Eggscellent News: Egg Prices Are Falling

After months of soaring costs, the price of large white shell eggs fell 15 percent in early March.

After months of soaring costs, the price of large white shell eggs fell 15 percent in early March.

Musk did not call for eliminating Social Security or Medicare. He also did not call for benefit cuts.

“When I win, I will immediately bring prices down, starting on Day One,” Donald Trump said on the campaign trail last summer.

In his first full month in office, that’s exactly what happened.

The transition away from government-driven growth was always going to be disruptive, but it is necessary for long-term stability.

Americans are far happier with the economic leadership of President Trump than they were under Joe Biden.

Americans got relief from inflation in February as prices rose at the slowest pace since last summer.

The January JOLTS report underscores a nascent blue-collar boom, particularly notable in manufacturing, as job openings and hires rose significantly in the early weeks of Trump’s second term.

Ontario backed down from a threat to raise the price of U.S.-bound electricity after Trump responded with an even bigger tariff hike.

Despite widespread media speculation about negative economic impacts from the Trump administration’s tariff policies and federal workforce reductions, the labor market data indicate ongoing stability.

The president’s move signals his determination to push back against what he sees as unfair economic policies from America’s northern neighbor

Rather than reversing the U.S. trade deficit, D.C. policymakers have allowed it to expand while simultaneously increasing the role of government to compensate for the damage it causes.

A steep and broad sell-off hit the U.S. market on Monday.

Slightly weaker than expected

Speaking today before the Economic Club of New York, Treasury Secretary Scott Bessent laid out the intellectual foundation of Trump’s economic vision, describing a comprehensive strategy designed to restore American prosperity and reclaim economic sovereignty.

President Donald Trump on Thursday paused tariffs on Mexican and Canadian goods that comply with the U.S.-Mexico-Canada Agreement (USMCA), granting a reprieve to America’s two largest trading partners. Trump signed an order modifying the tariffs he put in place earlier

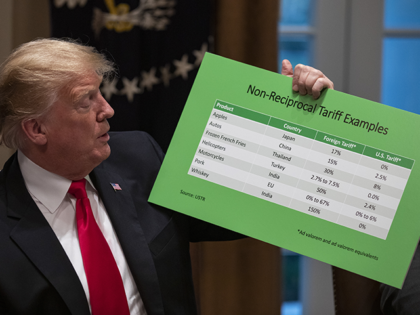

President Trump’s tariff policies are a recognition that America cannot fix its economy without confronting the policies of surplus nations that have spent decades rigging the system in their favor.

USMCA compliant cars may get a lower tariff rate or be exempted altogether, Commerce Secretary Howard Lutnick said in an interview Wednesday.

“We are going to rediscover the unstoppable power of the American spirit,” President Donald Trump said Tuesday night.

The history of tariffs suggests that initial fears of widespread consumer price increases were overstated.

President Trump’s new round of tariffs is set to take effect, and once again, critics are predicting economic disaster.

Tariffs on Mexico’s exports to the U.S. are poised to hit at a particularly difficult time for the country’s factories. Mexico’s manufacturing sector contracted at its fastest pace in five months in February, as declining U.S. demand and a steep

Americans are not likely to be hit hard even if the tariffs on Mexico, Canada, and China rise significantly this week. A new analysis from the Federal Reserve Bank of Atlanta suggests that the consumer price impact of proposed import

S&P Global PMI Shows Strongest Growth Since 2022, While ISM Reports Weaker Demand

Wall Street ended the week on a high note, shaking off geopolitical tensions after President Donald Trump’s tense White House showdown with Ukrainian President Volodymyr Zelensky.

“It’s very difficult to do an economic deal with a leader who doesn’t want to do a peace deal,” Bessent said in an interview after Zelensky’s outburst brought a White House meeting to an abrupt halt.

Zelensky’s Oval Office outburst leaves the fate of mineral rights deal uncertain.

The latest GDP report released Thursday by the Bureau of Economic Analysis confirms what many economists had been quietly warning: beneath the surface, the economy is weaker than it seemed.

A dramatic and decisive shift is sweeping through corporate America, as diversity, equity, and inclusion (DEI) initiatives crumble in the face of legal scrutiny, economic reality, and shifting public sentiment.

Corporate America is rushing to abandon practices and policies based on the diversity, equity, and inclusion ideology after President Trump issued an executive order banning racial discrimination in hiring practices.

The Republican Party has firmly re-established itself as the party of tariffs, marking a sharp departure from the free trade consensus that dominated its economic philosophy in the late 20th century.

U.S. consumer confidence slid sharply in February, posting its steepest decline since August 2021, as Americans grew increasingly concerned about rising prices, weakening job prospects, and the broader economic outlook. The Conference Board’s Consumer Confidence Index fell 7 points to

It would be nearly impossible to exaggerate the economic significance of renewing provisions from the 2017 Tax Cuts and Jobs Act (TCJA).

Economic activity in the United States softened at the beginning of the year, according to data released Monday by the Federal Reserve Bank of Chicago. The Chicago Fed National Activity Index (CFNAI), a broad measure of economic momentum, declined to

Uncertainty about the fate of the Trump tax cuts, especially bonus depreciation, may already be weighing down investment.

Some analysts argue that these “DOGE Dividends” could contribute to inflation. However, the economic impact of this policy differs significantly from the Biden-era stimulus measures that drove inflation to four decade highs.

Existing-home sales stumbled in January, falling 4.9 percent from December to an annualized pace of 4.08 million, a sharper drop than the 2.6 percent decline economists had expected. The start of 2025 continues a prolonged period of weakness in home

A sharp partisan divide over economic expectations and inflation.

America has become an unwitting partner in a trade policy designed in Beijing—a policy that systematically erodes U.S. manufacturing, distorts global markets, and leaves American workers at a disadvantage.

A wise man once said that the best investors buy from pessimists and sell to optimists.

Businesses expect they’ll raise prices less this year than they did last year.