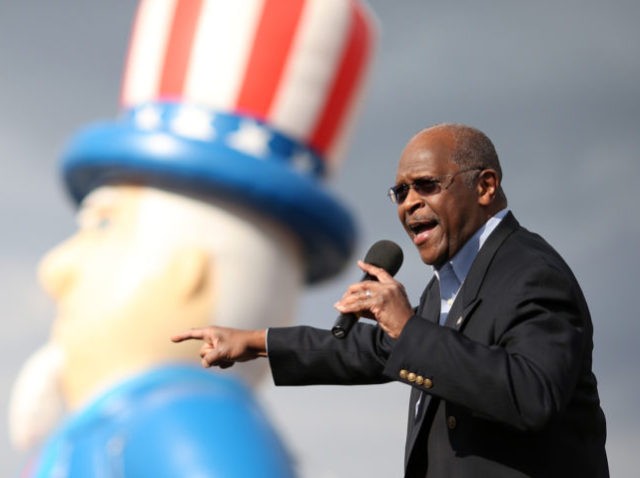

Wall Street is not happy with President Donald Trump’s plans to nominate Herman Cain and Stephen Moore to the Federal Reserve board of governors, according to a CNBC Survey published Monday.

The survey asked fund managers, economists, and strategists employed at Wall Street firms whether Moore and Cain should be confirmed. Sixty percent said the Senate should not confirm Moore and 53 percent said it should not confirm Cain.

Just thirty-four percent said the Senate should approve Moore, with 6 percent saying they were not sure or did not know. Forty-percent said Cain should be confirmed, with 6 percent saying they weren’t sure.

Trump has not yet formally appointed Moore or Cain but has said he intends to do so.

Of course, being unpopular on Wall Street is not likely to hurt the chances of Cain and Moore to be nominated or confirmed. President Donald Trump has shown a willingness to buck Wall Street on immigration and corporate media mergers. And Wall Street overwhelmingly supported Hillary Clinton over Trump in the 2016 election.

Wall Street knows its influence over the president or the Senate here is limited. Fifty-one percent of respondents say the Senate will confirm Moore. Just 19 percent predict he would not be confirmed. Forty-nine percent expect Cain would win Senate approval, while 28 percent predict he would not.

Trump’s public criticism of the Federal Reserve is no longer as unpopular on Wall Street as it once way. Sixty-one percent of those surveyed said Trump’s remarks were inappropriate, with 39 percent saying they were appropriate. In July, the last time CNBC asked about Trump’s Fed comments, 83 percent disapproved and only 15 percent approved.

On the other hand, Wall Street also is becoming more convinced that Trump may actually be influencing the Fed with his comments. Back in November, 83 percent said Trump’s comments had “no effect” on monetary policy. That dropped to 65 percent in the most recent survey. The number saying Trump’s criticisms make rate hikes less likely rose to 22 percent from 14 percent in November.

Between the two surveys, The Fed changed its approach to monetary policy, going from a policy of gradual rate increases to putting rate changes on pause until evidence of higher inflation or lower growth emerges. That brought the Fed more in line with the president’s views, although recently Trump said the Fed should actually cut rates to accelerate economic growth.

In other words, Wall Street took notice of the Fed changing its policies after Trump blasted last year’s hikes.

COMMENTS

Please let us know if you're having issues with commenting.