Fed Should Delay Raising Interest Rates Until After Presidential Primaries

The Federal Reserve should delay further raising interest rates until after the major party presidential nominees emerge this summer.

The Federal Reserve should delay further raising interest rates until after the major party presidential nominees emerge this summer.

The U.S. corporate bond default rate jumped to 3.3 percent at the end of February, a level higher than when Lehman Brothers filed for bankruptcy in September 2008.

A caller who spouted sickening anti-Semitic hatred for 13 minutes during a live BBC radio phone-in, telling listeners that the UK and corporate America were “ruled by Zionist Jews”, will not be prosecuted, the Metropolitan Police have confirmed. As Breitbart Jerusalem

Large denomination physical cash is going to be outlawed if central bankers have their way.

Financial analyst and Fox News contributor Gary Kaltbaum was not impressed with Federal Reserve chairwoman Janet Yellen’s congressional testimony this week.

Many Americans may not know her name, but Gary Kaltbaum appeared on Breitbart News Thursday to explain why Federal Reserve chairwoman Janet Yellen is the most important woman in our lives.

Content: Clown protesters mock Finland’s xenophobic ‘Soldiers of Odin’; The European Central Bank saves the stock markets for another day

On Wednesday’s “Your World with Neil Cavuto” on the Fox News Channel, New Jersey Governor and Republican presidential candidate Chris Christie argued that he “would not be looking to rescue these banks” if he had to as president and that

Much of the debate over the maybe-recovery concerns the manipulation of government reports. The Western world is moving rapidly toward a stagnant feudal system populated only by rich aristocrats, rich government officials, and a vast lower class that needs welfare transfer payments to survive. Debt-burdened workers with flat wages, shaky job prospects, and government subsidies for their basic needs are serfs, not a vibrant and independent middle class of entrepreneurs selling their labor to the highest bidders.

The Fed’s decision to raise interest rates a quarter point for the first time in nearly a decade represents an important and welcome step in the direction of fiscal sanity. It’s a small step, but one that benefits ordinary Americans and will be disliked by many on Wall Street. And in the nation’s capitol.

WASHINGTON (AP) — The Federal Reserve is raising interest rates from record lows set at the depths of the 2008 financial crisis, a shift that heralds modestly higher rates on some loans.

The problem facing Democrats as they roll into the 2016 election cycle is that the economy has improved just enough for the Federal Reserve to kill it with an interest-rate hike.

Monday’s Chicago Purchasing Manager’s Index for Mid-West manufacturing plunge to a score of 48.7 would have caused widespread economic concern three decades ago, but today’s blue-collar employment is down to only one in twelve Americans.

Sen. Ted Cruz (R-TX) and 20 other of his colleagues have co-sponsored Sen. Rand Paul’s (R-KY) Federal Reserve Transparency Act of 2015, according to a statement released by Cruz.

With the appointment of Neel Kashkari as President of the Federal Reserve Bank of Minneapolis, former Goldman Sachs executives will hold 4 of the 5 Fed Presidents’ seats on the powerful Federal Open Markets Committee that controls U.S. interests rates.

Economic freedom is the practical expression of liberty – if we’re not free to sell our goods and labor, spending and investing the proceeds as we see fit, we’re not truly “free” to do anything but complain about how the government treats us. And if we don’t have access to valid information about the government, and how its activities distort our markets, we don’t have economic freedom, any more than the victim of a common swindle made a “free” choice to be robbed, themes discussed on Breitbart News Daily.

Senator Rand Paul is talking about America’s debt crisis, telling Breitbart News Daily that if he’s elected President, he will do everything in his power to prevent the debt ceiling from being raised again.

Treasury Bill rates have recently fallen to zero percent, but few Americans understand that since September 2008 this has happened 46 times, and about 3 percent of all U.S. government debt under one year in maturity has been sold without paying any interest during the last 7 years.

Analysts were expecting well over 200k new jobs for September – which isn’t really all that great, but at least it’s enough to keep pace with population growth. Instead, we got 142k new jobs, the past few months were revised downward, wage growth remained flat, and the labor force shrank by another hair-raising 350k, knocking workforce participation down to 62.4 percent.

Fed Data: Federal Reserve Swindled Trillions From American Savers

The Federal Reserve is keeping U.S. interest rates at record lows in the face of threats from a weak global economy, persistently low inflation and unstable financial markets.

At the Jackson Hole Economic Summit the American Principles Project demonstrated that the people can’t be fooled in the long term by monetary magic forever. In a national poll by McLaughlin & McLaughlin 1,000 respondents were asked if they would support the Gold Standard in the United States. 39% replied yes, 15% replied no, and 46% were undecided. That is more than a 2:1 ratio for favorability.

These results and the margin between approve and disapprove are better than recent polls on the Federal Reserve or its recent leaders as shown in recent Gallup polls over the last two years: Negative on the Fed and its leaders are very high, while negatives on Gold are very low.

