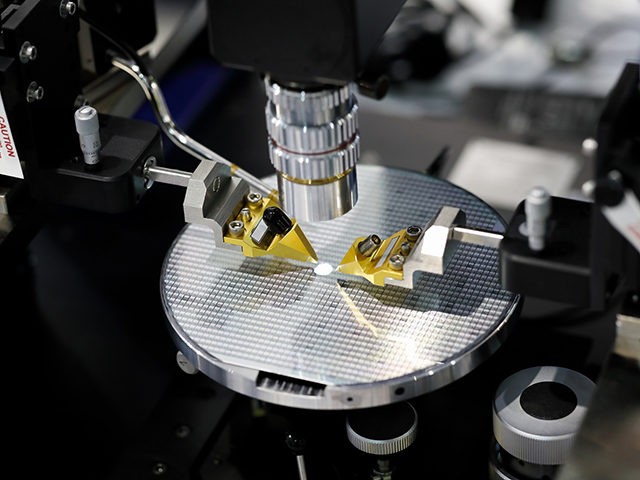

Taiwan Semiconductor Manufacturing Co. (TSMC) announced Thursday it will increase investments in its production capabilities by $100 billion over the next three years — and raise prices on its chips — to handle “a structural and fundamental increase in underlying demand driven by key long-term growth megatrends including 5G and high-performance computing.”

The coronavirus pandemic and its aftershocks were also cited as a reason for dramatically increasing chip supplies.

CEO C.C. Wei said in a letter to clients that wafer price reductions will be suspended for essentially all of next year. He described this as a “modest action is the least disruptive option to supply chains so that TSMC can deliver our mission of providing leading semiconductor technologies and manufacturing capability to you in a sustainable manner.”

Nikkei Asia noted the suspension of price cuts was a highly unusual move since chip prices usually fall steadily each quarter. The suspension will have a significant ripple effect through the electronics world, as TSMC supplies almost every major chip developer.

Wei said the $100 billion investment plan will produce thousands of new jobs, with some in the United States at a $12 billion facility under construction in Arizona. He said new production capacity was urgently needed because TSMC cannot keep up with current levels of demand, even with every existing plant running at 100 percent capacity.

TSMC’s Chairman Mark Liu said 2020 saw a “fundamental increase for chip demand brought by pandemic-driven digital transformation on top of the 5G and AI megatrend.”

AI (Artificial Intelligence) is seen by computer analysts as the leading industry trend for 2021, and probably the rest of the decade. Machine learning solutions — broadly speaking, systems that improve themselves automatically by accumulating data and function with minimal human direction — are spreading across every segment of the electronics industry, creating an enormous demand for computing power.

The Semiconductor Industry Association (SIA), an alliance of U.S. chipmakers, published a study Thursday that warned the global semiconductor supply chain has become dangerously vulnerable to disruptions ranging from accidents that take plants offline to regional and international calamities that interrupt global shipping.

The SIA study found it troubling that over 50 points on the semiconductor supply chain pass through regions that command more than 65 percent of global market share — in other words, relatively small geographic regions whose irreplaceable contributions to the complex supply chain could be disrupted or completely knocked out by natural disasters or political upheaval.

A recent example of supply chain difficulties occurred in February, when General Motors shut down automobile factories in Kansas, Mexico, and Canada due to a worldwide shortage of semiconductor chips. Another GM factory in South Korea was scaled back to half capacity. Autos are one of the many products that now contain numerous sophisticated computer chips, running everything from safety systems to entertainment.

To put it bluntly, most chip manufacturing runs through Asia, about 92 percent of Asian manufacturing runs through Taiwan, and Taiwan is threatened by both natural disasters and the profoundly unnatural threat of invasion by Communist China. SIA warned that if Taiwanese production was taken offline for a year, “the electronics supply chain would come to a halt,” inflicting some $500 billion in damage on the industry.

SIA’s study found it was “infeasible” for individual countries to “onshore” production instead of using the global supply chain, a conclusion TSMC Chairman Liu referenced in his remarks about the company’s expansion plans. The U.S. would have to spend up to $450 million to fully onshore production, a cost that would inevitably ruin the competitiveness of American chips by making them vastly more expensive.

SIA recommended a compromise approach of developing emergency production capacity in the U.S. and Europe — with government assistance — to cushion the blow, should products from Asia become temporarily unavailable.

China’s state-run Global Times said Wednesday that China’s premier chipmaker, the Semiconductor Manufacturing International Corporation (SMIC), enjoyed “strong financial growth in 2020 with record numbers” despite the pandemic and U.S. sanctions.

SMIC’s annual report showed a 24.8 percent increase in revenue growth during 2020, reaching about $4.19 billion, and a 141 percent increase in profits. The growth in sales was driven by surging demand for smartphones.

“According to the company, the Covid-19 [Chinese coronavirus] pandemic in the past year also brought some opportunities to industries as the stay-at-home economy strengthened demand for the Internet of Everything and brought rare market opportunities to the semiconductor industry,” the Global Times wrote, relaying an assessment not unlike TSMC’s explanation for surging chip demand.

SMIC chairman Zhou Zixhuan touched on the same points in his letter to shareholders, which said “the rise of new formats, models and applications, such as AI and Internet of Things, drives demand for chips,” and current worldwide production capacity cannot keep up.

COMMENTS

Please let us know if you're having issues with commenting.