Lawmakers including Sen. Elizabeth Warren (D-MA) have demanded that Goldman Sachs reveal how its new Apple Card credit algorithm works following allegations of gender discrimination against women.

Business Insider reports that following recent allegations of gender bias, lawmakers are calling on Goldman Sachs to reveal the algorithm it uses to determine credit limits for its new Apple Card. The issue started on Thursday after entrepreneur David Heinemeier Hansson claimed that the Apple Card gave him 20 times the credit limit his wife received. Apple co-founder Steve Wozniak has stated that his wife experienced similar results.

The Apple Card was launched in partnership with Goldman Sachs which has claimed that applicants were evaluated independently according to income and creditworthiness, with factors such as personal credit scores and personal debt taken into account. The bank stated that it was possible for two family members to receive very different credit decisions but added: “We have not, and will not, make decisions based on factors like gender.”

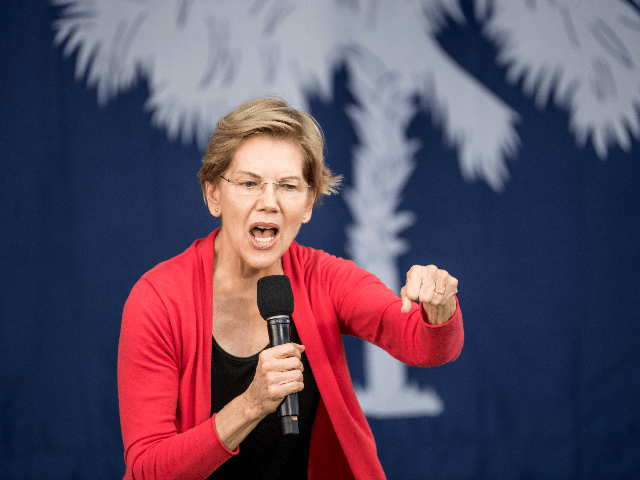

Presidential candidate Elizabeth Warren criticized Goldman Sachs in an interview with Bloomberg recently, stating: “Yeah, great, so let’s just tell every woman in America, ‘You might have been discriminated against, on an unknown algorithm, it’s on you to telephone Goldman Sachs and tell them to straighten it out. Sorry, guys, that’s not how it works.”

Sen. Ron Wyden (D-OR) also tweeted that he would be investigating the allegations surrounding the Apple card, stating: “I’m investigating whether these allegations are true. If they are, I expect Apple and Goldman Sachs to do everything in their power to put an end to discrimination.”

Breitbart News financial editor John Carney wrote an article about this issue recently, stating that it was unlikely that Apple or Goldman Sachs were discriminating based on gender. Carney wrote:

I hate to be the one who tells you this but Apple and Goldman do not care about you. They do not care about your hopes, your dreams, your philosophy, your politics, or your gender. They’ll use whatever pronouns you ask them to.

We are all just future income streams to them. That’s it. Dollars divided by time. A discount rate, a probability of default, and a regulatory capital charge.

Neither company has a particular interest in rationing credit, apart from some attempt to estimate the maximum credit they can provide and still get paid back at an acceptable rate. They do not really care if you, as an individual, wind up paying them back. They just want to get paid back at a rate that means making short-term consumer loans is slightly profitable enough to cover their cost of capital.

They are constrained by regulations that penalize them for supplying what the government sees as too much credit to people whose lives might be ruined by over-indulgence in borrowing. Those include a myriad of rules from the Consumer Finance Protection Bureau, capital regulation from the FDIC and the Federal Reserve, and state laws on credit.

Think about it this way. If there were a team at Goldman Sachs who developed a computer program that gave too little credit to women, what are the odds that another team at Goldman wouldn’t have figured out how to make more money by providing the appropriate level of credit? Is everyone there too sexist to want to make money by lending appropriately to women customers?

Read the full article here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan or email him at lnolan@breitbart.com

COMMENTS

Please let us know if you're having issues with commenting.