Reports: Bank Protests Once Again Rock China’s Henan Province After Violent 2022 Crackdown

Protesters once again stormed banks in China’s Henan province last weekend, a little over a year after a violent regime crackdown.

Protesters once again stormed banks in China’s Henan province last weekend, a little over a year after a violent regime crackdown.

China overtook the U.S. as the European Union’s top trading partner in 2020, as ties between Brussels and Beijing continue to deepen.

The data showing the dramatic rebalancing of China’s economy continues.

Credit Suisse claims that China’s middle class is now the biggest in the world, growing much faster than America’s, but the reason for this situation is less obvious than one would think.

Asian stocks were crushed across the board at midday trading after China cut employment for the twenty-second month in a row, as the nation’s General Manufacturing PMI™index deteriorated at its fastest rate since March 2009.

The Chinese turmoil roiling markets right now presents a fresh and profound challenge to the world economy: For the first time, a giant, non-European superpower threatens world financial stability and the powers that be seem at a loss. If the IMF and World Bank have stumbled with Greece, how are they going to get a hold on the stock market travails of Communist China? What tools do we even have to affect how it plays out?

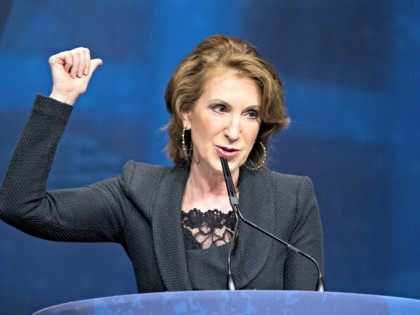

GOP presidential candidate Carly Fiorina told the Wall Street Journal’s Opinion Journal Monday that when the United States is “not leading, the world is a more dangerous and a more tragic place, and unfortunately we are not leading.”

Diana Choyleva of Lombard Street Research, who produces an “unmassaged” calculation of China’s true economic growth, just reported that China’s fourth quarter GDP growth plummeted to 1.7 percent, versus the official 7.4 percent rate.

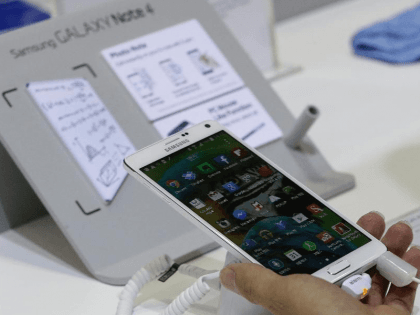

After Apple (AAPL) reported that it had sold $74.6 billion in products and earned a record corporate profit of $18.04 billion profit in a single quarter, Samsung Electronics admitted Thursday that much of Apple’s gain came at its expense. Korea’s former corporate juggernaut reported its lowest annual profit since 2011, with a 32% drop in quarterly profit, to $21.3 billion.