Ripple: It’s one of the hottest companies in Silicon Valley, flush with VC cash. Dozens of global brand names have announced pilot programs with its technology. One of its products, recently featured on Ellen, is the third largest cryptocurrency in the world.

Yet if you ask the right questions, Ripple will all but deny any connection to that famous asset, XRP.

The company and its defenders have made “XRP is not Ripple” a continuous mantra over the past few months, changed the digital token’s logo, and even amended testimony to the U.K. parliament in a transparent attempt to fend off regulatory scrutiny.

And, in a blog post published Wednesday, Ripple claims that XRP “is in many ways a more transactional, functional and decentralized ledger than either Bitcoin or Ethereum.” A statement from Ripple to Breitbart News strips away any caveats: “XRP is even more decentralized than Bitcoin and Ether.”

What Is XRP?

XRP is a digital “altcoin” that first entered public markets in 2013, though many market analysts call it “Ripple” for its close association to the company. It saw a meteoric rise in price over 2017, going from six tenths of a penny in January to an all-time high of $3.79 one year later. At the time of this writing, it has an estimated market capitalization of $13 billion.

All digital monies, starting with Bitcoin, are simply ledgers — records of credits and debits from a total balance set by their coders — but they are “distributed ledgers,” meaning hundreds or thousands of people all keep a copy of the ledger to compare the integrity of the data. To ensure that no one double spends their personal balance, a network of “nodes” or “validators” stay online 24/7 to check all incoming transactions against the full history of the ledger.

Why Wouldn’t Ripple Want to Claim XRP?

As regulators examine the world of digital money — Bitcoin and its hundreds of imitators, competitors, and scams — billions of dollars are at stake. None of the major exchanges are yet legally authorized to trade securities, so if the SEC declares certain assets to be unregistered securities, they will be universally de-listed and likely see their value drop near zero. And, on top of that calamity, then the coins’ creators may face legal and financial penalties.

Kyle Samani, managing partner at the crypto hedge fund Multicoin Capital, told Fortune in June: “It’s quite clear to us that Ripple is a security… if [the SEC labels it as such], liquidity is going to dry up on XRP and the price will plummet.”

The two biggest, most vulnerable targets for regulators are XRP and the Ethereum Foundation’s Ether, according to former CFTC chairman Gary Gensler. Bill Hinman, Director of the SEC’s Corporation Finance Division, has since said that Ether in its current state is sufficiently “decentralized” and not considered a security — though that does not automatically mean that the “initial coin offering” for Ether was not a securities sale.

For Ripple, however, the SEC — and a growing pile of civil lawsuits alleging that XRP is an unregistered security — remain looming threats. Message discipline is a must, and the company has gone into overdrive trying to prove XRP is as “decentralized” as the cryptocurrencies already given a green light by the SEC, particularly Bitcoin.

Before we proceed, consider my biases. I own Bitcoin, and if its value rises, I stand to gain financially.

‘Decentralized’

David Schwartz, the CTO of Ripple Inc., writes on the company’s website that the setup of XRP’s “validators,” which do not utilize “mining,” make the ledger more resistant to bad actors than Bitcoin’s.

As of today, four mining groups currently control 58 percent of the Bitcoin network and three miners account for 57 percent of Ethereum’s daily capacity. Further, 80 percent of the mining on the Bitcoin blockchain is centralized in China, despite the country’s ban on digital assets. This puts it at greater risk of being manipulated by a single, sovereign government.

Some experts even suggest that in a worst case scenario, miners of Bitcoin and Ethereum blockchains could use this to their advantage — conspiring to rewrite history on the blockchain through a 51 percent attack that results in verified transactions being unvalidated and allows for fraud to occur.

…

Unlike Bitcoin and Ethereum — where one miner could have 51 percent of the hashing power — each Ripple validator only has one vote in support of an exchange or ordering a transaction.

