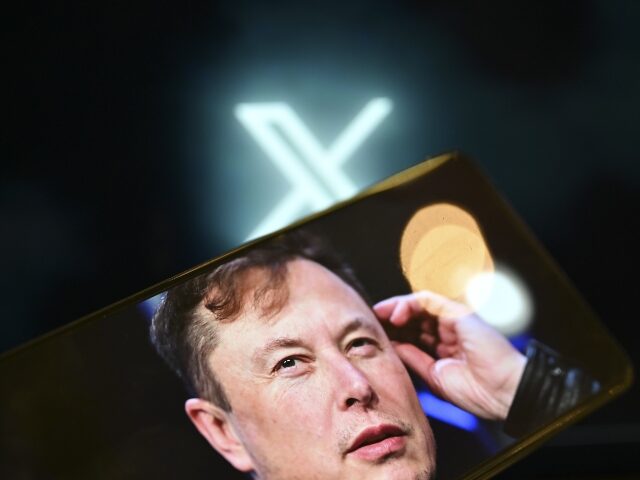

Elon Musk’s is now valued at a paltry $19 billion valuation, just one year after the Tesla and SpaceX tycoon paid $44 billion to take the platform private. The value is based on the company’s own calculations for an employee equity plan.

Fortune reports that Elon Musk’s X/Twitter has unveiled a new equity plan for employee that rewards them with restricted stock units (RSUs), pricing each share at $45. This calculation results in an overall valuation of the company at just $19 billion, a drop of about 55 percent from Elon Musk’s initial purchase price of $44 billion.

Other organizations that contributed to Musk’s takeover have taken even more extreme losses. Axios reports that Fidelity invested $300 million in Musk’s Twitter buyout, and has now written down the value of its investment by a startling 65 percent.

The Wall Street Journal reports that banks who lent Musk billions to complete the transaction are also expecting to take a loss:

After holding the debt for a year—an eternity in the corporate-finance world—the banks, which had hoped they could sell it by Labor Day, have recently begun preparations to try to unload at least some of it, the people said.

First they must secure a rating from the likes of Moody’s and S&P, a quality seal investors such as mutual funds and loan managers typically require. If X receives a low credit rating, it would be hard for the banks to sell the debt to a broad investor base without taking an even bigger loss than what they are already anticipating.

Elon Musk has revealed that X/Twitter is navigating through a phase of “negative cash flow.” Musk attributed this financial strain to a combination of factors, including a substantial 50 percent plummet in advertising revenues and the bearing of a hefty debt load.

Read more at Fortune here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship.

COMMENTS

Please let us know if you're having issues with commenting.