From its founding until the beginning of the 20th century, the United States went from a non-economy to being the world’s largest and wealthiest economy. It achieved this feat on the gold standard mostly, with no central bank, (except for 36 years), and with little or no central planning.

The sold-out Jackson Hole Summit, which seeks to be a conservative counter-balance to the Kansas City Federal Reserve’s Jackson Hole Symposium, kicked off with a fascinating history lesson by a Director of the Council on Foreign Relations on how the Bretton Woods Conference at the end of WW II led to the massive monetary expansion of Federal Reserve and impoverishment of America.

You might think, as many investors do, that a loss of confidence in Beijing caused the Chinese market rout, but Beijing thinks you’ll find the real culprits along the banks of the Potomac.

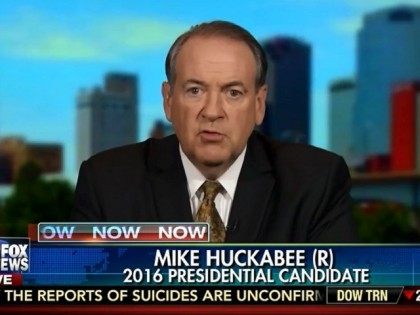

Republican presidential candidate and former Arkansas Governor Mike Huckabee declared “We now seem to be more interested in stabilizing Iran than we are America” on Monday’s “Your World with Neil Cavuto” on the Fox News Channel. Huckabee said that President

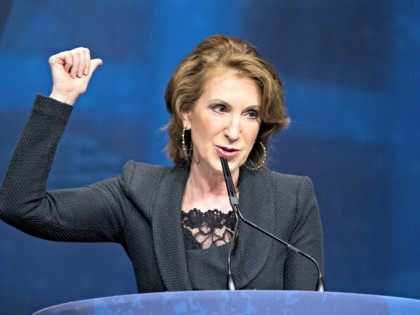

GOP presidential candidate Carly Fiorina weighed in on the market crash and what can be done to stop the sell off that’s occurring.

Teenage jobs are about to suffer as Mexico’s looming financial crisis is about to accelerate illegal immigration.

A new study from the New York Federal Reserve faults the federal government’s policy of boosting aid to families in recent decades to make college education more affordable, because it enabled institutions to raise tuitions much faster than inflation.

The Federal Reserve’s action Monday means the eight banks together will be required to shore up their financial bases with about $200 billion in additional capital.

It was a very deep depression, as deep as the one that succeeded in 1929. But in this case, the government did not intervene, and it was over in less than two years. Was this a coincidence? Grant does not think it was. He believes, as this writer does, that present government interventions have deepened our current economic malaise and are retarding a full recovery.

International reserves, which measure global savings available for financial market investment, have fallen twice this century: once in the first quarter of 2009, and once in the fourth quarter of 2014. That most recent reserve drop is causing some analysts to warn that conditions for a crash may be building.

I must admit I was appalled to hear of Treasury Secretary Jack Lew’s decision last week to demote Alexander Hamilton from his featured position on the ten dollar bill. My reaction has been widely shared, see for example here, here, here, here, and here.

Investors anxiously await Federal Open Market Committee (FOMC) minutes, like the details of the April 28-29 meeting released Friday. But despite the Fed’s monetary policy purchase of $4 trillion in bonds to drive interest rates to near zero, Fed Chairman

Many experts reckon the first cyberwar is already well under way. It’s not exactly a “cold war,” as the previous generation understood the term, because serious damage valued in millions of dollars has been done, and there’s nothing masked about the hostile intent of state-sponsored hackers. What has been masked is the sponsorship.

Federal Reserve Chairwoman Janet Yellen recently joined the rising chorus of economists and former Fed officials warning about the risks of irrational exuberance by bond and stock investors paying bubble-inflated prices. Conspicuously silent about the risks of stock investing over the last 6 years, Yellen’s comments quickly tanked the bond market. But with the NASDAQ tech-heavy index up 500% since the bottom of the last crash, Yellen seems to be warning this bubble could pop.

With University of California tuition more than doubling in the last decade, about two-thirds of Californians now rate affordability at America’s largest public college system as poor. Despite Federal Reserve warnings about default risks for student loans, the UC system intends to raise tuition by 5 percent next year and 21.5 percent over the next 5 years.

Farmland prices that had been enjoying a 28-year bull market finally turned down in 2014. Despite real estate, stocks, bonds and commodities crashes over the period, farmland had never had a down year since 1986. However, the Wall Street Journal has reported that farmland suffered a loss of 3 percent last year, “reflecting a cooling in the market driven by two years of bumper crops and sharply lower grain prices, according to Federal Reserve.”

Calling Sen. Rand Paul’s rhetoric regarding the Federal Reserve “dangerous and irresponsible,” the Wall Street-backed establishment GOP is pushing back on what’s become a Paul talking point.

The Federal Reserve has declared economic growth “solid.” But several new reports show most Americans are treading along a dangerous financial tightrope, where one slip could be devastating.