Apple Announces $350 Billion Investment in America Over the Next Five Years

Apple announced that it will invest $350 billion in the U.S. economy over the next five years thanks to the Tax Cuts and Jobs Act.

Apple announced that it will invest $350 billion in the U.S. economy over the next five years thanks to the Tax Cuts and Jobs Act.

The Trump Interior Department’s plan to sell offshore oil and gas drilling rights is an effort to make California pay for being the largest state beneficiary of federal spending.

With the passage of President Donald Trump’s tax reform package, the IRS has put out new withholding tables for employers which will result in less tax being removed from workers’ paychecks and employees seeing larger paychecks.

Pew Research Center released an analysis that shows that the 115th session of Congress is the least productive in three decades.

Walmart will provide a one-time bonus, raise wages, and expand benefits to their employees in response to President Donald Trump signing the Tax Cuts and Jobs Act.

The U.S. Bureau of Labor Statistics report released on Friday revealed that the economy added 148,000 jobs in December; the unemployment rate remains at 4.1 percent.

Barbra Streisand weighed in on the newly-signed tax reform law Thursday, explaining that she believes the GOP-led effort was deliberately set up to harm blue states, athletes, Hollywood, and the middle class.

California’s Democrat-controlled state government wants to re-classify state taxes as charitable contributions to avoid the new $10,000 cap on state and local tax (SALT) deductions in President Donald Trump’s new tax reform.

Nationwide Insurance announced on Wednesday that most of their workers will receive a $1,000 bonus, and they will increase their 401(k) match rates thanks to the recently passed Tax Cuts and Jobs Act.

Medical manufacturers asked President Donald Trump to repeal Obamacare’s device tax now that the law will take effect in 2018. Estimates suggest that the tax’s repeal could create another 53,000 jobs.

President Donald Trump had a successful first year, but there were moments when his supporters felt particularly vindicated about their decision to vote for him. Those moments are “MAGA moments,” when it was clear that Trump was keeping his promise to Make America Great Again.

First Farmers Bank and Trust announced that they will hike wages, distribute bonuses, and invest in their workers and community.

Sinclair Broadcasting Group, America’s largest television station owner, announced Friday that they will join a slew of other large U.S. companies in using the savings from the just-passed Tax Cuts and Jobs Act to give employees bonuses.

After Republicans repealed Obamacare’s individual mandate through the tax bill, many wonder whether Republicans can repeal Obamacare in 2018.

Liberal California Congressman Ted Lieu blamed “human nature” for his “no” vote on President Trump’s tax reform package because he thinks poor people will get jealous of other people’s tax cuts.

The final version of the Tax Cuts and Jobs Act, passed Wednesday by the House and headed to President Donald Trump’s desk, will still allow illegal aliens to claim a lucrative child tax credit.

Former Republican Congressman Michael Grimm (R-NY), who is challenging incumbent Rep. Dan Donovan, chided his Republican primary opponent arguing that Donovan “betrayed us once again” by voting against tax reform.

Comcast announced that they will give their employees bonuses and invest over $50 billion to their employees to celebrate tax reform.

Sen. Tim Scott (R-SC) seriously schooled a liberal Huffington Post blogger who joined the far-left hysteria against President Donald Trump’s tax relief bill and posted a tweet slamming Scott as a token black man because he was part of the celebration over the passage of the bill.

Chuck Schumer attacked AT&T just hours before the telecommunications giant announced huge bonuses and domestic investment in America.

“I want to thank you, Mitch McConnell. What a job,” he said. “It’s always a lot of fun when you win.”

The Boeing Corporation, America’s largest aerospace company, tweeted Wednesday that the just passed Tax Cuts and Jobs Act will allow them to spend $300 million on “employee-related and charitable investment.”

The House passed the final Tax Cuts and Jobs Act, sending the historic tax cut legislation to President Donald Trump to sign. The president said that the tax reform bill would ensure a “Merry Christmas” for the country.

The Senate passed the historic Tax Cuts and Jobs Act on Tuesday, sending the bill to the House, and soon to President Donald Trump to sign.

Grassroots conservatives and populists cheered the Tax Cuts and Jobs Act’s passage through the House on Tuesday.

During a speech on the Senate floor on Monday, Senator Susan Collins (R-ME) expressed her support for the conference agreement on the Republican tax bill, the Tax Cuts and Jobs Act, and touted the act as one that will create

President Donald Trump and Republicans will score an historic victory by likely passing the Tax Cuts and Jobs Act this week, the largest tax cut legislation in decades.

Sen. Bob Corker (R-TN) announced that he will vote for the Tax Cuts and Jobs Act, presumably giving Republicans enough votes to pass it.

Rep. Kristi Noem (R-SD) suggested that the final version of the Tax Cuts and Jobs Act will include an expanded child tax credit to appease Sen. Marco Rubio (R-FL).

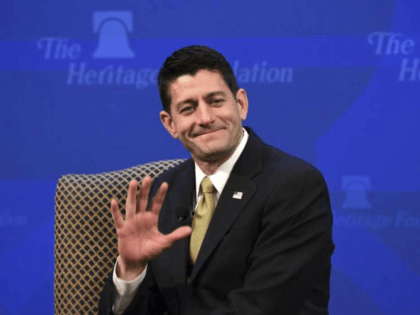

Both Speaker of the House Paul Ryan and White House spokeswoman Sarah Huckabee Sanders claimed Thursday that widespread rumors that Ryan will leave Congress after his current term ends are false.

Sen. Marco Rubio (R-FL) will oppose the Republican Tax Cuts and Jobs Act unless it includes an expansion of the child tax credit.

Speaker of the House Paul Ryan (R-WI) may be on his way out of Congress after the end of this term.

The House and Senate reached a deal for the Tax Cuts and Jobs Act on Wednesday. Republicans hope to pass the tax bill before Christmas.

European ministers complained to Steven Mnuchin in a letter on Monday that the Republican Tax Cuts and Jobs Act will favor American trade.

A Morning Consult/Politico poll has President Donald Trump’s approval rising to 45 percent of registered voters in the first month of December, his best result in that poll since September and matching his highest since July.

Former Bill Clinton Treasury Secretary Larry Summers argued in an op-ed for the Financial Times on Monday that thousands will die because the Republican Tax Cuts and Jobs Act will repeal Obamacare’s individual mandate.

Saturday on MSNBC’s “AM Joy,” author and former President Ronald Reagan adviser Bruce Bartlett likened the Tax Cuts and Jobs Act to “rape” on the poor. “It really defies comprehension,” Bartlett told host Joy Reid. “Maybe they think that the poor have

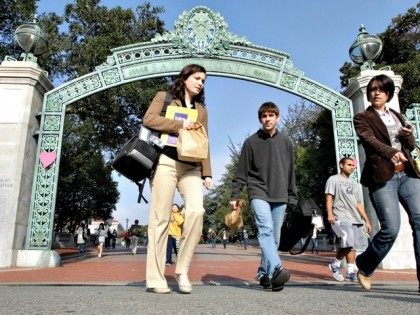

Hundreds of UC Berkeley graduate students are marching in opposition to the higher taxes they believe they will have to pay under the Republican House-sponsored tax reform bill.

President Donald Trump reportedly told Republican senators on Tuesday that he supports the Alexander-Murray bipartisan stabilization bill, which may help bolster support for the tax reform vote later this week.

The House passed the Tax Cuts and Jobs Act 216-205, a tax reform bill that features massive tax cuts for middle-class families and small businesses.