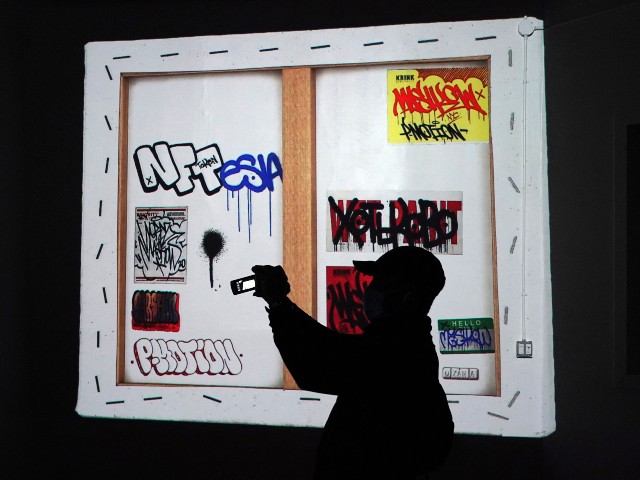

Despite being one of the hottest cryptocurrency trends in recent years, the trading volume of non-fungible tokens (NFTs) on the popular OpenSea marketplace is down 99 percent from its peak in May.

Fortune reports that while NFTs appeared to once be the most popular new trend in the crypto space, with the bull market of 2021 fueling a huge surge in popularity of NFT projects such as the Bored Ape Yacht Club collection and many more, the fad appears to have died down.

Trading volume on the most popular NFT marketplace, OpenSea, is down by 99 percent since May according to recent figures. At the beginning of May, Opensea processed a record $2.7 billion in NFT transactions, but on Sunday the marketplace recorded just $9.34 million worth, according to data from DappRadar.

OpenSea recorded 24,020 users on Sunday, a third fewer than when it hit its record transaction number in May. The decline in NFT popularity appears to coincide with a major nosedive in crypto prices, with popular cryptocurrencies such as Bitcoin declining by nearly 57 percent since the start of the year to $20,276. Ethereum, the second most popular cryptocurrency, fell by around 59 percent to $1,528 over the same period.

The floor price of the Bored Ape Yacht Club NFT collection fell 53 percent to 72.4 Ether ($110,000) as of Monday from a high of 153.7 Ether on April 30. A spokesperson for OpenSea said that it disagrees with DappRadaer’s methodology, claiming that the 99 percent swing compared the site’s all-time highest trading day with one of its lower days.

OpenSea prefers to calculate trading volume using ETH volume, leaving out the effects of the cryptocurrency’s price fluctuations. Still, using this metric trading is sharply down. Measuring trading via ETH volume reveals that monthly volume fell 62 percent from May to July and is on track to decline further in August.

An OpenSea spokesperson said: “We’re playing the long game because we see what’s possible, so we’re not that concerned about short-term volatility. We always expected frothiness, hype, and deflation as the community and use cases evolve, the tech gets more sophisticated, and creators figure out how to build more utility into their projects.”

Read more at Fortune here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan

COMMENTS

Please let us know if you're having issues with commenting.