Disgraced FTX CEO and Democrat super donor Sam Bankman-Fried has launched a newsletter on Substack in an attempt to defend himself from allegations of fraud. SBF defiantly claims that “No funds were stolen,” according to the first post to his newsletter.

The Washington Post reports that Sam Bankman-Fried, the disgraced founder of the now-defunct cryptocurrency brokerage FTX, has launched a newsletter in which he denies stealing money or hiding billions of dollars. Since the filing of eight counts of fraud, money laundering, and other charges by the Department of Justice against him last month, this is his most extensive public defense. The Securities and Exchange Commission and Commodity Futures Trading Commission also filed similar civil complaints against Bankman-Fried.

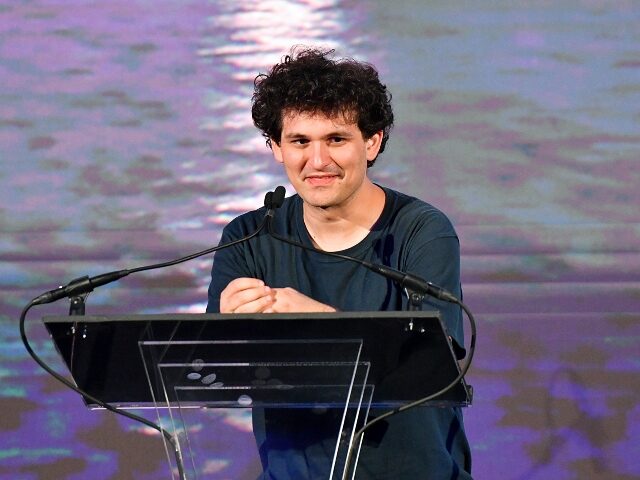

FTX founder Sam Bankman-Fried (second on left) is led away in handcuffs by officers of the Royal Bahamas Police Force in Nassau, Bahamas, on December 13, 2022. (MARIO DUNCANSON/AFP via Getty Images)

According to the allegations, Bankman-Fried misused FTX customer funds to finance his own risky investments, discretionary spending, and political contributions. Bankman-Fried claimed in his newsletter that FTX’s financial situation following bankruptcy was not as dire as many of the company’s legal and governmental detractors had claimed and that “FTX US is fully solvent and always has been,” and that it was “ridiculous that FTX US users haven’t been made whole and gotten their funds back yet.”

Attorneys for the restructured FTX said in bankruptcy court on Wednesday that although the process is complicated, they have recovered about $5 billion to help repay creditors. John J. Ray, the seasoned bankruptcy executive hired to try to clean up FTX, has stated that it will take months to track down the vast number of accounts and subsidiaries due to severely inaccurate bookkeeping. Investigators also claim that up to $8 billion cannot be accounted for.

Bankman-Fried portrayed the losses as a matter of the ups and downs of markets and not any criminality, even though numerous customers are still waiting for their money, which they have not been able to access. Bankman-Fried wrote: “No funds were stolen. Alameda lost money due to a market crash it was not adequately hedged for.” He further claimed that the investment-fund Alameda lost money because it was not sufficiently hedged against a market crash. He also attempted to portray FTX as an isolated victim of Alameda’s problems, much like the numerous independent crypto businesses that have been impacted by market contagion.

However, the SEC claimed that Bankman-Fried was Alameda’s top decision-maker in its complaint. Additionally, it claimed that he used client deposits to the FTX sister company to fund private venture investments, extravagant real estate purchases, and sizeable political donations, painting a picture of a business that was anything but a passive observer of Alameda’s problems.

Caroline Ellison and Gary Wang, former Bankman-Fried associates who have both pleaded guilty, are reportedly working with the government and are on the prosecution’s side to support their case. After the bankruptcy, Bankman-Fried conducted a number of interviews, including a lengthy conversation with ABC’s George Stephanopoulos and since being charged a month ago by prosecutors in the Southern District of New York, he has also continued to tweet.

Read more at the Washington Post here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan

COMMENTS

Please let us know if you're having issues with commenting.