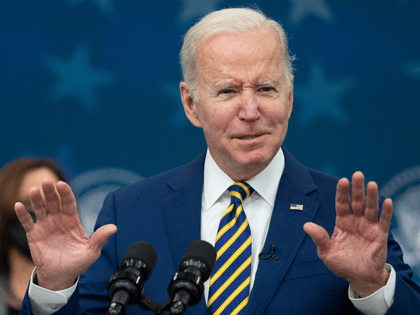

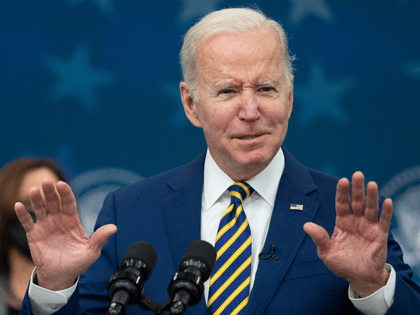

Bidenflation: Consumer Prices Surge 7%, Worst Since 1982

The seventh straight month of inflation running above five percent.

The seventh straight month of inflation running above five percent.

No more stimulus needed.

Eighty-five percent of wholesalers and 70 percent of retailers report they are raising prices.

The economy was mentioned as a top priority by 68 percent of Americans, while the virus was mentioned by just 37 percent.

The pandemic’s contribution to inflation is probably going to get worse in the weeks ahead.

Because of Bidenflation, workers are worse off even though nominal wages are increasing at historic rate.

The Fed realized it was offsides on inflation and the labor market. The reversal of policy may now come even more quickly than signaled at last month’s meeting.

Construction spending in the U.S. is up but prices of construction materials are up by even more.

Gas prices could climb to a national average of $4.00 per gallon by late spring of 2022, according to a report by GasBuddy.

Half of Democrats said inflation is impacting the way they budget, an iCitizen poll released on Tuesday found.

The vice-president of the European Central Bank has said that current inflation is not ‘as temporary’ as initially expected.

Some of Britain’s favourite biscuit brands, such as Jaffa Cakes, are set to jump in price by up to 5 per cent as inflation soars in the UK.

Capacity utilization is running a bit hot compared with its post-financial crisis average, which may portend more inflation ahead.

High prices of materials were holding back construction. But now that inflation appears to be persistent, it no longer makes sense to hold off on new projects.

Expectations for inflation hit their highest level since at least 2012.

The Fed pivots from pumping up employment to removing accommodation.

Many economists mistook early holiday shopping for consumer strength instead of concerns over inflation and supply chains constraints pulling shopping forward.

Inflation in the prices of goods and services purchased by businesses soared in November.

Fifty-six percent of Americans say inflation is a very serious problem and 54% say it prices are the best indicators of the state of the economy.

Is the Fed finally going to confront its inflation crisis?

A record-high increase in the prices of longer-lasting goods marks inflation as the hallmark of Joe Biden’s presidency.

The next trip to your favorite fast food joint may not produce a happy meal. Prices at fast-food restaurants jumped one percent in November compared with October, a big monthly jump that followed months of unusually high price hikes. Compared

A few months ago, Biden administration and Federal Reserve officials were declaring that auto-inflation had been vanquished. Then prices started soaring again.

Putting food on the family breakfast table got much more expensive in November.

The fastest pace of price hikes in four-decades cements inflation as the hallmark of the Biden administration’s first year.

The White House’s campaign to convince Americans that its big social welfare spending bill would reduce inflation has failed.

Among independents who own small businesses, support for Biden fell from 51 percent in the third quarter to just 33 percent now.

The rise of exports means more income for U.S. producers, an economic positive, but it also increases the risk that inflation will continue to accelerate. Rising foreign demand for U.S. goods and services can push up prices for domestic consumers.

Labor costs are soaring by more than expected.

The forecast for the fourth quarter has gone from 5.1 percent inflation to six percent, even while growth expectations have been downgraded.

Durable goods orders rose by more than expected but more than all of the growth can be chalked up to rising prices.

The record-breaking November reading for ISM’s services measure was pumped up by inflation and supply chain problems.

It took six or seven months but now everyone agrees that Bidenflation is persistent rather than transitory.

Seventy-one percent of lower-income households are suffering while 63% of Democrats say they have suffered no hardship at all.

Inflation within the Eurozone hit nearly 5 per cent in November, the highest level recorded since the Euro was introduced in 1999.

Jerome Powell again focused on the risk of inflation running hotter and longer than many economists expect.

Shortages, rocketing fuel prices, and record high cost inflation are weighing down the U.S. manufacturing sector.

As prices of labor and construction materials soared, spending on building new homes actually declined in October.

Persistently high inflation would justify the Fed moving faster on winding down its bond purchases, Powell told a Senate panel Tuesday.

High and rising inflation is convincing more people that business conditions are poor and the labor market will weaken in the months ahead.