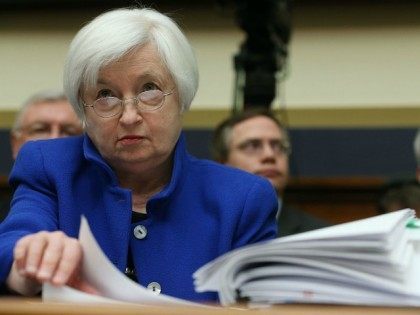

Fed Hikes Interest Rates, More to Come in 2017

The Federal Reserve raised interest rates a quarter of a point on Wednesday for only the second time in a decade, and with an improved economic outlook, rates are now predicted to rise three times in 2017.