World View: Oil Prices Crash and OPEC Collapses over Iran-Saudi Rivalry

Contents: Oil prices crash and OPEC collapses over Iran-Saudi rivalry; Kazakhstan may be forced to choose between Russia and Turkey

Contents: Oil prices crash and OPEC collapses over Iran-Saudi rivalry; Kazakhstan may be forced to choose between Russia and Turkey

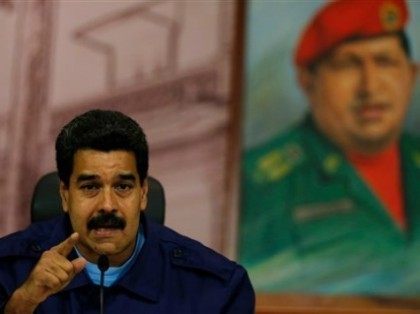

Venezuela’s socialist government has run the OPEC nation’s economy to the group, prompting shortages of goods as varied as toilet paper, coffin materials, beer, and water. The shortage has now hit pharmacies, with most pharmacies having completely run out of most forms of contraceptives, particularly birth control pills.

With every OPEC member now at a higher break-even cost than the U.S., it is OPEC members that are at risk of being bankrupted in the second wave of the U.S. oil boom.

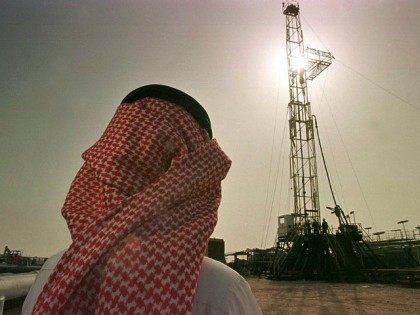

The U.S. Energy Information Agency (EIA) reported that domestic crude oil productionfor the week ending May 22 surged by 304,000 barrels per day (bpd) to a 44-year high of almost 9.566 million bpd. The latest production numbers come on the heels of Breitbart News’ report that the Organization of Petroleum Exporting Countries (OPEC) had effectively conceded defeat in its battle against U.S. shale oil competition.

OPEC’s attempt to over-produce crude oil for export to crush prices and bankrupt the American shale-fracking oil boom has failed, according to a draft OPEC long-term strategy report seen by Reuters ahead of the cartel’s policy meeting in Vienna on June 1st.

The U.S. Energy Information Administraiton (EIA) has released a Drilling Productivity Report (DPR) that shows the U.S. drilling rig count in the four major “tight-oil” regions of the Permian, Eagle Ford, Bakken, and Niobrara fields fell 32%, from their October peak of 1160 to 780 rigs. However, despite a 65 percent crude oil price decline and the rig count at the lowest level in almost four years, the EIA predicts that production from these four regions is 500,000 barrels per day higher than in October. That translates to a $25 per barrel break-even price, meaning U.S. crude oil prices will remain low.

Citigroup: Oil could plunge to $20 per barrel; Iran’s threatens oil transports, blaming Saudis for falling oil prices; More on the growing Muslim versus Muslim wars

We will finally learn, after more than 40 years of not knowing, what the free market supply/demand price of crude truly is. This knowledge will make it harder for secretive governments and corporations to manipulate prices in the future, while strengthening domestic production to weather supply shocks in the future.

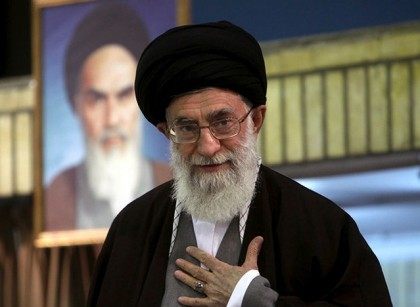

Iranian President Hassan Rouhani said on Tuesday that nations responsible for the downward spiral of oil prices will suffer.

For the first time since 2009, the price of United States oil fell below $50 a barrel, and Brent crude (West Texas Intermediate crude) fell to a five-and-a-half year low of $51.12 per barrel. That statistic is in great part due to fracking and a global excess in oil supply, combined with OPEC’s refusal to slow its production.

Venezuelan President Nicolás Maduro is currently en route to China to ask President Xi Jinping for some much-needed financial assistance in light of an oil crisis that has left a mismanaged and increasingly impoverished Venezuela on the brink of disaster.

(Reuters) – Falling world oil prices will hurt countries across the Middle East unless Saudi Arabia, the world’s biggest crude exporter, takes action to reverse the slump, Iran’s deputy foreign minister told Reuters.

With fracking and shale oil production putting increasing pressure on OPEC, Saudi Oil Minister Ali al-Naimi issued bold and startling remarks to the Middle East Economic Survey, announcing OPEC is prepared to let oil prices fall to $20 a barrel.