war between OPEC, principally Saudia Arabia, and Russia. The Saudis, under pressure from President Donald Trump, earlier this month agreed OPEC would cut production by about 10 percent. But that has not been nearly enough to reduce the global oversupply and the Saudis now argue that U.S. producers should scale back.

COMMENTS

Please let us know if you're having issues with commenting.