The Federal Reserve announced a huge round of bond purchases alongside its decision to slash interest rates down to zero.

The Fed said it would begin on Monday buying at least $500 billion in Treasuries and $200 billion in mortgage-backed securities and reinvest all of the proceeds from debt already on its balance sheet maturing.

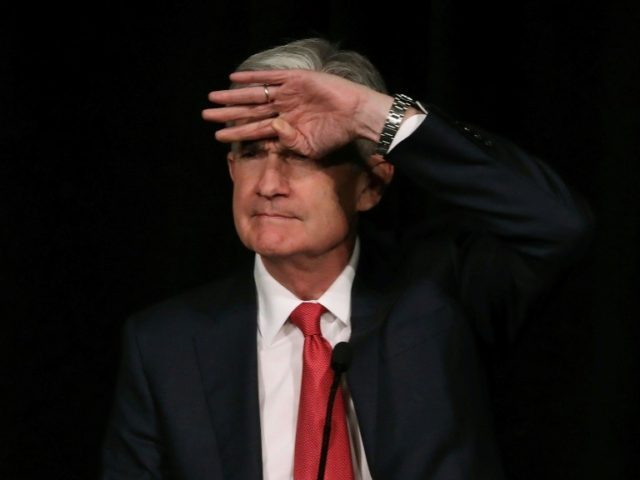

Large scale asset purchase programs in the recent past were known as quantitative easing because they were aimed at easing financial conditions to support the economy. Asked by reporters if this new round of bond purchases should be considered “quantitative easing,” Fed chair Jerome Powell said he had no strong opinion about what the program should be called.

Powell said the purpose of the asset purchases is to “support the availability of credit in the economy, households and business, and thereby support the overall economy. How do they do that? They do that supporting proper market functioning in the Treasury and MBS market.”

That would appear to be different from quantitative easing because it has the less ambitious goal of supporting proper functioning of the bond market rather than driving down long-term interest rates or forcing holders of financial assets to adjust their portfolios to support riskier assets.

In addition, the Fed said it would encourage banks to use their capital and liquidity buffers to lend to households and businesses. Those buffers were built up under regulations passed following the financial crisis and are intended to protect the ability of banks to lend in tough economic times. They have not yet been tested in adverse circumstances however and it remains to be seen if banks will indeed reduce their capital and liquidity levels as the economy threatens to contract.

The Fed also lowered the rate charged by its discount window, an overnight backstop lending facility available to banks, to 0.25 percent from 1.75 percent. It said it would eliminate the reserve requirement, which requires banks to hold reserves equal to a small percentage of their deposits, toward the end of the month.

The Fed is also working with five other central banks to provide swap lines that allow those institutions to provide dollar funding to banks in their territories. This is aimed at preventing disruptions to dollar funded transactions around the globe.

COMMENTS

Please let us know if you're having issues with commenting.