The Senate tax plan delivers the largest tax cuts to middle-class Americans, according to a new report from the nonpartisan Joint Committee on Taxation.

The Senate plan goes even further than the House bill to cut taxes for middle-class Americans. The average tax rate for a family earning $50,000 to $75,000 would fall from 14.5 percent under current law to 13.6 percent, the JCT said in its report on the Senate plan. That is a 6.2 percent tax cut.

The wealthiest Americans get a much smaller tax cut. The average rate for a household earning more than $1 million per year would fall to 31.1 percent from 32.1 percent, merely a 2.8 percent reduction.

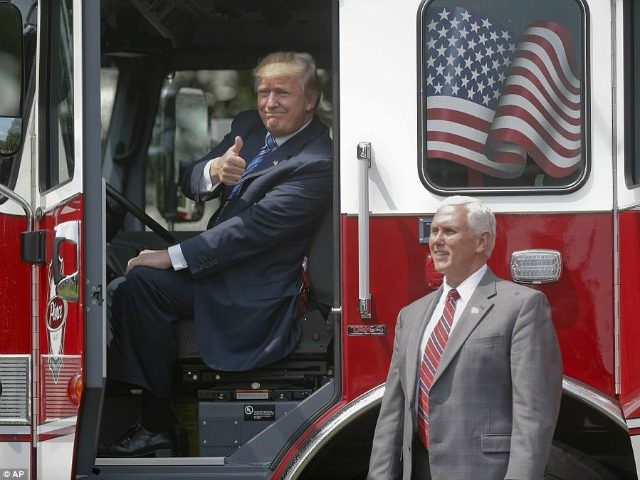

The JCT report also vindicates President Donald Trump’s claims that truckers would benefit from tax cuts. The average income of all truck drivers is $41,340, according to government statistics. At that level of income, the JCT estimates that the average tax rate will fall from around 11 percent to 10.3 percent, a nearly 6.4 percent reduction. Truckers who work for large fleets, where the average salary is closer to $75,000, would also see big cuts.

COMMENTS

Please let us know if you're having issues with commenting.