This narrative appears to be a delayed response to a widely-read research article from Bitmex, a popular cryptocurrency exchange, which concluded: “the Ripple system appears for all practical purposes to be centralised and is therefore perhaps devoid of any interesting technical characteristics, such as censorship resistance.”

Schwartz addresses this complaint, saying that users can configure their nodes to “Users on the XRP Ledger select a Unique Node List (UNL), a list of validators trusted by that user… The network has a number of recommended UNLs, including one list Ripple recommends, and users can choose whichever one they prefer or create their own.”

Bitmex appears to have pre-empted that argument, saying that despite the option of non-Ripple UNL lists, “there is no evidence that many users of Ripple manually change this configuration.”

Ripple, then, has worked through the year to make its recommendations less reliant on the company’s own servers: “to increase the resiliency and diversity of the network, more than half of the validators on Ripple’s recommended UNL are operated by people or groups external to the company,” Schwartz writes, “and Ripple continues to add even more independent validators to the list. This further demonstrates that Ripple’s validators do not wield meaningful power over the XRP Ledger.”

The Real Issue

Did that technical discussion make your eyes glaze over? It’s probably by design. The question of XRP’s technological decentralization, which Ripple can take steps to increase, distracts from the token’s economic centralization, which Ripple cannot easily wave away.

In short, the issue that Ripple faces is:

1.) When the ledger first launched, the company and its founders owned all XRP.

2.) The company has slow-walked the distribution of its XRP reserves. Nearly six years later, less than half of the total supply is publicly traded.

3.) All XRP enters the market through the company. The company has set a de facto monetary policy for this “inflation” rate.

4.) Ripple sells its reserves of XRP to exchanges and institutional investors or gives them away for charity and positive press.

To understand the extraordinary nature of this approach, we need to understand how it differs from Bitcoin’s.

The Mining Competition

Bitcoin employs a system called “proof of work” where, approximately every ten minutes, the software saves the most recent state of the ledger in a “block” of transaction information. People running the Bitcoin software use their computers to encrypt the newest valid block in a process called “hashing” or, more commonly, “mining.”

For the time being, Bitcoin does have a programmed inflation rate, or what is called a “block reward.” Any time a new block is confirmed, the software gives out a number of new Bitcoins to the miner that found it, increasing the ledger’s total balance. When the program first began in 2009, the ledger started with 50 Bitcoins, adding 50 more to the balance with each new block. That reward decreases by 50% periodically until it becomes so small (circa 2140) that no new Bitcoins will be added to the ledger, capping the total balance at 21 million.

People who contribute more hashes have a greater chance of finding a block first and thus getting the block reward, which has led to a profitable market for specialized computer hardware that just spits out hashes as fast as possible. In addition, people will pool their work so that they find blocks more regularly, then split the reward among all the miners according to how much they contributed to the process.

The point is, with Bitcoin, issuance of new “coins”/credits is a competition that is open to anyone. Before any trading or speculation, the software has impartially rewarded new Bitcoins to tens of thousands of different people without regard for any aspect of their identities — and despite the emergence of large mining pools, dumb luck still sometimes trumps their overwhelming power. With each block, the mining reward is not pledged to anyone; nothing is guaranteed until a competitor emerges victorious.

And the other important facet of this process is that the Bitcoin block reward does not enrich any other party besides the miner. The software only receives cryptographic hashes that validate transactions and increase the network’s security in return. No company gets compensated for the issuance of new Bitcoins unless they find a block and receive Bitcoins.

XRP’s Central Bank

By contrast, XRP does not utilize proof of work. Its total balance of 100 billion credits was immediately available at the ledger’s genesis. At the time of their creation, there was no competition for those digital credits. All of the XRP made available to the public has been issued through the company and its founders. In the crypto world’s parlance, this is called a “premine.”

And since Ripple is the issuer of XRP, it was able to unilaterally set an inflation rate for the token. Currently, the circulating supply is less than 40 billion XRP, according to CoinMarketCap. In December 2017 — shortly before its incredible bull run — the company locked up 55 billion XRP in escrow, to be released at a rate of one billion per month, then re-locking whatever was not sold at the end of each month. CEO Brad Garlinghouse wrote on the company’s blog, “this lockup eliminates any concern that Ripple could flood the market, which we’ve pointed out before is a scenario that would be bad for Ripple!”

