Oil prices jumped on Thursday to a new ten-month high, with U.S. crude rising above $90 a barrel for the first time this year.

West Texas Intermediate crude rose by more than 1.9 percent on Thursday to reach a high of $90.29 a barrel, the highest level since November of last year.

Brent crude, the international benchmark most closely related to gasoline prices in the U.S., rose by nearly two percent to $93.68.

The rising price of oil comes at a particularly challenging time for American consumers. U.S. gasoline prices surged 20 percent last month, according to the producer price index data released Thursday. This accounted for 60 percent of the rise in the index for final demand goods, the Bureau of Labor Statistics said.

On Thursday, gasoline prices were once again on the rise across the nation. The national average gas price rose to $3.853 a gallon, up from $3.484 a day earlier. This is more than 50 cents higher than a month ago.

Saudi Arabia and Russia said last week that they would extend their cuts in oil supplies through the rest of 2023. This has pushed up oil prices, as intended.

The U.S. is also producing less oil than it could be. The total oil rig count in the U.S. is down to 513 from 591 a year ago.

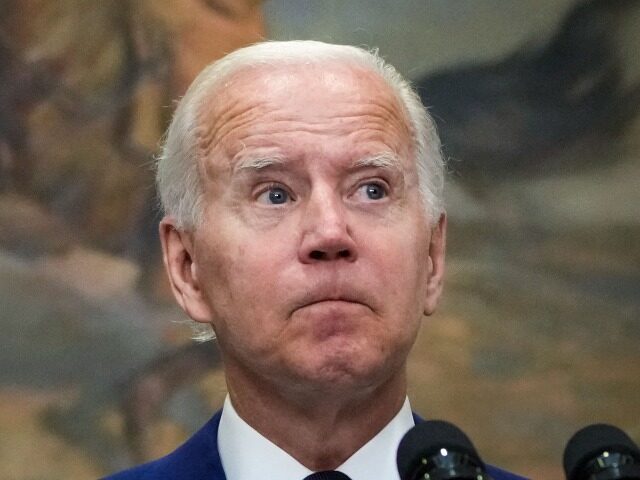

The Biden administration’s policies are discouraging investment in domestic fossil fuel production by limiting production in Alaska and the Gulf of Mexico, pushing automakers away from traditional combustible engines, and promising to reduce the use of fossil fuels in the years to come.

Efforts by the Biden administration to talk oil producers and refiners into increasing oil stocks have not succeeded in holding down prices.

“The Energy Department is in touch with producers and refiners to resolve any issues and to try to ensure stable supply,” White House economist Jared Bernstein told reporters on Wednesday.

With the U.S. strategic reserves at extremely low levels following President Biden’s decision to flood the market with government owned oil in the run-up to last year’s midterm Congressional elections, there’s no ready supply that can be brought online quickly to fill the gaps in supply. Biden released 180 million barrels from the reserve starting in March 2022, bringing the strategic stockpile to its lowest level in four decades.

Although the Biden administration has repeatedly promised to refill the strategic reserves, it largely failed to do so. Critics say that the administration made a significant policy error when it failed to quickly restock the reserves when oil prices were relatively low earlier this year.

The Biden administration recently said it would delay plans to restock the nation’s reserve because prices had moved too high.

COMMENTS

Please let us know if you're having issues with commenting.