Tesla shares fell by five percent in morning trading after CEO Elon Musk proposed selling 10 percent of his stock in a Twitter poll. His followers voted that they would “support” his idea of selling a big chunk of his ownership in protest of claims he is avoiding taxes with “unrealized gains.”

CNBC reports that Tesla shares fell by five percent Monday morning after CEO Elon Musk asked his followers on Twitter if he should sell 10 percent of his company stock. Share prices fell by 5.3 percent to $1,157.30 at 9:16 a.m. ET, a decrease from $1,222.09 at the market close last Friday.

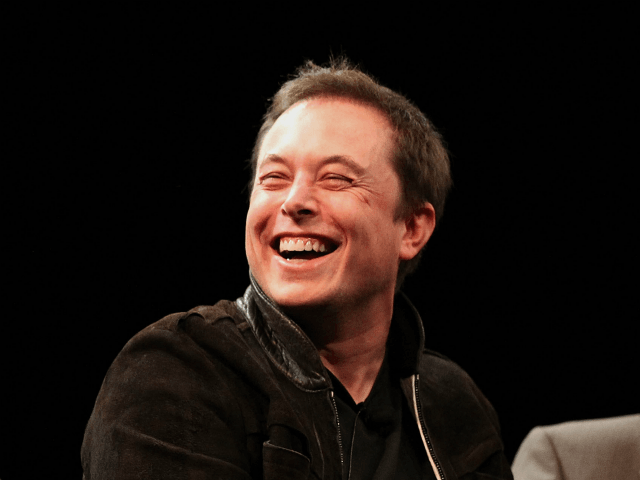

Dan Neil and Tesla Motors CEO Elon Musk attend Tribeca Talks After The Movie: ‘Revenge of the Electric Car’ during the 2011 Tribeca Film Festival at the SVA Theater on April 23, 2011 in New York City. (Photo by Dario Cantatore/Getty Images)

Shares fell by over seven percent in pre-market trading on Monday. In a Twitter poll posted on Saturday, musk asked: “Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock. Do you support this?”

Musk’s followers could choose from “Yes,” or “No.” 3,519,252 people responded to the poll and 57.9 percent voted “yes.”

Musk has said in the past that he’d likely sell a “huge block” of options in the fourth quarter. He said at the Code Conference in California in September that his marginal tax rate will be over 50 percent when his stock options expire at Tesla. “I have a bunch of options that are expiring early next year, so … a huge block of options will sell in Q4 — because I have to or they’ll expire,” he said.

Jeffries raised the Tesla share price target from $950 to $1,400 on Monday. Analyst Philippe Houchois wrote: “Without dismissing execution risk, Tesla is getting to a position where it can balance affordability and speed, goals which are as important as profitability in Elon Musk’s vision.”

He added: “Tesla looks set to gain share from large OEMs [original equipment manufacturers], potentially claiming a disproportionate share of the industry profit pool in the coming 3-5 years as legacies enter the margin dilutive EV transition phase.”

The SEC has ordered a “Twitter sitter” to oversee Elon Musk’s social media usage and has found that the company has failed to follow through.

As Breitbart News reported:

The Wall Street Journal reports that securities regulators told Tesla last year that company CEO Elon Musk’s use of Twitter had twice violated a court-ordered policy requiring Musk’s tweets about the company to be preapproved by company lawyers. Tesla and the SEC settled an enforcement nation in 2018 alleging that Musk had committed fraud by tweeting about a potential buyout of his company.

Musk paid $20 million to settle the case and Tesla also paid $20 million. Musk also agreed to have his public statements on social media overseen by Tesla lawyers. In letters sent to tesla in 2019 and 2020, the SEC stated that tweets Musk wrote about Tesla’s solar roof production volumes and its stock price had not undergone the required preapproval by Tesla’s lawyers.

The communications highlight the running tensions between the SEC and Musk, who has previously mocked regulators even after setting fraud claims with the agency. The SEC told tesla in May 2020 that the company had failed “to enforce these procedures and controls despite repeated violations by Mr. Musk.”

Read more at CNBC here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan or contact via secure email at the address lucasnolan@protonmail.com

COMMENTS

Please let us know if you're having issues with commenting.