But why would an immediate doubling of XRP liquidity be “bad for Ripple”?

Ripple sells XRP for pure profit; an agreement between the company’s founders explicitly states that the XRP credits (20 billion for themselves, 80 billion for the company) had no value at the time of the company’s incorporation. Whether through strategic partners, programmatic sales, or through its licensed money business subsidiary, Ripple gets cash for XRP. The company has every incentive to push the token’s price as high as possible. Selling, per their figures, an average of 300 million a month above 15 cents for 4+ years will net them billions of dollars — much more than selling 55 billion XRP for the likely sub-penny price that an immediate dump would cause.

When Ripple distributes XRP for free, it is typically to the company’s benefit — whether by raising awareness of their product early on with a giveaway or by announcing classroom supply donations to the press. An April report by Bloomberg alleged that Ripple offered to loan $100 million of XRP to Coinbase, the largest U.S. exchange between Bitcoin and fiat/bank currencies (Coinbase listings typically lead to massive price surges).

Izabella Kaminska of the Financial Times compares Ripple’s issuance of XRP to an exchange-traded fund: “It is entirely centrally controlled, operating more like an ETF unit than anything else since the issuer has the capacity to release or absorb (pre-mined) tokens in accordance with their valuation agenda.”

In contrast, a statement from the company says that the escrow plan contributes to the decentralization of XRP: “Ripple has escrowed its XRP such that it only has actual access and control of 13% of the actively traded XRP. The terms of the escrow are such that Ripple will likely never have outsized control of the outstanding XRP [emphasis added].” Note the necessary caveats — and the failure to address Ripple’s central issuance.

Ripple representatives often say, “If Ripple the company shut down tomorrow, XRP will continue to exist.” And while this is technically true of the network/ledger, we don’t know what would happen to Ripple’s escrowed XRP — at least half of the supply. The company’s press contact did not respond to questions on that subject.

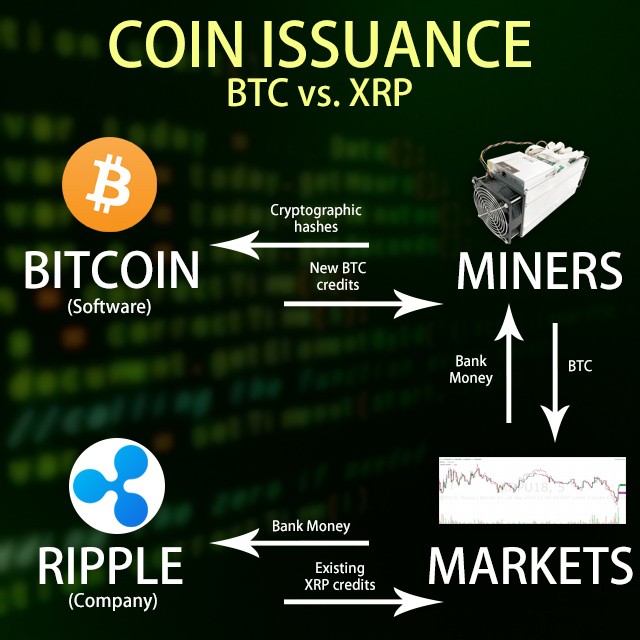

A simplified graphic illustrates the difference between these two digital assets’ issuance models.

Note that there is no interaction between Bitcoin’s software and markets — because distribution is handled in the code. Since XRP’s code does not address distribution, aside from a single genesis account that holds all XRP, that process is centrally controlled by the company.

This claim to “decentralization” is one of several ways Ripple is trying to fight off regulators by obfuscating on its relationship to XRP. Stay tuned as we explore these other defenses in the coming days.

COMMENTS

Please let us know if you're having issues with commenting.