California May Already Be in Recession

The Trump tax cut may not save the California economy that may already be in recession.

The Trump tax cut may not save the California economy that may already be in recession.

The largest budget in California State history contains none of Gov. Jerry Brown’s promised cuts—but it’s chock full of nasty surprises for taxpayers—including increases in taxes, more money for legal defense of illegal aliens, and expands gun control.

California Democrats passed a $125 billion budget Thursday, the largest in state history, while slipping in a provision to alter the recall process to protect State Sen. Josh Newman (D-Fullerton) and their supermajority.

The California State Assembly will not renew it’s $25,000 per month contract with former US Attorney General Eric Holder—according to a statement by Assembly Speaker, Anthony Rendon.

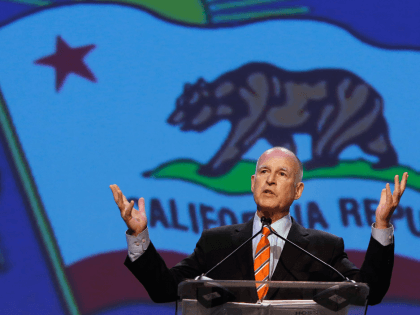

Columnist George Skelton of the Los Angeles Times makes an interesting observation about California Governor Jerry Brown and his new budget: while the governor talks “like a skinflint, a penny-pinching scold,” his spending priorities are liberal, and even radical.

Last week, Governor Jerry Brown unveiled his May revisions to the state budget proposal he rolled out in January. Buried deep among billions of dollars in proposed new spending are millions of dollars for the state to provide criminal defense for illegal immigrants in California who are facing deportation to their home country by our own federal government.

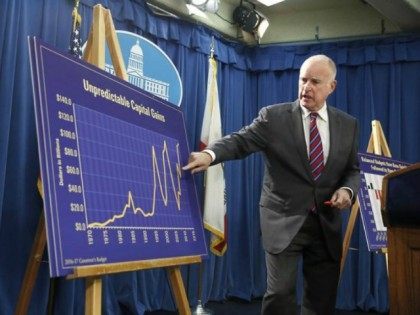

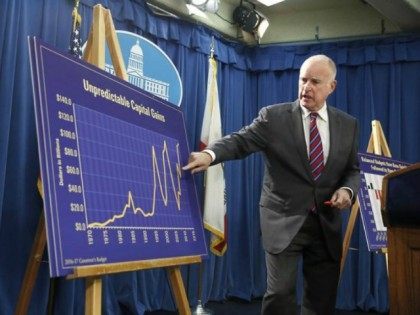

Governor Jerry Brown warned in his May Revised Budget last week that California is expected to suffer a $20 billion tax crash in it next recession.

Gov. Jerry Brown warned this week that despite record economic growth, California’s $122.8 billion budget will suffer its first deficit since 2012 due to spending growing twice as fast as the economy.

President Donald Trump will have the power to turn off California’s illegal alien magnet by enforcing existing federal law.

Every California governor for the last 44 years has used the state’s line-item-veto to kick-out the most egregious fantasy spending by the legislature, but Governor Jerry Brown signed this year’s record $125 billion budget without a single spending veto.

Gov. Jerry Brown’s distant vice presidential prospects may be more remote than ever, as a state appellate court appears ready to strike down California’s “cap-and-trade program as an unconstitutional tax.

California Gov. Jerry Brown warned state legislators on Friday that they should be prepared for falling revenues, presenting a revised $122.2 budget that he cast as a conservative plan for tighter fiscal times.

The “everything is awesome” UCLA Anderson Forecast just predicted that over the next two years, technological advancements from California will make U.S businesses more productive and double the national growth rate.

On Thursday, California Governor Jerry Brown proposed a tax in his new budget that would tax all health plans, replacing California’s current tax that only taxes health plans that participate in Medi-Cal, the state’s Medicaid plan.

With the “one percent” paying more than 50 percent of state taxes, a sustained stock market crash would shrivel California’s “one-time” capital gains taxes and throw the Golden State back into a financial crisis.

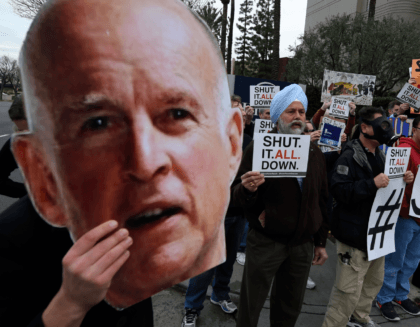

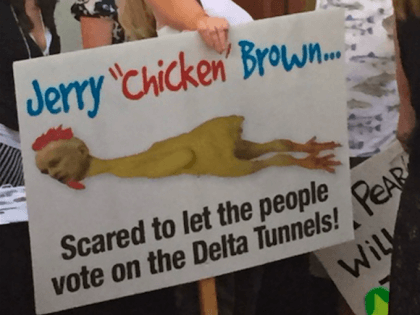

Activists enraged by California’s runaway spending have begun a campaign for the “Stop Blanks Check” ballot initiative. The measure, sure to make the ballot next November, thanks to $3 million in contributions and loans from wealthy Stockton-area formers and business owners Dean and Joan Cortopassi, aims to make sure that big-ticket multi-billion dollar spending projects have to be approved by the voters before they can move forward.

Both houses of the California legislature have agreed to a budget deal to forward to Governor Jerry Brown by the June 15 deadline. The ball is now Governor Brown’s court to use his line-item-veto to decide how much he wants to protect taxpayers from irresponsible spending.

Once again, California Gov. Jerry Brown is heading for a confrontation with labor groups, social welfare groups, and Democratic legislators who want Brown to raise taxes and expand spending. The newly re-elected Brown successfully pushed through temporary sales and income taxes three years ago with Proposition 30, but refuses to continue whole-heartedly in that direction, preferring to let the taxes die by 2018.

Governor Jerry Brown triumphantly unveiled a record $113 billion state budget this week that increases spending by 5%, with promises to give a boast to K-12 schools, deposit $1.2 billion into the rainy day fund, and make a $1.2 billion debt payment. Yet he barely mentioned that healthcare costs for Covered Care, Medi-Cal and retirees are on fire and are sure to burn down California in the next recession.