Elon Musk’s alleged drug use and close relationships with multiple Tesla board members, who are supposed to provide independent oversight on issues like Musk’s compensation package, have raised concerns about conflicts of interest, according to a recent Wall Street Journal report.

A recent Wall Street Journal report highlighted the close personal and financial ties between Tesla CEO Elon Musk and several board members, both current and former. These relationships have led to questions about whether the directors can act independently to oversee Musk and represent shareholders’ interests.

The report alleged that multiple directors have vacationed with Musk, attended parties where illegal drugs were used, and invested millions of dollars in Musk’s companies like SpaceX and Neuralink. For example, former director Antonio Gracias is a decades-long friend of Musk’s who has allegedly used drugs with him at private parties. Gracias also allegedly lent $1 million to Musk personally.

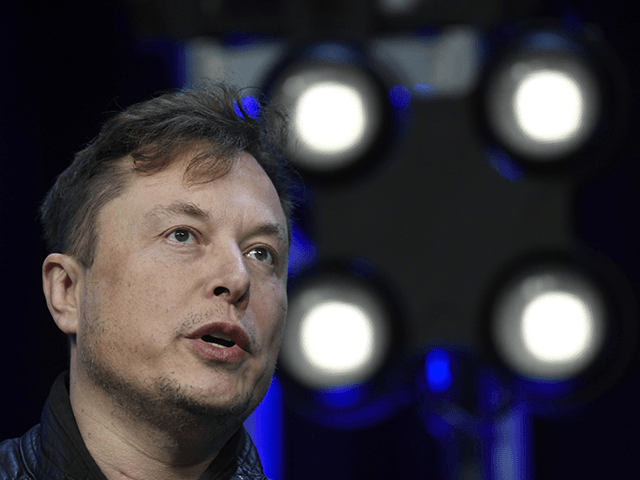

Elon Musk speaks at the SATELLITE Conference and Exhibition March 9, 2020, in Washington..(AP Photo/Susan Walsh, File)

Other directors highlighted include Larry Ellison, who offered for Musk to “dry out” from drugs at his Hawaiian estate; Ira Ehrenpreis, who has invested $70 million across Musk firms; and James Murdoch, who vacationed with Musk in places like Israel and Mexico.

According to the WSJ, several directors were also aware of Musk’s illegal drug use but did not take any public action. And the board approved a record $55 billion pay package for Musk in 2018, despite his close ties to directors responsible for the deal.

Recently, Delaware Chancery Court Judge Kathaleen McCormick ruled that Elon Musk’s Tesla compensation plan, the largest ever awarded to a CEO, was unfair and failed to prove that Tesla’s board properly negotiated the package with Musk.

The judge found that Musk, who owned 21.9 percent of Tesla at the time, controlled the process leading to the board’s approval of the plan. She wrote that neither the compensation committee nor the board “acted in the best interests of the company” when negotiating the plan, with little evidence of actual negotiations taking place.

The Tesla board members have profited handsomely from their seats, with directors having made over $650 million by selling shares earned through options. They hold additional options worth nearly $1 billion more.

Governance experts say such deep personal connections between directors and Musk are highly unusual for a public company board. Under Nasdaq rules, independent directors cannot have relationships that interfere with objective judgment.

While Musk is viewed as central to Tesla’s success, his behavior and drug use have created volatility in the stock price. The board, packed with loyal friends, has rarely challenged Musk’s authority. But despite long-standing concerns, the board has not formally addressed Musk’s conduct or drug use.

Read the full report at the Wall Street Journal here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship.

COMMENTS

Please let us know if you're having issues with commenting.