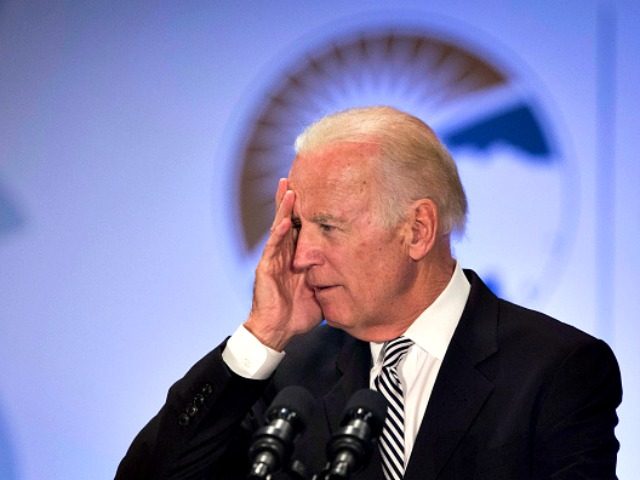

Former Vice President Joe Biden’s family and business ties to China, as well as those of Senate Majority Leader Mitch McConnell, may become a focus for voters in the 2020 election, James Freeman of the Wall Street Journal writes.

Biden has recently been downplaying the seriousness of China’s economic challenge to the U.S.

“Our workers are literally three times productive as workers in the far east — excuse me — in Asia,” Biden said. “So what are we worried about?”

Freeman connects the dots on Joe Biden’s family connections, through son Hunter Biden, to China.

“It’s not clear what value Hunter Biden adds when he does deals overseas,” Freeman writes. “But while his father was vice president he seems to have been treated in China as a financier of the first rank. Shortly after Hunter Biden travelled with his father to China aboard Air Force Two, the younger Biden’s firm Rosemont Seneca scored a business coup. ”

Freeman also points to a recent article in the New York Times spotlighting the ties of U.S. Secretary of Transportation Elaine Chao’s American family to the Chinese government. Chao is married to Mitch McConnell, who is up for re-election in 2016. Much of what the New York Times reported was uncovered first by Government Accountability Institute President and Breitbart Senior Contributor-at-Large Peter Schweizer in his 2018 book Secret Empires.

“It’s a very simple question. There’s no evasion here. What were you being paid to do? How did these deals come about? The fact that you’re doing deals in China and Ukraine — which are precisely the countries that your father, as vice president, is point person on — is a very alarming thing that needs to be looked into,” Schweizer said on Breitbart News Saturday in May.

Here’s the reporting from the Wall Street Journal‘s 2014 story on the deal.

A consortium of foreign and Chinese private-equity firms is aiming to raise about $1.5 billion to invest abroad, with the yuan-denominated portion of the fund to be converted to U.S. dollars through Shanghai’s free-trade zone.

The fund—launched by Chinese asset managers Bohai Industrial Investment Fund Management Co. and Harvest Fund Management Co. alongside U.S. investment and advisory firms Rosemont Seneca Partners and Thornton Group LLC—started fundraising in the second quarter, and has raised its target to $1.5 billion from an original $1 billion plan, a spokesman at Bank of China International Holdings Ltd. said. BOCI is one of the largest stakeholders in Bohai.

As the Wall Street Journal pointed out, the Bohai-Harvest fund was “likely one of the biggest Sino-foreign collaborations in private equity to take advantage of the free-trade zone’s benefits in converting yuan to dollars that can then be invested in foreign companies.” Ordinarily, China restricts conversion of its currency as part of its economic policy of managing its value against foreign currencies.

“If the spotlight remains on U.S.-China relations, how much wiggle room will voters give to Messrs. Biden and McConnell?” Freeman asks.

COMMENTS

Please let us know if you're having issues with commenting.