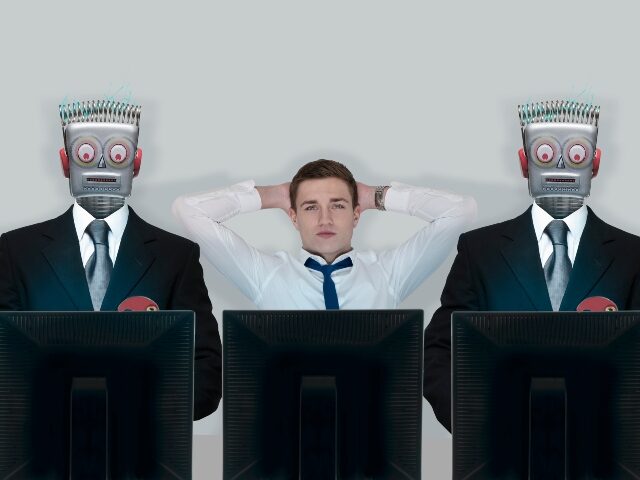

The traditional rite of passage for young professionals seeking a career in investment banking may soon be upended by the rapid advancements in AI technology, according to a recent report.

The New York Times reports that investment banks are increasingly turning to AI to automate and streamline many of the tasks typically performed by entry-level analysts, raising questions about the future of these roles in the industry. The grunt work that has long been associated with the early stages of a Wall Street career, such as creating PowerPoint presentations, crunching numbers in Excel, and finessing financial documents, can now be completed by AI tools in a fraction of the time.

WASHINGTON, DC – APRIL 05: Jamie Dimon, chairman and CEO of JPMorgan Chase & Co. (Photo by Mark Wilson/Getty Images)

Major banks, including Goldman Sachs, Morgan Stanley, and Deutsche Bank, are already experimenting with AI software that can perform these tasks with remarkable speed and efficiency. According to Christoph Rabenseifner, Deutsche Bank’s chief strategy officer for technology, data and innovation, “The easy idea is you just replace juniors with an AI tool.” However, he also acknowledged that human involvement will still be necessary to some extent.

The potential impact of AI on the investment banking industry is significant. Accenture estimates that AI could replace or supplement nearly three-quarters of bank employees’ working hours across the industry. As a result, top executives at major banks are debating how deeply they can cut their incoming analyst classes, with some suggesting reductions of up to two-thirds.

Jamie Dimon, chief executive of JPMorgan Chase, compared the consequences of AI to those of “the printing press, the steam engine, electricity, computing and the internet, among others” in his annual shareholder letter. He also noted that AI “may reduce certain job categories or roles” and labeled the technology as one of the most important issues facing the nation’s largest bank.

The adoption of AI in investment banking is not limited to entry-level positions. Banks are also exploring the use of AI in other areas, such as identifying clients for bond offerings, analyzing economic data, and determining investment strategies for wealth management clients.

Read more at the New York Times here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship.

COMMENTS

Please let us know if you're having issues with commenting.